What are crypto ETP outflows?

Crypto ETPs provide exposure to digital currencies through conventional financial products. When more capital exits these instruments than enters, it is termed an “outflow”—indicating more individuals are selling than purchasing.

Crypto exchange-traded products (ETPs) consist of cryptocurrency assets as their foundational commodity. Their aim is to facilitate an exchange-traded investment opportunity for those looking to gain exposure to crypto without the need for direct ownership of digital currencies.

This approach is favored by many investors, especially institutional ones, as it integrates crypto investment within traditional financial frameworks. This negates the need to navigate unregulated markets or handle the security and safety associated with digital assets.

A variety of crypto ETPs exist, including exchange-traded funds (ETFs), exchange-traded commodities (ETCs), and exchange-traded notes (ETNs). Notably, Bitcoin ETFs received approval and commenced trading in January 2024. These crypto ETPs see high trading volumes and often represent a significant portion of transaction activity—both inflows and outflows.

If you’ve been monitoring cryptocurrency prices like Bitcoin (BTC), you’ve probably encountered reports concerning crypto ETP outflows.

So, what exactly are crypto ETP outflows?

These occur when funds exit these investment vehicles, indicating a market keen on divesting. The motivations behind this can vary, spanning from profit-taking to negative market sentiment or adjustments in risk appetite.

Crypto ETP investment trends

Outflows from crypto funds can be substantial and may introduce significant volatility into the markets. For instance, in March 2025, global crypto products experienced a loss of $1.7 billion within a single week. This resulted in a cumulative outflow of $6.4 billion over the preceding five weeks. During this period, a record streak of 17 consecutive days with outflows was noted, marking the longest stretch since tracking began in 2015.

As an investor, comprehending ETP flow can provide insights into institutional investor sentiment. Such trends can often precede broader market movements in the days and weeks that follow. Outflows may serve as warning signs of shifts in market dynamics. In cases of record outflows, it could indicate a change in how institutional investors assess risk within cryptocurrency markets.

Factors driving crypto ETP outflows

ETP outflows stem from a combination of factors, including economic conditions, industry dynamics, regulations, market cycles, and more, which can help identify imminent market movements.

Understanding the forces behind ETP flows is crucial if they are to serve as effective sentiment gauges in the market, especially given the rapid movements and variability of crypto markets. Here are several common factors that often correlate with increased ETP outflows:

- Macroeconomic pressures: Economic instability and adverse news can prompt money to flee from risky assets, including concerns over US Federal Reserve policies, inflation rates, and interest rate indecision.

- Security issues: Disruptions within the sector, particularly concerning fraud or hacks—such as the $1.5 billion breach at Bybit in early 2025—can lead to investor unease.

- Regulatory changes: Fluctuating government attitudes towards crypto can influence capital flow. Notably, legislative measures against crypto or tax proposals can deter ETP investors.

- Market cycles: After significant market rallies, pullbacks often occur as institutions engage in profit-taking, resulting in money being drawn from the market.

- Institutional sentiment: Large financial institutions play a crucial role in the market. Their reassessment of crypto allocations can lead to outflows as strategies shift towards less risky assets.

- Technical signals: Many traders closely analyze technical indicators. If critical support levels for major cryptocurrencies are breached, it can trigger heightened selling pressure.

Frequently, multiple factors can converge to create a scenario ripe for declining investor sentiment, resulting in historically significant outflows. Recognizing these influences is vital for distinguishing between routine volatility and fundamental market changes.

Impact of ETP outflows on crypto markets

Crypto ETP outflows serve as indicators of significant shifts in sentiment, which subsequently exert downward pressure on cryptocurrency valuations.

Extended periods of outflows raise alarms among crypto investors, as they signify a fundamental change in cryptocurrency investor sentiment. Prolonged outflows typically initiate with Bitcoin ETPs—being the most recognized and largest cryptocurrency—eventually spreading to ETPs connected to other assets like Ether (ETH), leading to a loss of faith in the wider crypto market.

During such episodes, direct price impacts on crypto assets become apparent, with notable price corrections of over 20% occurring within weeks amid substantial ETP outflows.

Liquidity is also compromised, resulting in a drop in total assets under management (AUM) by billions. With more sellers than buyers in the marketplace, diminished liquidity hampers the ability to sell many crypto assets, further intensifying downward price movements.

Market sentiment rapidly becomes infectious, as negativity cascades from institutions to retail investors. In such cases, even robust growth trends can abruptly halt as bullish momentum wanes.

ETP outflow indicators

Being aware of key indicators can provide early warnings for investors looking to anticipate major market transitions.

The concentration of flows in particular products and recognizing geographical differences can facilitate targeted monitoring for investment opportunities. Investors often focus on the following indicators:

- Volume: Unusual surges in ETP trading volumes typically precede significant outflow events, indicating potential shifts in market sentiment or conditions. For example, a large increase in volume may suggest that investors are preparing for or reacting to news or market changes.

- Premium/discount variations: The premium or discount signifies the difference between an ETP’s trading price and its net asset value (NAV). Changes in these metrics can offer insight into market sentiment or prospective price adjustments. For instance, if an ETP that usually commands a premium begins trading at a discount, it could indicate declining investor confidence or broader concerns.

- Leading product indicators: Certain products or assets often reflect broader market trends. For example, movements in a prominent Bitcoin ETF can hint at increasing institutional interest, potentially foreshadowing market growth. The performance of these leading products is closely watched, as their price shifts can serve as indicators for forthcoming trends across both crypto and traditional sectors.

- Institutional holdings reports: Institutional holdings highlight positions managed by large investment entities, such as mutual funds and hedge funds. Changes in the allocations by these major players may imply shifts in their market perspectives. For instance, if an institution starts reducing its stake in a specific stock or ETP, it might signal expectations of price declines or adjustments based on economic factors.

- Flow momentum indicators: These indicators monitor capital flow rates in and out of markets or assets. Accelerated outflows might represent panic or increasing uncertainty, while a slowing rate of outflows could suggest sentiment stabilization, offering insight into market resilience or impending reentry points.

- Regional flow disparities: Variations in capital outflow patterns across different regions can enhance understanding of global market dynamics. Typically, US-based investors lead sell-offs given their significant market share and willingness to take risks, resulting in heightened outflows domestically. However, such disparities could present opportunities for international investors during times of upheaval in their home regions.

- Cross-asset correlations: Examining how different asset classes, such as cryptocurrencies and traditional markets, correlate can provide vital insights. High-risk assets like Bitcoin often align closely with tech stocks. Declinings in traditional markets, like equity downturns, can lead to similar movements in crypto markets as investors seek refuge.

Crypto ETP inflows and outflows: 2024–Q1 2025 trends and insights

Throughout 2024, crypto ETPs experienced exceptional inflows totaling $44.2 billion, primarily driven by Bitcoin and Ether products, despite minor outflows towards the year’s end. In contrast, 2025 sees a dramatic turn of events, with notable outflows beginning in February, leading to net inflows of $2.55 billion by March 10.

Key highlights of the 2024–2025 crypto ETP trends include:

- 2024 overall inflows: Data indicated that net inflows for 2024 reached an unprecedented $44.2 billion, marking a 320% rise from the former record of $10.5 billion set in 2021.

- Bitcoin ETP inflows: Bitcoin ETPs alone accounted for inflows of $38 billion, making up 29% of Bitcoin’s total AUM of $130 billion.

- Ether ETP inflows: Ether-focused ETPs also performed admirably, with late 2024 momentum driving annual inflows to $4.8 billion, equivalent to 26% of ETH’s $18.6 billion AUM.

- Small outflows in 2024: Though the year was dominated by net inflows, there were episodes of outflow, particularly during the last trading week of 2024, which saw $75 million in net outflows, as noted on January 6, 2025.

- Overall positive net inflows in 2024: These outflows paled in comparison to the year’s inflows, as 2024 ultimately displayed a positive net flow of $44.2 billion.

- Promising start to 2025: The beginning of 2025 was strong, with $585 million in inflows recorded during the first three days of January.

- 2025 net inflows by February 10: By February 10, 2025, net inflows for the year reached $7.3 billion, including five consecutive weeks of inflows, highlighted by a notable week ending February 10, with $1.3 billion in inflows, where Ether ETPs attracted $793 million, surpassing Bitcoin.

- Increased outflows beginning February 17, 2025: However, a sharp decline began the week ending February 17, 2025, noting the first significant weekly net outflow of $415 million.

- End of a 19-week inflow streak: This shift concluded a robust 19-week period of inflows following the US elections, tallying $29.4 billion—outstripping the $16 billion marked in the initial weeks of US spot ETF launches during 2024.

- Ongoing outflows in late February 2025: The trend of outflows persisted, with $508 million drawn from Bitcoin during the week ending February 24, 2025, and the week ending March 3, 2025, recording an unprecedented $2.9 billion in outflows, summing up to a three-week total of $3.8 billion.

- March 2025 outflows: The week concluding on March 10, 2025, saw further outflows of $876 million, culminating in a total of $4.75 billion over four weeks. Commencing the week of March 17, cryptocurrency ETPs faced an acceleration of liquidations, recording $1.7 billion in outflows, which lifted the total outflows over the past five weeks to $6.4 billion.

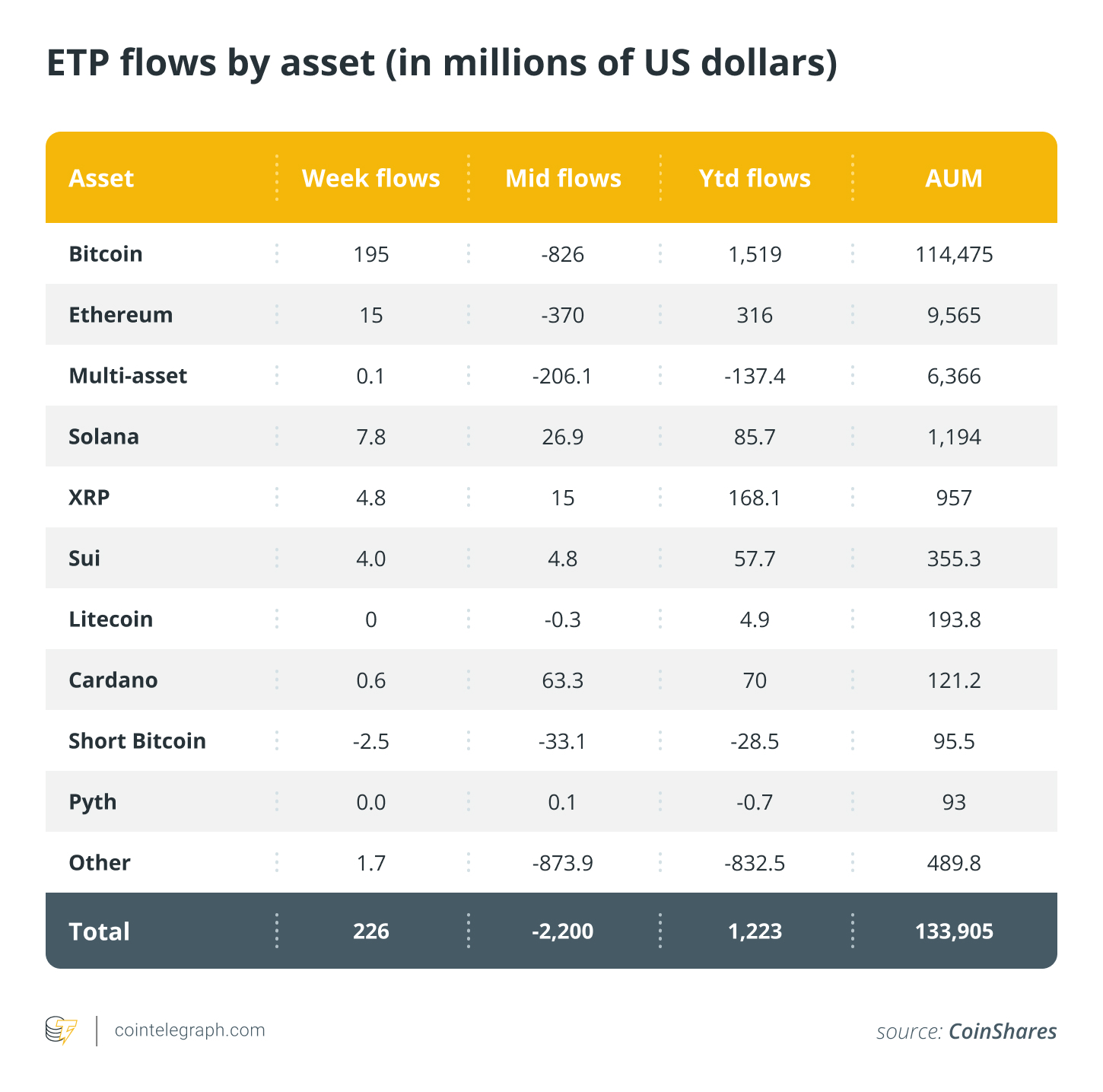

- Crypto ETP inflows surge; AUM decline (as of March 31): Global crypto ETPs experienced $226 million in inflows for the week ending March 30, following a prior week of $644 million. Despite this two-week positive trend following a five-week outflow streak, total AUM had dropped below $134 million by March 28. Alts saw $33 million in inflows after four weeks of outflows totaling $1.7 billion.

Future of crypto ETPs

Despite concerning outflow events in 2025, the ongoing introduction of new ETP varieties indicates sustained financial interest in the sector.

Taking into account the long-term upward trend of crypto AUM, the outlook for crypto ETPs as a viable investment vehicle and market catalyst remains favorable. While large outflows may be alarming in the short term, even dramatic pullbacks of 20%–30% can rebound during broader market cycles. Many investors regard these pullbacks as beneficial during growth phases, as they enable profit-taking and market position consolidation.

Regulatory developments seem to trend positively, especially in the US, with recent support from figures in government. Initiatives that enhance crypto regulations and the establishment of strategic reserves indicate a promising direction.

Financial institutions are consistently filing new crypto ETPs aimed at expanding investment options. Beyond Bitcoin and Ether, ETPs linked to Solana and XRP have garnered notable attention following their approvals and market entry. These newer offerings have continued to attract inflows, despite adverse moves in Bitcoin and Ether.

As the crypto landscape changes, the introduction of new ETPs is likely to foster further innovation and appeal to a diverse array of investors. With advancing regulatory clarity and increasing institutional interest, future offerings could encompass additional promising cryptocurrencies.

Consequently, expect ongoing diversification within the crypto ETP realm, with the potential for increased inflows and fresh market opportunities, even amidst fluctuations in established assets like BTC and ETH.