An asset management firm has submitted a request to list an exchange-traded fund (ETF) that includes a varied selection of spot cryptocurrencies, according to recent regulatory filings in the US.

On April 1, the firm filed an S-3 document with the US Securities and Exchange Commission (SEC), a necessary step to convert their non-listed fund into an ETF.

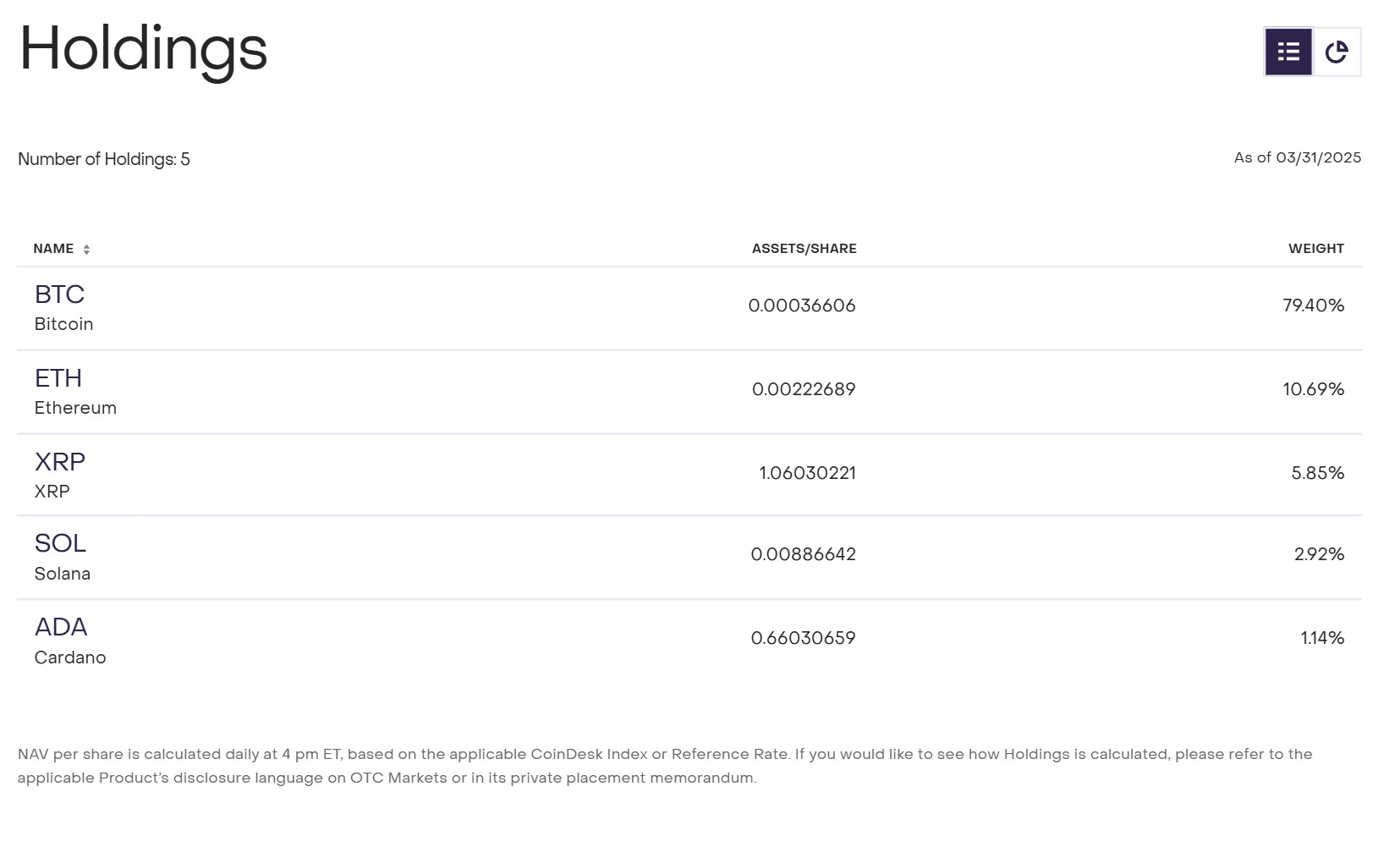

The Digital Large Cap Fund, established in 2018 but not yet traded on an exchange, consists of a cryptocurrency index portfolio that includes Bitcoin (BTC), Ether (ETH), Solana (SOL), XRP, and Cardano (ADA).

As of April 1, this fund boasts over $600 million in assets under management (AUM) and is available exclusively to accredited investors, as noted on their official site.

This submission follows a request made on October 29 by NYSE Arca, a US securities exchange, seeking approval to list the index fund.

The digital large cap fund holds a diverse collection of digital assets.

Related: US cryptocurrency index ETFs see slow initiation in the early days following their listings

Focus on Index ETFs

This filing highlights the urgency among ETF issuers to launch crypto products, particularly following a shift in federal regulatory attitudes influenced by the current administration.

In December, the SEC approved a selection of mixed crypto index ETFs. However, these funds, backed by Hashdex and Fidelity, are limited to Bitcoin and Ether and have attracted relatively modest investments since their launch in February.

In February also, the SEC took notice of over a dozen exchange filings related to cryptocurrency ETFs. These submissions cover topics like staking, options for existing funds, and proposals for new funds focusing on altcoins such as SOL and XRP.

Industry analysts indicate that after the debut of Bitcoin and Ether ETFs last year, crypto index ETFs have become a primary interest for issuers on Wall Street. “Index ETFs represent the next logical step because they provide an efficient investment vehicle, much like purchasing the S&P 500 in an ETF format. The same approach will apply in the crypto sector,” remarked the head of investment research at a prominent crypto bank.

Magazine: How cryptocurrency regulations are evolving globally in 2025