- The price of Tron increased by 3% to $0.25 on Monday, managing to rise despite overall market downturns driven by BTC, ETH, and XRP.

- Stablecoin provider Tether created $1 billion in USDT on the Tron blockchain.

- The US Congressional Financial Services Panel is poised to begin evaluating new regulations concerning stablecoins this Wednesday.

On Monday, Tron’s price showed resilience against the wider cryptocurrency market decline, rising by 3% to reach $0.25. This upward momentum coincided with stablecoin issuer Tether minting an additional $1 billion worth of USDT on the Tron network, according to on-chain data. Meanwhile, the atmosphere in the market is shifting as Congress prepares to assess potential new stablecoin legislation that could significantly influence Tron’s ecosystem.

Tron price breaks against market negativity with 3% increase

On Monday, Tron (TRX) emerged as one of the few altcoins to register gains while the broader crypto market struggled with negative trends due to macroeconomic factors and Congressional scrutiny surrounding Paul Atkins, the nominee to succeed Gary Gensler.

Tron (TRX) Price Analysis, March 31, 2025 | Source: CoinMarketCap

While Bitcoin (BTC), Ethereum (ETH), and XRP experienced losses on Monday, Tron’s native token TRX stood out by rising 3%, reaching a high of approximately $0.25 before pulling back to $0.24 at the time of reporting.

The inability to maintain a close above $0.25 hints at early profit-taking as bearish trends continue to influence the wider crypto market amidst ongoing macroeconomic uncertainties and regulatory worries.

Nonetheless, the 3% surge on Monday suggests that there are active internal bullish factors driving TRX’s price.

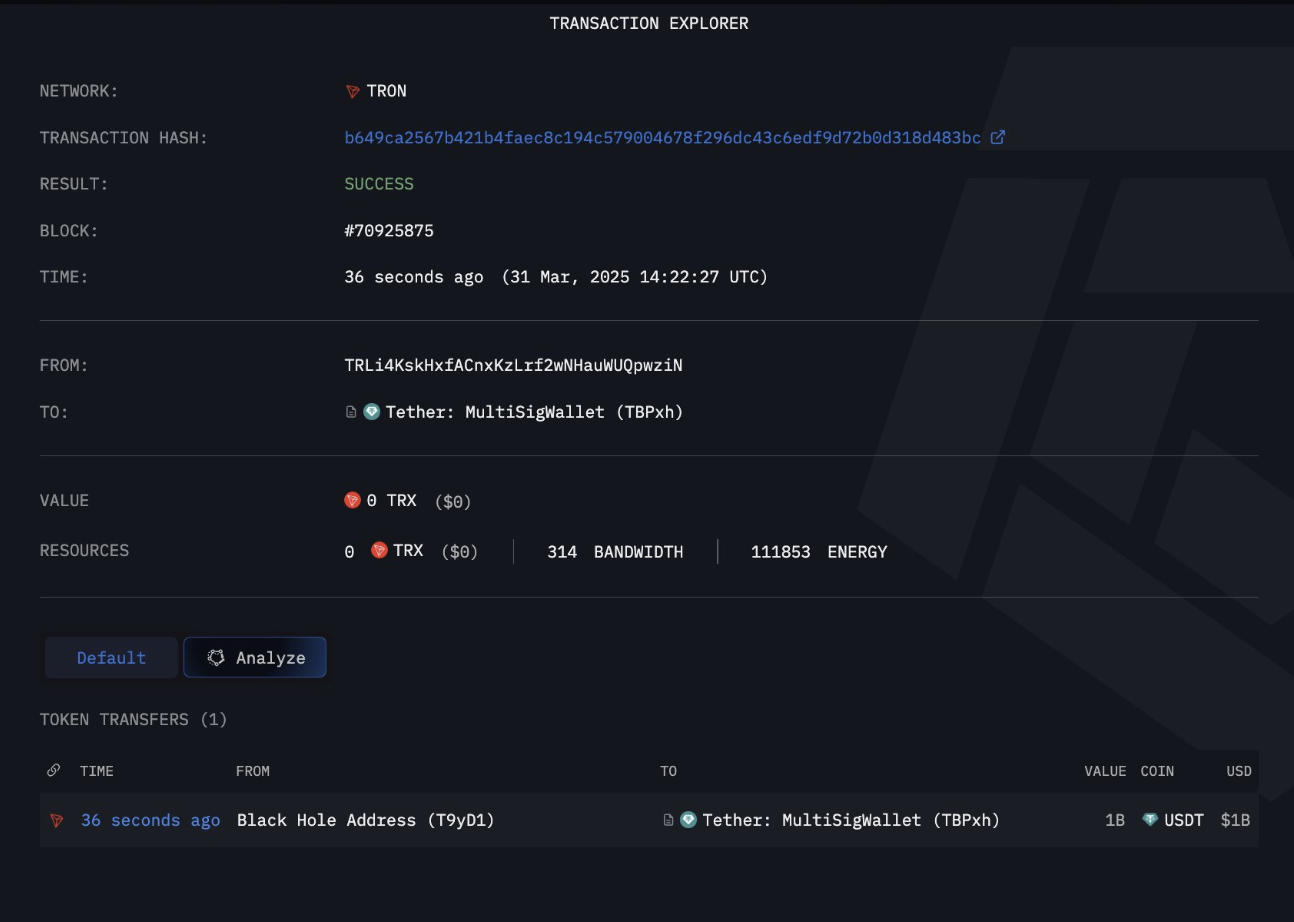

Tether’s $1 billion minting fuels enthusiasm for Tron’s ecosystem

On Monday, data from an on-chain analytics platform indicated that Tether, the leading stablecoin issuer, has minted an additional $1 billion in USDT tokens on the Tron blockchain.

As reported, Tether’s $1 billion injection now indicates that over 50% of the total USDT supply is held on the Tron network, solidifying its status as the preferred blockchain for stablecoin transactions due to low fees and quick transfers.

Tether mints $1 billion worth of USDT on Tron blockchain network, March 31, 2025 | Source: Arkham

Tether’s latest minting of $1 billion is considered favorable for TRX’s price trajectory for several reasons.

Firstly, it reaffirms the dominance of the Tron blockchain in the stablecoin market, especially following various US corporate firms taking strategic steps to enter the sector last month.

In March 2024, notable entities such as Fidelity, the WLFI backed by Trump, and the State of Wyoming announced plans to issue stablecoins.

Historically, large USDT mints have coincided with upward momentum for TRX, as increased liquidity in stablecoins typically leads to higher transaction volumes and network activity.

If demand for USDT on Tron continues to rise, TRX could extend its gains in the weeks ahead.

Congress to Assess Stablecoin Legislation on April 2—Implications for Tron

The U.S. House Financial Services Committee is set to assess a new stablecoin bill on April 2, which is a crucial regulatory development that could shape potential alternatives to the digital dollar, such as USDT.

Reports indicate that the proposed legislation seeks to impose stricter regulations on stablecoin issuers, which may affect Tether’s operations and, by extension, Tron’s position in the market.

Should the legislation introduce new compliance requirements for stablecoins, it could lead to volatility in TRX’s price action.

Conversely, if the bill offers clearer regulatory frameworks that support stablecoin adoption, Tron might experience increased institutional interest and network growth, potentially driving prices toward $0.30 as April 2025 progresses.

Tron Price Forecast: $0.30 target attainable as TRX aims for a strong April

Current price predictions for Tron suggest a bullish start to April 2025, particularly with the buying momentum spurred by Tether’s recent $1 billion USDT mint.

The stablecoin issuer’s increased reliance on Tron’s network boosts investor confidence.

As U.S. Congress begins its review of stablecoin legislation on April 2, the Tron network is likely to garner more attention.

Technical indicators are sending mixed signals for TRX. The MACD histogram has turned bullish, with the MACD line crossing above the signal line, indicating strengthening momentum.

If the upward movement continues, TRX could breach the $0.25 resistance and test $0.27 in the near term. Surpassing this level could spur a push toward $0.30.

Tron Price Prediction | TRXUSD

Nevertheless, downside risks persist. The rejection around $0.25 highlights the resistance at the supply zone, and an inability to maintain the upward trend could lead to a pullback to $0.23.

The volume-weighted average price (VWAP) at $0.2372 indicates significant demand levels.

If TRX cannot hold above this point, bearish pressures might increase.

Tron’s short-term direction is likely to be influenced by stablecoin regulatory actions.

If the Congress review garners considerable media coverage, TRX could maintain its rally into Q2 2025.