Investors in cryptocurrency are increasingly reallocating their funds into stablecoins and tokenized real-world assets (RWAs) as a means to avoid volatility in anticipation of a highly expected tariff announcement from US President Donald Trump on April 2.

More and more capital is being directed into stablecoins and the sector of tokenization for real-world assets, which includes financial instruments and tangible assets like real estate and fine art represented on the blockchain.

”Stablecoins and RWAs are seeing consistent capital inflows as investors seek safe havens in the current unpredictable market,” a crypto intelligence platform reported on March 31.

“However, since these assets are stored on-chain, even minor sentiment shifts can lead to substantial price changes, as the barriers to reallocating capital in real-time are lower,” the platform highlighted.

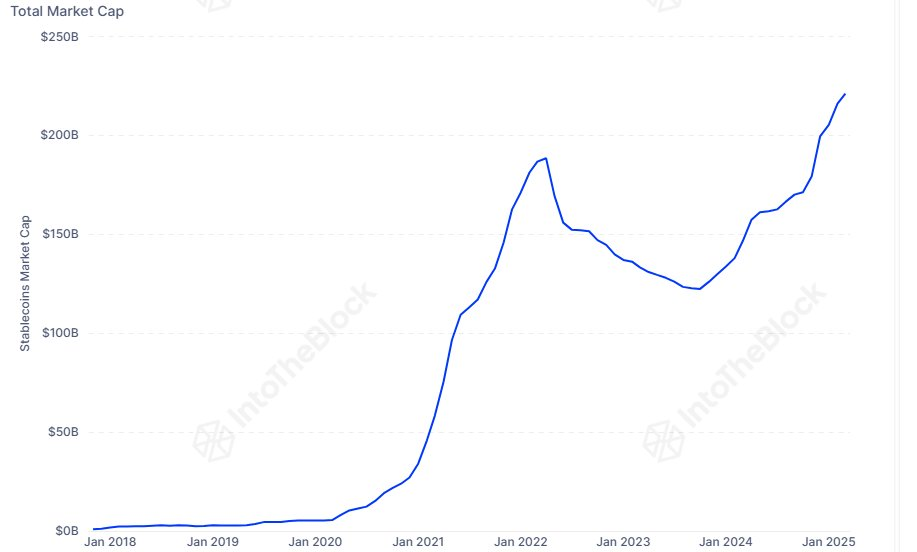

Total market cap for stablecoins.

This shift towards safety is primarily linked to geopolitical tensions and concerns over global trade, according to a senior research analyst from the platform:

“Many investors anticipated economic growth following Trump’s presidency, but rising geopolitical tensions, tariffs, and general political instability have made them more wary.”

“This caution is justified, as while global growth predictions remain positive, expectations have diminished across the board in recent months,” he further noted.

Related: Bitcoin predicted to reach $110K before $76.5K — Arthur Hayes

The looming prospect of a global trade conflict has intensified inflation-related worries, leading to marked declines in both cryptocurrency and traditional stock markets.

S&P 500, BTC/USD, daily chart.

Bitcoin (BTC) has fallen by 19%, while the S&P 500 (SPX) index has decreased by over 7% since Trump announced import tariffs on Chinese products on January 20, the day he took office.

The anticipated announcement on April 2 is expected to outline reciprocal trade tariffs aimed at major US trading partners, intended to reduce the country’s estimated $1.2 trillion goods trade deficit and enhance domestic manufacturing.

Related: Experts call for stablecoin regulations in the US prior to cryptocurrency tax reform

Investor sentiment affected by upcoming tariff announcement

Concerns about global tariffs and uncertainty surrounding the announcement continue to weigh on investor sentiment in worldwide markets.

“Risk appetite remains low amid tariff threats from President Trump and ongoing macroeconomic uncertainty,” a dispatch analyst from a digital asset investment platform commented.

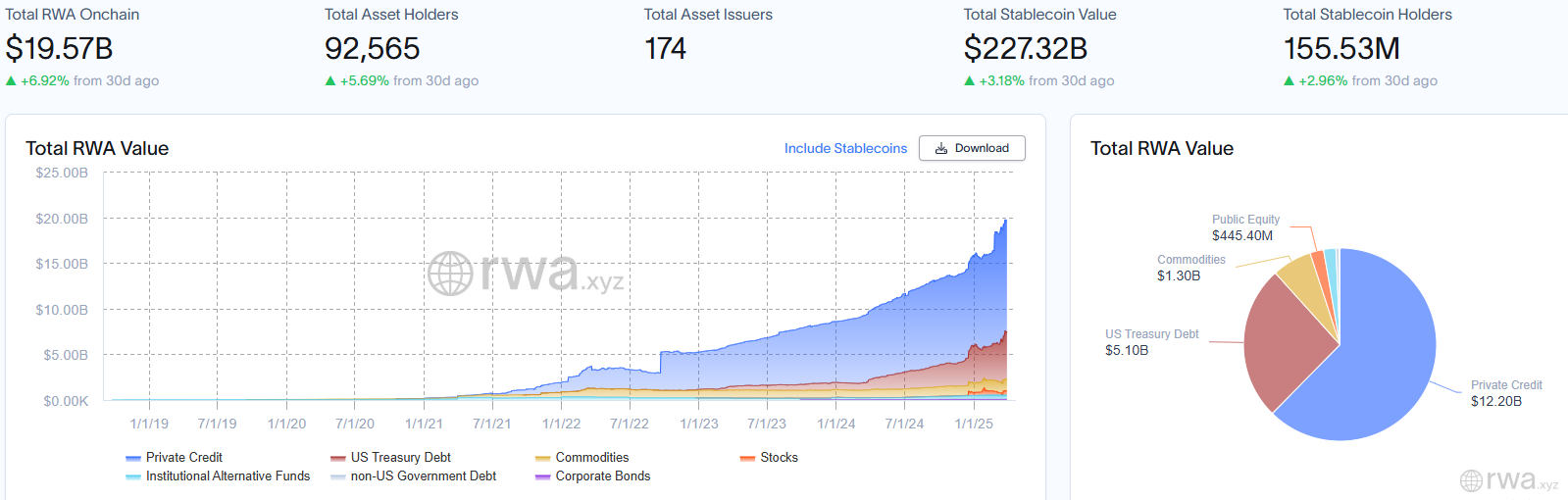

In the meantime, RWAs reached a new cumulative all-time high of over $17 billion on February 3 and are currently close to surpassing the $20 billion benchmark, as per data from industry sources.

RWA global market dashboard.

Some industry observers predict that Bitcoin’s lack of upward momentum could lead RWAs to reach a $50 billion all-time high before the end of 2025, given that increased liquidity will help RWAs capture a significant portion of the estimated $450 trillion global asset market.

Magazine: SCB predicts BTC will reach $500K, SEC postpones Ether ETF decisions, and more: Hodler’s Digest, Feb. 23 – March 1