The native cryptocurrency of Ethereum, Ether (ETH), has faced four consecutive months of declines, recording an 18.47% drop in March alone. The current market dynamics for this altcoin reveal a persistent bearish trend, reminiscent of the bear market seen in 2022.

With each monthly closing price falling below the prior month’s low, analysts are engaged in discussions regarding whether ETH is nearing a bottom, or if there is still more downside potential for the altcoin.

Ethereum/Bitcoin ratio reaches a new five-year low

On March 30, the ratio of Ethereum to Bitcoin plummeted to a five-year low of 0.021. This ETH/BTC ratio illustrates how Ether is faring against Bitcoin, with the current downtrend highlighting Ether’s underperformance relative to Bitcoin over the last five years.

Interestingly, the last occasion this ratio dipped to 0.021, ETH was priced between $150 and $300 in May 2020.

Chart of Ethereum/Bitcoin over one month.

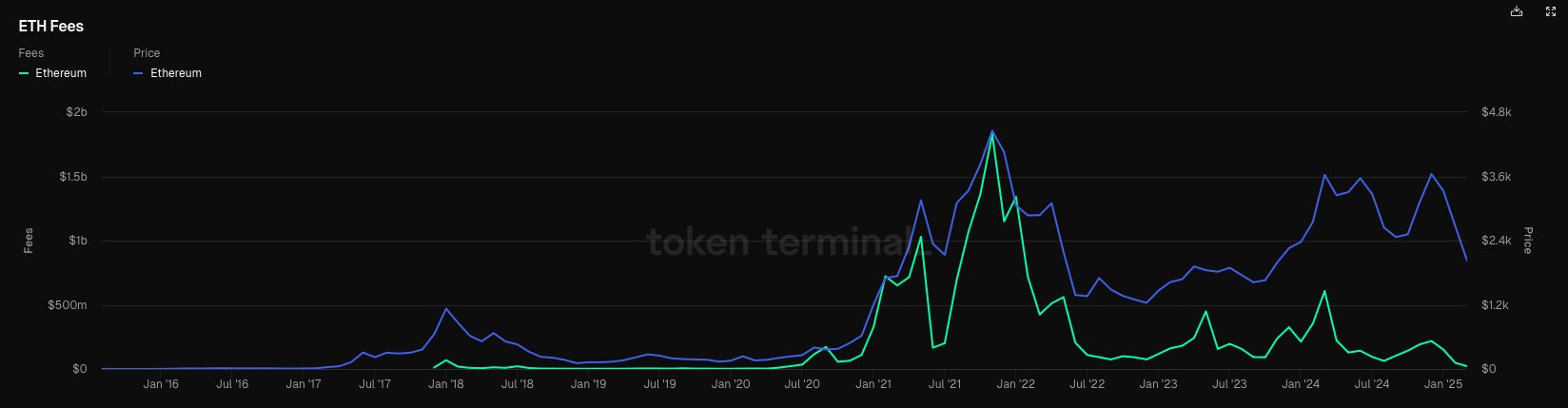

Recent data highlighted a decline in Ethereum’s monthly fees to $22 million in March 2023, marking the lowest level since June 2020 and signaling diminished network activity and market interest.

The fees associated with Ethereum transactions reflect user costs and are driven by network demand. A decrease in these fees suggests a lower utility for the network.

Ethereum fees compared to its price.

Despite the price fluctuations and revenue struggles, an Ethereum analyst has suggested that a bottom for the ETH/BTC ratio might materialize in the coming weeks. They speculated a potential range between 0.017 and 0.022, implying that the ratio could dip further prior to any rebound. The analyst remarked,

“It’s possible we may see another lower low on the RSI and one more downward push, reminiscent of the market patterns during the 2018-2019 Fed tightening and quantitative easing cycle, anticipating the first higher high post-May FOMC when the Fed concludes quantitative tightening and resumes QE.”

Analysis of Ethereum/Bitcoin by the analyst.

Related: Ethereum price has dropped nearly 50% since a public endorsement.

Historical data suggests a potential short-term bottom

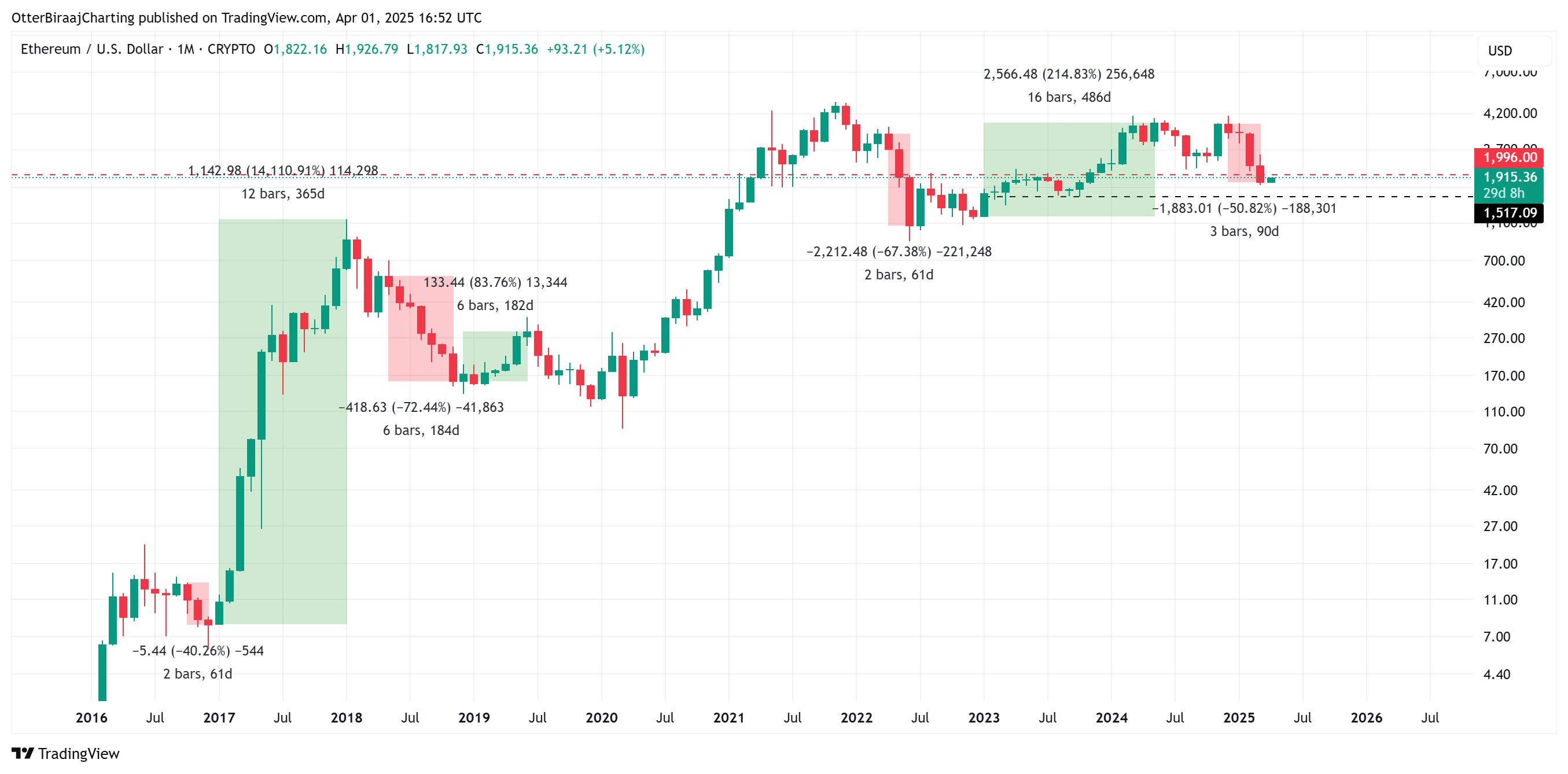

Since its launch, ETH has experienced three or more consecutive bearish months on five occasions, and each time ended with a short-term bottom. Analysis indicates that the most significant back-to-back red months occurred in 2018, totaling seven, followed by an 83% price surge after the downturn.

Monthly chart for Ethereum.

In 2022, following three consecutive negative months, ETH’s price remained stable for nearly a year, but the bottom was seen after the third bearish month in June 2022. Historically, Ethereum has displayed a 75% chance of experiencing a positive month in April.

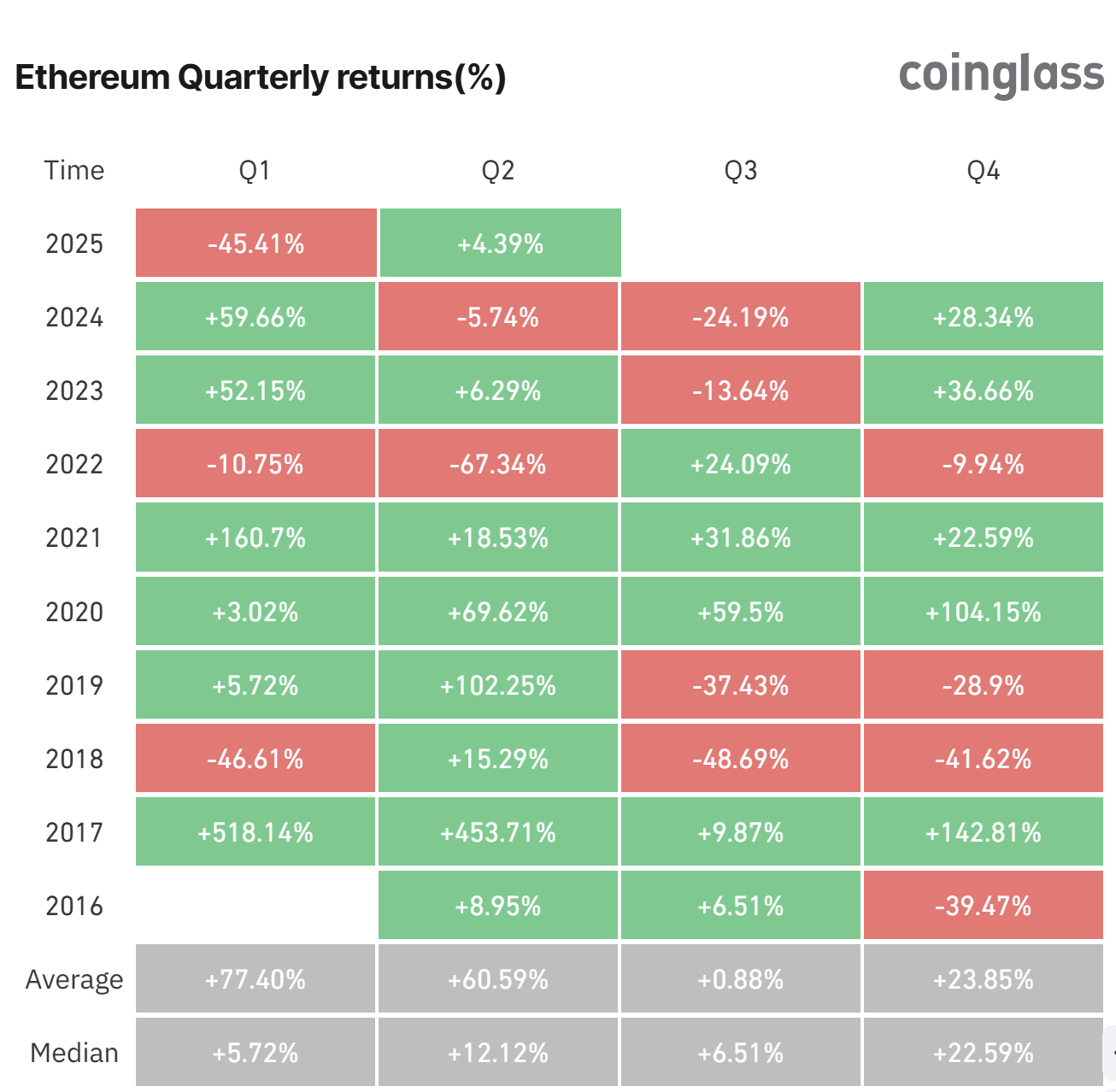

Examining previous quarterly returns, the altcoin has had fewer drawdowns in Q2 compared to other periods. With average returns for Q2 reaching as high as 60.59%, the probability of seeing positive performance in April remains optimistic.

Quarterly returns for Ethereum.

Related: What is driving the rise in Ethereum (ETH) prices today?

This content does not offer financial advice. Every investment and trading action carries risks, and readers are encouraged to perform their own due diligence before making decisions.