The CEO of Coinbase is advocating for changes in US legislation that would allow stablecoin holders to earn “onchain interest” on their assets.

In a post on March 31, the CEO emphasized that crypto firms should be regulated similarly to banks, enabling them to “share interest with consumers” and be incentivized to do so. He mentioned that permitting onchain interest aligns with a free market philosophy.

Source: CEO of Coinbase

Currently, two conflicting pieces of federal stablecoin legislation are making their way through Congress: the Stablecoin Transparency and Accountability for a Better Ledger Economy Act (STABLE Act) and the Guiding and Establishing National Innovation for US Stablecoins Act (GENIUS Act).

Regarding the stablecoin legislation, the CEO stated that there is potential for the US to “level the playing field and ensure these laws allow all regulated stablecoins to provide interest directly to consumers, similar to what savings or checking accounts can offer.”

Onchain Interest: A Boost for the US Economy

The CEO contended that stablecoins have already established market demand by “digitizing the dollar and other fiat currencies,” and that incorporating onchain interest would enable “the average person and the US economy to fully realize the benefits.”

He noted that if regulatory changes permitted stablecoin issuers to provide interest to holders, American consumers could earn around 4% on their assets, significantly surpassing the expected 2024 average yield of 0.41% on consumer savings accounts.

Furthermore, he highlighted that onchain interest could positively impact the broader US economy by promoting the global usage of US dollar stablecoins, which could enhance their prominence, “drawing dollars back to US treasuries and reinforcing dollar dominance in a digital global landscape,” according to the CEO.

The potential for higher yields compared to traditional savings accounts would mean “more yield in consumers’ hands translates to increased spending, saving, and investing—thereby stimulating economic growth in local economies where stablecoins are held.”

“Failing to unlock onchain interest could mean the US misses out on billions of USD users and trillions in possible cash flows,” he further remarked.

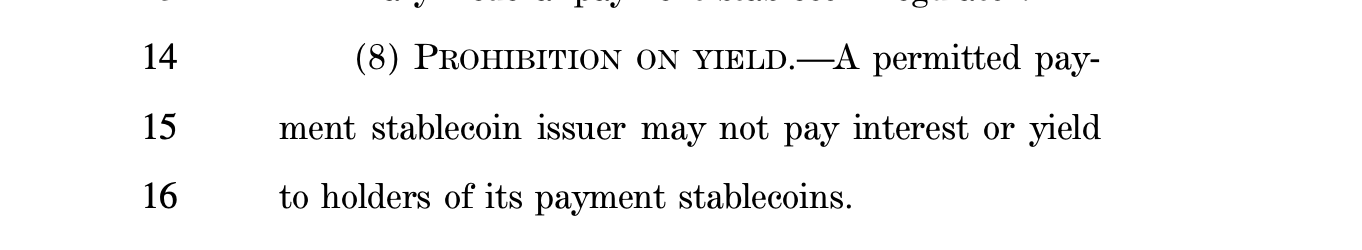

At present, neither the STABLE Act nor the GENIUS Act permits stablecoins that generate onchain interest. In its current draft, the STABLE Act even includes a provision restricting “payment stablecoin” issuers from providing yield to holders:

Source: STABLE Act

In a similar vein, the GENIUS Act, which recently received approval from the Senate Banking Committee with an 18-6 vote, has been modified to omit interest-bearing instruments from its definition of a “payment stablecoin.”

Commenting on the current status of the STABLE Act, one representative remarked that the two legislative proposals are likely to align after a few more drafting sessions in both the House and Senate since the differences between them are largely textual rather than substantive.

“Ultimately, I think there’s a consensus to collaborate with our Senate colleagues to finalize this,” the representative stated.

Magazine: SEC’s Shift on Crypto Raises Important Questions