The stablecoin landscape underwent significant changes in March, with Ethena’s USDtb entering the top 10 stablecoins by market capitalization, Tether witnessing a loss of 61% in market share, and EURC achieving a new all-time high in its market capitalization.

As reported on March 26, the market value of USDtb, a synthetic stablecoin backed by BUIDL, skyrocketed by 1,219% to reach $1.18 billion, making it the 8th largest stablecoin by market cap.

This remarkable ascent followed the launch of Converge, an EVM-compatible blockchain developed by Ethena Labs in collaboration with Securitize, where USDtb will function as the main currency for transaction fees.

The analysis also pointed out other significant trends within the stablecoin market. Tether (USDT) saw its market presence shrink to 62.1%, marking its lowest level since March 2023, as several exchanges removed the stablecoin for failing to comply with MiCA regulations.

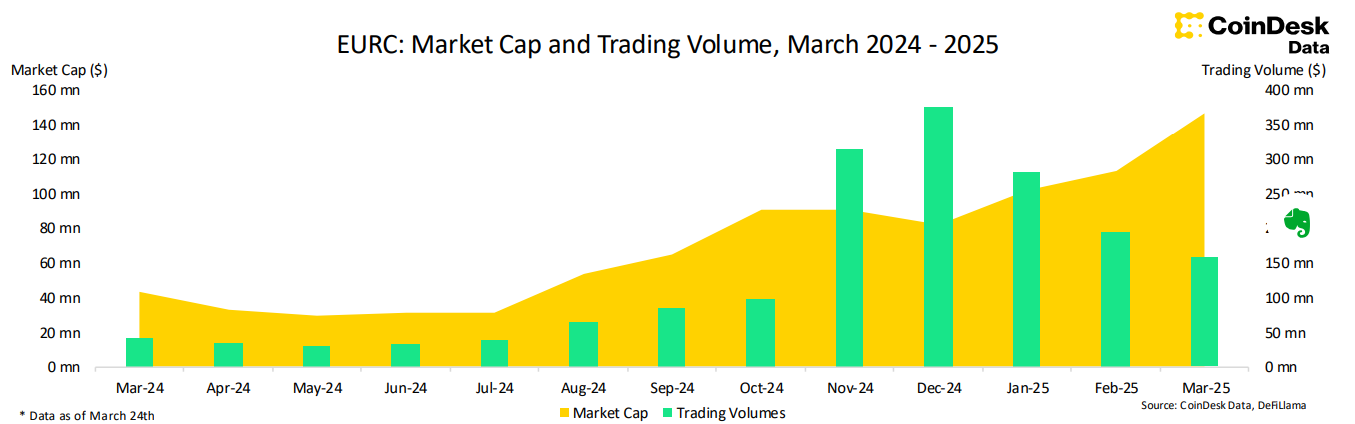

Conversely, EURC, the euro-backed stablecoin from Circle, experienced a 29.5% increase in market capitalization, rising to $147 million, which represents a new record high and the third month of consecutive growth. This surge can largely be attributed to the delisting of non-MiCA-compliant stablecoins like USDT on European exchanges, leading users and platforms to shift towards regulated options like EURC. Consequently, EURC now comprises 45.6% of the total market capitalization of euro-denominated stablecoins.

Overall, the stablecoin market grew, with its market cap dominance reaching 8.02%.