Binance has ceased spot trading pairs involving Tether’s USDt within the European Economic Area (EEA) to adhere to the Markets in Crypto-Assets Regulation (MiCA).

The cryptocurrency exchange has removed several spot trading pairs featuring tokens that are not compliant with MiCA regulations in the EEA, following a strategy unveiled in early March.

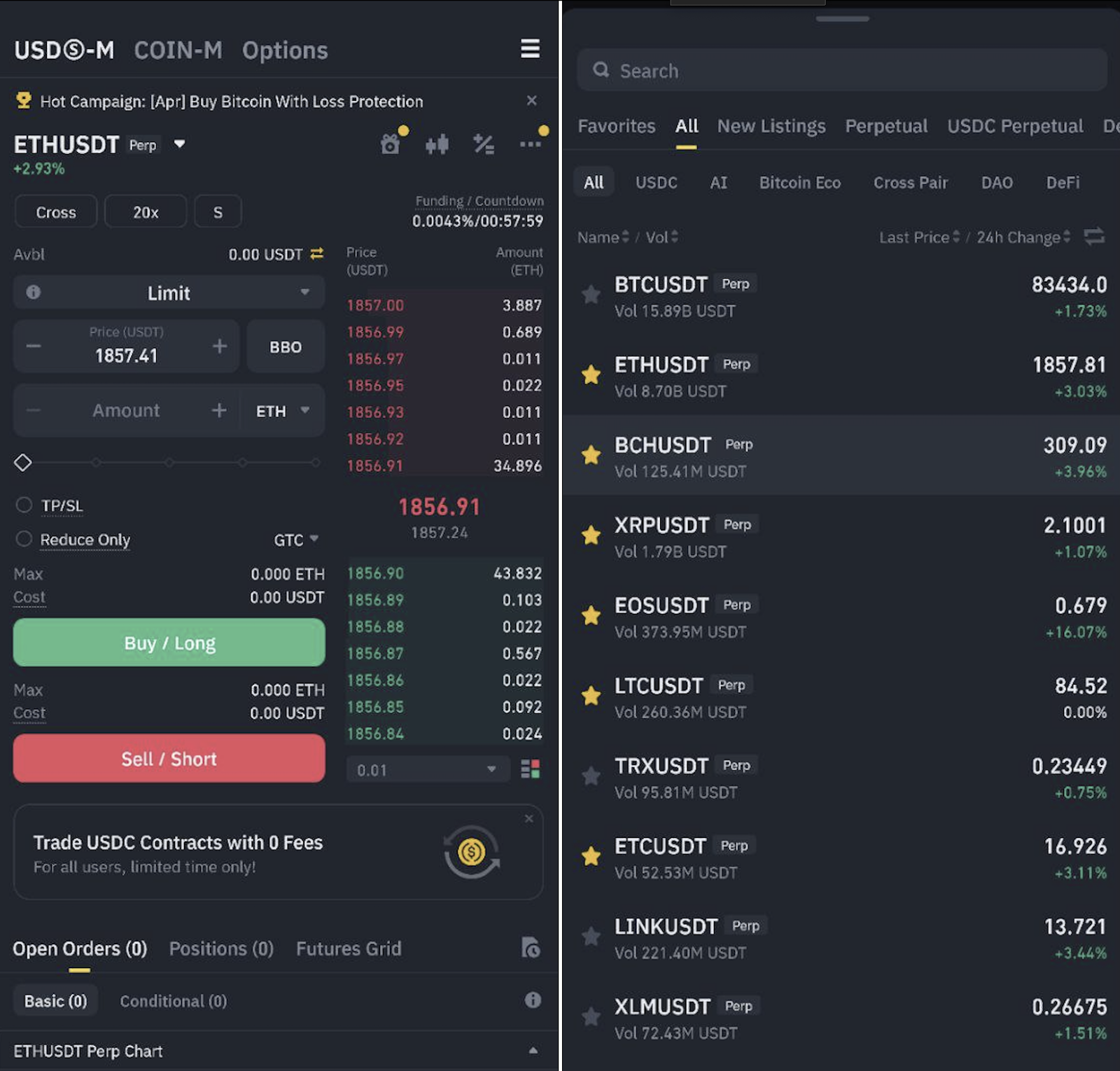

Although pairs for tokens like USDt (USDT) have been delisted from spot trading on Binance, users in the EEA can still hold the affected tokens and engage in trading through perpetual contracts.

USDT remains available for perpetual trading on Binance.

A previous announcement indicated that spot trading pairs for non-MiCA-compliant tokens were to be removed by March 31, aligning with local mandates to exclude such tokens by the end of the first quarter of 2025.

Delistings by Other Exchanges in the EEA

Binance is not the sole cryptocurrency platform scrapping non-MiCA-compliant tokens from spot trading in the EEA.

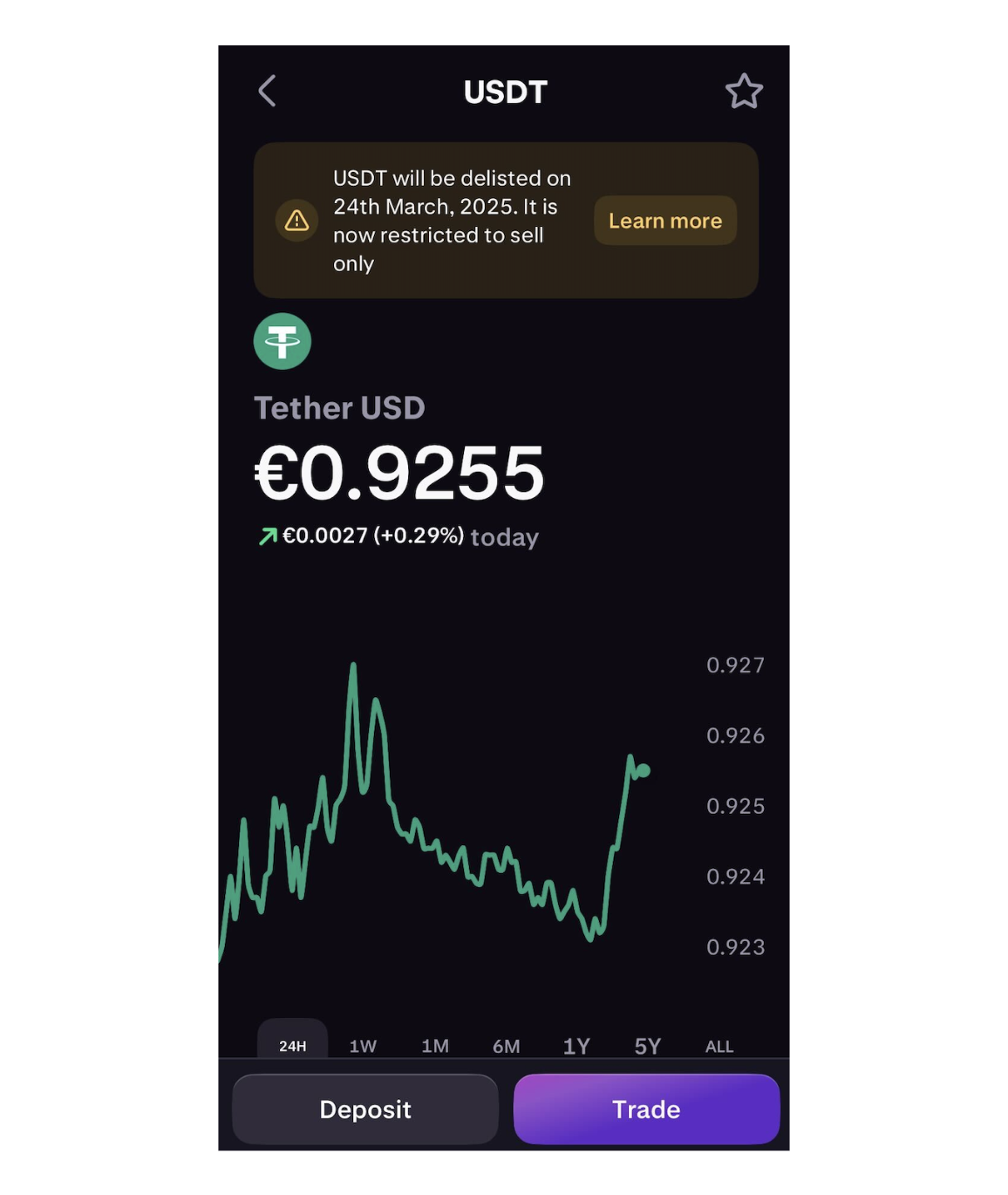

Other exchanges, like Kraken, have also delisted spot trading pairs for tokens like USDT after revealing their plans in February.

A notice on Kraken’s site stated that USDT was switched to sell-only mode for EEA users on March 24. As of now, the platform prohibits its EEA users from buying the affected tokens.

USDT has been limited to sell-only mode on Kraken since March 24.

In addition to USDt, Binance has also removed spot trading pairs for other non-MiCA-compliant tokens including Dai (DAI), First Digital USD (FDUSD), TrueUSD (TUSD), Pax Dollar (USDP), Anchored Euro (AEUR), TerraUSD (UST), TerraClassicUSD (USTC), and PAX Gold (PAXG).

Related: Tether acquires 30% stake in Italian media entity Be Water

Kraken’s delisting plan in the EEA included only five tokens: USDT, PayPal USD (PYUSD), Tether EURt (EURT), TrueUSD, and TerraClassicUSD.

ESMA Allows Custody of Non-MiCA-Compliant Tokens

The decision by Binance and Kraken to continue offering custody services for non-MiCA-compliant tokens aligns with earlier guidance from MiCA compliance supervisors.

On March 5, an ESMA spokesperson confirmed that custody and transfer services for stablecoins not compliant with MiCA do not breach the new European cryptocurrency regulations.

Conversely, the same regulatory body had previously advised European crypto asset service providers to stop all transactions involving these tokens after March 31, leading to some confusion regarding MiCA guidelines.

Magazine: How crypto regulations are evolving globally in 2025