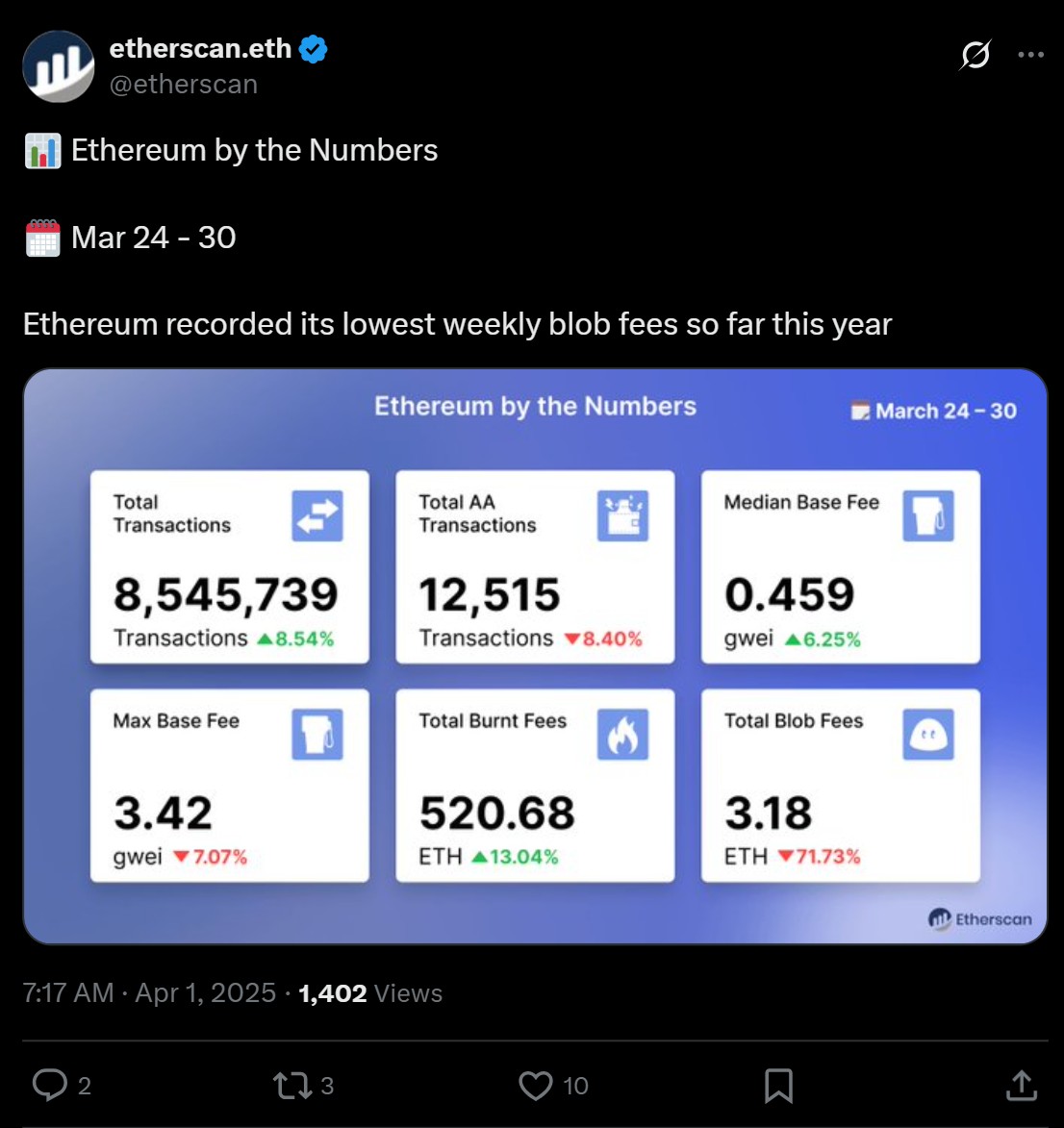

The primary revenue stream for the Ethereum network from layer-2 (L2) scaling solutions—known as “blob fees”—has dropped to its lowest weekly figures recorded this year, based on information gathered from Etherscan.

In the week that concluded on March 30, Ethereum generated merely 3.18 Ether (ETH) from blob fees, equating to around $6,000 as of April 1.

This represents a staggering 73% decline compared to the week before and a decline of over 95% from the week ending March 16, when Ethereum’s earnings from blob fees surpassed 84 ETH, according to Etherscan.

Source: Etherscan

Related: Ethereum’s fees set for recovery amidst L2 and blob fees uptick

Growing Pains Post-Dencun

The Dencun upgrade, implemented in March 2024, transitioned L2 transaction data to temporary offchain storage systems referred to as “blobs.”

This upgrade reduced costs for users but also led to a significant decrease in overall fee revenue for Ethereum—initial estimates suggested a drop of as much as 95%, according to data from an asset management firm.

“ETH Fees Have Been Low Due to Insufficient Blob Revenues as L2s Have Yet to Utilize Available Capacity,” remarked the head of digital asset research at the asset management firm in a social media post on November 1, 2024.

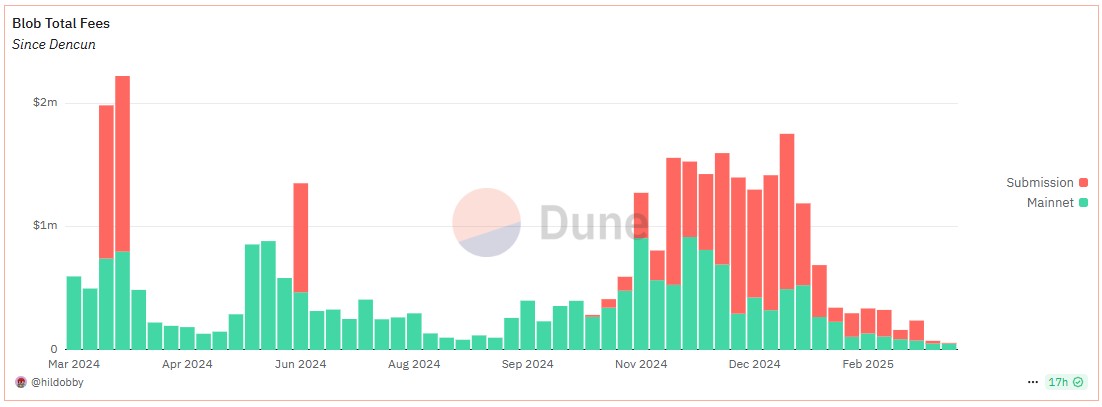

Since that time, the growth of blob fees has been inconsistent. Ethereum’s weekly blob fee revenue reached nearly $1 million in November before experiencing a sharp decline in subsequent weeks, based on analytics data.

The blob fee income for Ethereum has been volatile. Source: Dune Analytics

Ethereum’s ongoing challenges in generating substantial income from blob fees highlight growing concerns regarding the network’s scaling model, which heavily depends on L2s for transaction volume.

“The future of Ethereum hinges on how well it functions as a data availability engine for L2s,” stated a newsletter author in a social media post on March 31.

A separate social media post by the founder of a DeFi report mentioned that L2 transaction volumes would need to increase over 22,000 times for blob fees to completely replace Ethereum’s maximum transaction fee revenues.

Despite these challenges, Ethereum’s economic framework is still evolving. For example, the Pectra Upgrade, aimed at significantly altering how blob space is allocated within Ethereum, is set to take place later this year.

“The strategy is straightforward: maximize Ethereum’s scalability to capture as much market share as possible, and address fee revenue at a later stage,” said the founder of a relevant newsletter in a social media post on March 17.

Magazine: AI agents trading crypto is a compelling narrative, but exercise caution to avoid common pitfalls.