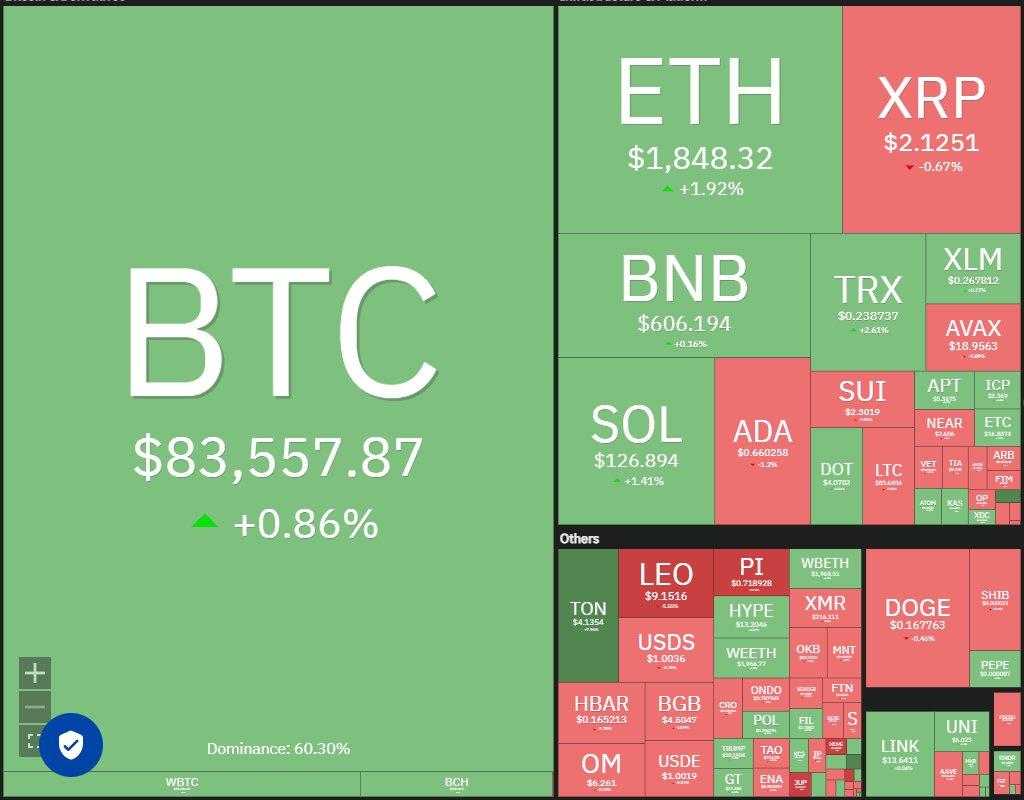

Bitcoin (BTC) experienced a drop of 4.29% last week, yet the bulls began a recovery, managing to push the price back above $83,500 by March 31. Nevertheless, traders are likely to stay cautious until April 2, coinciding with the implementation of new US trade tariffs, which could lead to some abrupt market reactions.

While traders are hesitant in the short term, an encouraging sign is that lower price levels are starting to attract buyers. According to reports, cryptocurrency exchange-traded products (ETPs) saw slight inflows of $226 million in the previous week, as of March 31.

Daily cryptocurrency market performance.

A strategic move during Bitcoin’s pullback resulted in the acquisition of 22,048 Bitcoin for $1.92 billion at an average price of $86,969. With this latest addition, the entity now holds a total of 528,185 Bitcoin at an estimated cost of around $35.63 billion.

Could Bitcoin overcome the intense overhead resistance and potentially pull certain altcoins higher? Let’s delve into the charts to analyze.

S&P 500 Index price analysis

The S&P 500 Index (SPX) surpassed the 20-day exponential moving average (5,706) on March 24, but this turned out to be a bull trap.

SPX daily chart.

The price sharply retraced on March 26, breaking below the 5,600 support. Both moving averages are trending downward, and the relative strength index (RSI) shows negative momentum, favoring the sellers. There is significant support at 5,500, but if this level fails, the index could decline to 5,400, and then further down to 5,100.

This pessimistic outlook will be negated if the price rises from the current position and exceeds 5,800, indicating that the index may have found a temporary bottom.

US Dollar Index price analysis

The US Dollar Index (DXY) has been trading beneath the 20-day EMA (104.46), reflecting a negative sentiment.

DXY daily chart.

The bears will aim to push the index down to 103.37, a crucial level to monitor. Buyers are anticipated to defend the 103.37 mark vigorously; failure to do so could lead to a drop to 101.

Conversely, a close above the 20-day EMA would signal that the bulls are making a comeback. This could see the index rise towards 105.42 and further to the 50-day simple moving average (106.09).

Bitcoin price analysis

Bitcoin is still under considerable strain as bears look to diminish the price down to the key support at $80,000. A small silver lining for bulls is their effort to halt the decline at $81,100.

BTC/USDT daily chart.

The bulls will attempt to push the price to the resistance line, which could provoke strong selling from the bears. If the price declines from the resistance line, the chances of dropping below $80,000 will increase. The BTC/USDT pair could potentially plummet to $76,606 and eventually to $73,777.

In contrast, a break above the resistance line would indicate that bears are losing their hold. The pair could gain momentum above $89,000 and rally towards $95,000.

Ether price analysis

Ether (ETH) has reached the critical support at $1,754, from which bulls are trying to initiate a relief rally.

ETH/USDT daily chart.

The bears will seek to interrupt the recovery attempt at the 20-day EMA ($1,980). A sharp decline from this level could increase the risk of a breakdown below $1,754, which might drive the ETH/USDT pair down to $1,550.

A significant sign of strength would be a break and close above the breakdown level of $2,111, completing a bullish double-bottom pattern targeting $2,468.

XRP price analysis

XRP (XRP) has touched the critical support level at $2, which should attract substantial buying interest from bulls.

XRP/USDT daily chart.

Should there be any rebound, it is likely to encounter selling pressure at the moving averages. A drop from these moving averages increases the risk of breaking below $2. If this occurs, the XRP/USDT pair may complete a bearish head-and-shoulders pattern. Minor support is found at $1.77; however, if it is breached, the pair could nosedive to $1.27.

The bulls need to act quickly to maintain upside potential by propelling the price above the moving averages, allowing the pair to aim for the resistance line.

BNB price analysis

BNB’s (BNB) narrow trading range broke downwards as the price closed below the moving averages on March 29.

BNB/USDT daily chart.

The BNB/USDT pair faces support at the 38.2% Fibonacci retracement level of $591, and then at the 50% retracement level of $575. If the price rebounds from support, bulls will aim to push the pair above the moving averages and through the $644 resistance. Should they succeed, a rally to $686 may follow.

Conversely, if the price closes below $575, the pair may decline to the 61.8% retracement level at $559. A more significant pullback could delay the next phase of any upward movement.

Solana price analysis

Solana (SOL) is finding robust support around $120, indicating strong buyer interest at this level.

SOL/USDT daily chart.

A sign of strength would emerge if the price closes above the 20-day EMA ($133), opening the possibility for a rise to the 50-day SMA ($148), which may present another strong resistance. However, if buyers manage to overcome this resistance, the SOL/USDT pair could ascend to $180.

Sellers need to target pulling the price beneath the $120 to $110 support zone. Achieving this could initiate another downward phase towards $80.

Related: XRP bulls in ‘denial’ as price trend mirrors previous 75-90% crashes

Dogecoin price analysis

Dogecoin (DOGE) is attempting to secure support at the $0.16 level, however, weak rebounds indicate insufficient demand from buyers.

DOGE/USDT daily chart.

The DOGE/USDT pair may decline to $0.14, where buying interest is expected to emerge. A bounce off $0.14 will likely face selling pressure at the moving averages. If the price retreats from these averages, the risk of breaking below $0.14 increases. Should that occur, the pair could plunge to $0.10.

To signal that a bottom has formed at $0.14, buyers need to push and keep the price above $0.20. Subsequently, the pair may rise to $0.24.

Cardano price analysis

Cardano (ADA) has fallen to the uptrend line, which is a critical near-term support level to observe.

ADA/USDT daily chart.

The declining 20-day EMA ($0.71) and the RSI in negative territory provide a slight edge to the bears. Should the price close below the uptrend line, it may prompt a downward move to $0.50.

Conversely, a bounce off the uptrend line could direct the ADA/USDT pair toward the moving averages. The buyers will regain control when they drive the price above the 50-day SMA ($0.75).

Toncoin price analysis

Toncoin (TON) is being squeezed between the 20-day EMA ($3.63) and the overhead resistance at $4.14.

TON/USDT daily chart.

The rising 20-day EMA and a positive RSI suggest that the path of least resistance favors an upward trajectory. If buyers successfully push the price above $4.14, the TON/USDT pair could gain momentum, potentially reaching $5 and later $5.65.

This positive outlook would be contradicted if the price turns down from the overhead resistance and drops below the 50-day SMA ($3.46), which could lead to declines towards $3.30 and possibly down to $2.81.

This piece does not offer investment advice or recommendations. Every investment and trading move involves risk; readers are encouraged to conduct their own research before making decisions.