Tether, the issuer of the USDT stablecoin, acquired 8,888 Bitcoin during the first quarter of 2025, based on on-chain data.

On-chain transaction data indicates that Tether transferred its newly obtained Bitcoin (BTC), valued at approximately $750 million at the time of writing, from a Bitfinex address to a wallet under its control. Analytics from a blockchain intelligence platform revealed that the firm now possesses 100,521 BTC, amounting to about $8.46 billion.

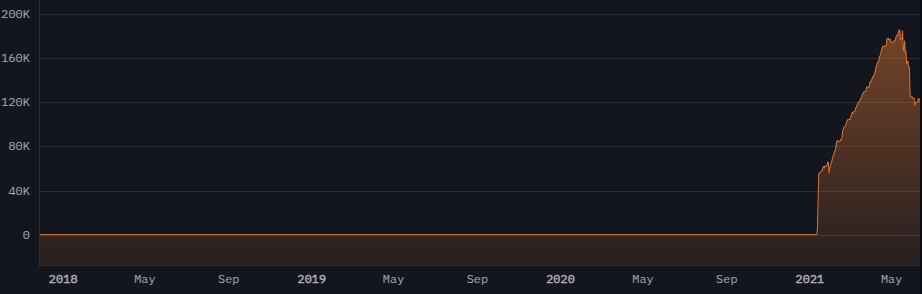

Tether’s Bitcoin balance chart.

This development follows reports from mid-February suggesting that Tether might need to liquidate some of its Bitcoin holdings to comply with anticipated US regulations. A report from JP Morgan noted that the proposed stablecoin regulations may classify a significant portion of the firm’s assets as non-compliant:

“According to the proposed legislation, Tether would have to replace its non-compliant assets with compliant ones. […] This could result in the sale of their non-compliant assets, which include precious metals, Bitcoin, corporate paper, and secured loans.”

However, Tether contested the conclusions drawn by JP Morgan’s analysts. A spokesperson for the firm expressed criticism in correspondence with Cointelegraph, stating that the analysts “lack understanding of both Bitcoin and Tether,” and emphasized that US stablecoin regulations have not yet been finalized.

Related: Binance halts Tether USDT trading in Europe to adhere to MiCA regulations

Tether emerges as an investment powerhouse

Tether reported $13 billion in profits for 2024, allowing the firm to allocate substantial capital into large-scale investments. This remarkable growth has positioned the stablecoin issuer as the seventh-largest purchaser of US Treasurys globally, outpacing economically significant nations like Canada, Taiwan, Mexico, Norway, and Hong Kong.

By the end of March, Tether invested €10 million ($10.8 million) in the Italian media company Be Water. In February, it obtained a majority stake in Juventus FC, a prominent Serie A football club located in Turin, Italy, and expressed interest in acquiring a majority stake in the South American agribusiness Adecoagro.

These investments are already amplifying Tether’s influence. Rumble, a video platform backed by a $775 million investment from Tether in late 2024, recently introduced its wallet for content creator payments, which supports Tether’s USDt.

Related: ‘Stablecoin multiverse’ begins, according to Tether CEO Paolo Ardoino

USDt continues to expand

USDt by Tether is recognized as the leading stablecoin and holds the position of the third-largest digital asset by market capitalization, according to available data. Currently, USDt’s total supply is just shy of 148 billion.

Aside from minor fluctuations in value compared to the US dollar, this supply indicates a market capitalization nearing $148 billion. Whale Alert data revealed that on March 31, Tether minted $1 billion worth of USDt on the Tron blockchain.

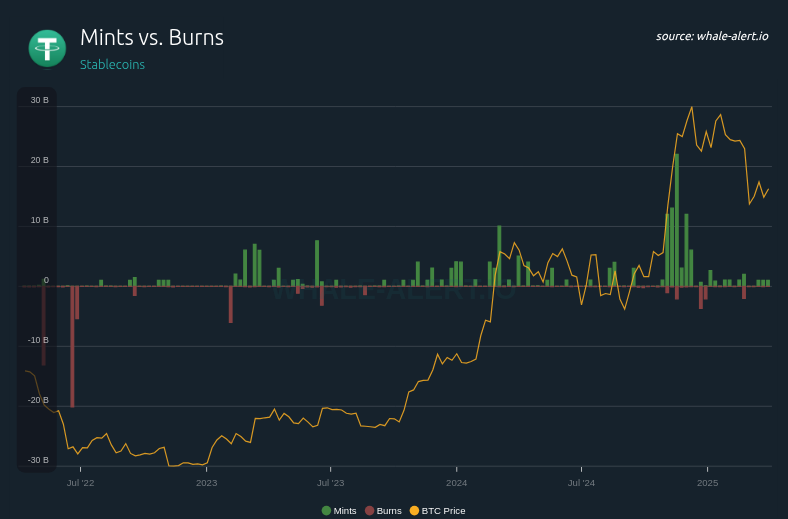

USDt minting, burning, and Bitcoin price trends.

Historically, Bitcoin’s price has tended to rise following increases in USDt minting, and significant minting of USDt has often followed notable price increases in Bitcoin. David Pakman, a managing partner at a crypto-focused investment firm, recently indicated that the global stablecoin supply could reach $1 trillion by the end of 2025, which could serve as a substantial driver for broader growth in the cryptocurrency market.

Magazine: Recent Bitcoin boost for Bhutan and Chinese Tether laundering issues: Asia Express