- The price of Pepe is nearing its descending trendline on Tuesday; a breakout could signal an impending bullish trend.

- The long-to-short ratio for PEPE suggests a potential rally, with bullish positions among traders reaching a monthly high.

- Traders are advised to remain cautious, as data indicates that a whale has offloaded 438 billion Pepe tokens.

On Tuesday, Pepe (PEPE) memecoin is trading around $0.000007 as it approaches its descending trendline, with a breakout suggesting a bullish move ahead. Additionally, PEPE’s long-to-short ratio supports a bullish outlook, as trader enthusiasm for bullish bets has surged to its highest level in over a month, indicating possible double-digit gains in the future.

Pepe’s price may rise if it closes above its descending trendline

The price of Pepe encountered resistance at its descending trendline (formed by connecting several high points since early December) on March 27, leading to an 18.43% drop by Sunday. This trendline aligns closely with the 50-day EMA at approximately $0.000008, marking a significant resistance area that could favor a bullish breakout. However, on the first day of the week, it bounced back by nearly 4%. At the time of writing on Tuesday, the price is edging closer to this crucial trendline.

If Pepe can break through the descending trendline and securely close above its 50-day EMA, this price movement would indicate a positive outlook. Such a scenario could propel PEPE’s rally by 25%, targeting a return to its February 14 peak at $0.00001 from the $0.000008 level.

On the daily chart, the Relative Strength Index (RSI) is currently at 47, trending upwards towards the neutral level of 50, which indicates a reduction in bearish momentum. To sustain bullish momentum, the RSI needs to cross above 50 to support a rally recovery.

PEPE/USDT daily chart

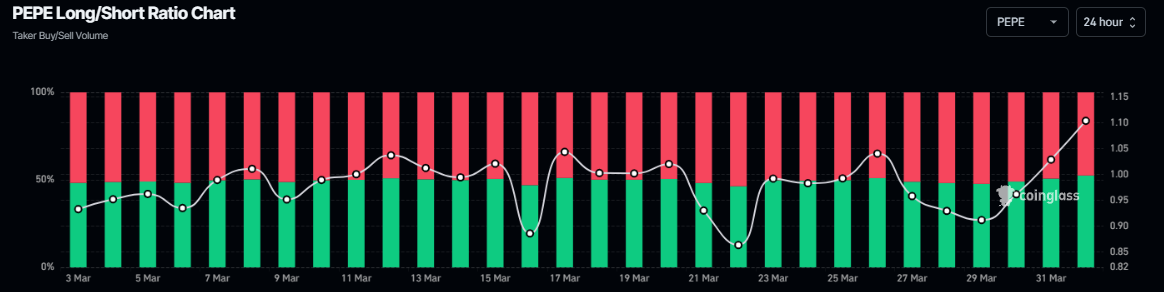

Another factor bolstering the bullish outlook for PEPE is the long-to-short ratio reported by Coinglass, which stands at 1.01—its highest point in a month. This ratio exceeding one indicates a bullish sentiment in the market, as a larger number of traders are betting on a price increase for the asset.

PEPE long-to-short ratio chart.

Nonetheless, traders should proceed with caution, as data reveals that a whale sold 438 billion PEPE tokens on Monday, valued at $3.03 million, resulting in a loss of $434K; this considerable sell-off could heighten selling pressure, potentially jeopardizing the bullish premise and leading to a decline in Pepe’s price.