Avalanche has experienced a notable increase in stablecoin supply over the last year, yet the on-chain utilization of these funds suggests that many investors are adopting a passive approach. This passive behavior could be capping the demand for the network’s utility token.

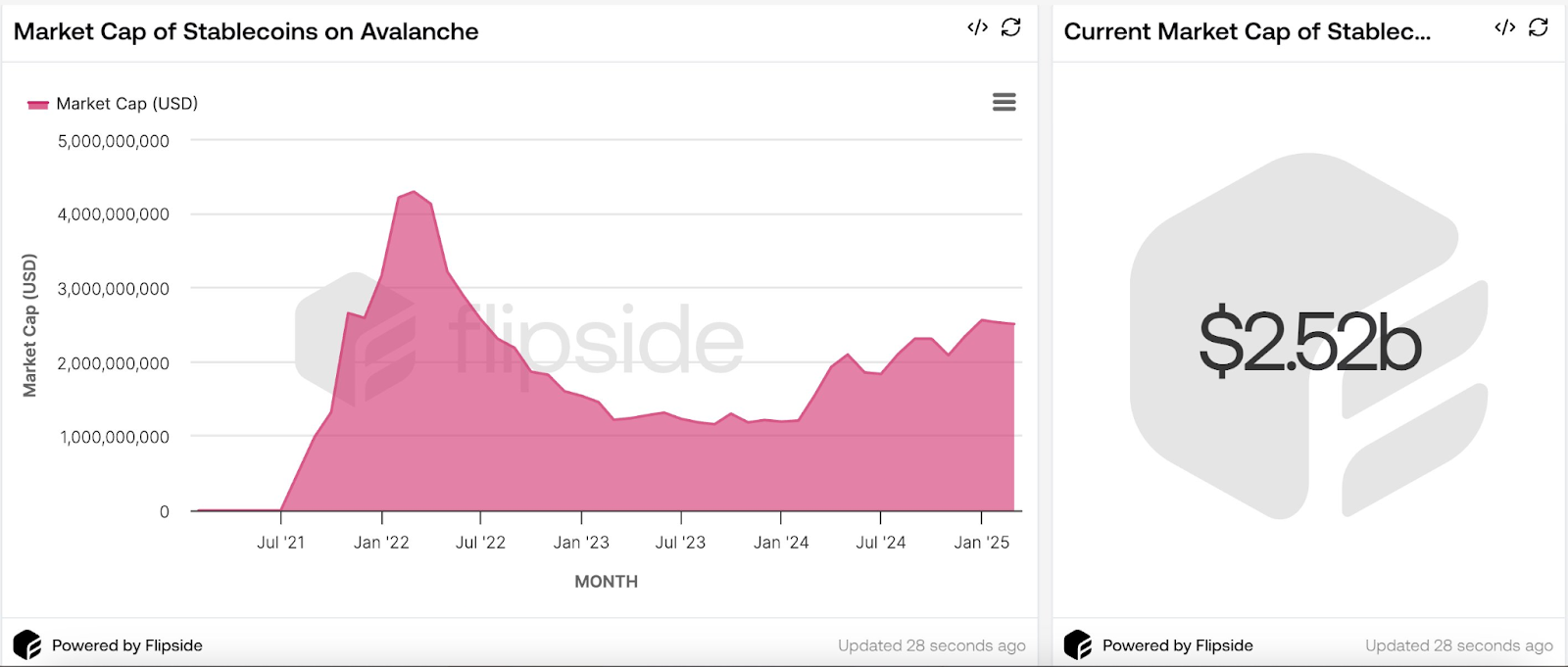

The stablecoin supply on the Avalanche platform surged more than 70% in the past year, climbing from $1.5 billion in March 2024 to exceed $2.5 billion by March 31, 2025, as indicated by a recent update.

Market capitalization of stablecoins on Avalanche.

Stablecoins play a crucial role as a bridge between fiat and cryptocurrency. An increase in their supply is typically interpreted as an indicator of forthcoming buying interest and heightened investor enthusiasm.

However, despite the $1 billion rise in stablecoin supply, Avalanche’s (AVAX) token has been on a downward trajectory, losing nearly 60% over the last year, trading just above $19 as of 12:31 PM UTC, according to market data.

AVAX/USD, 1-year chart.

Experts suggest that the disconnect between the rising value of stablecoins on Avalanche and the significant decline in AVAX’s price might be linked to the manner in which this stablecoin liquidity is being utilized. A senior research analyst noted that a “considerable portion” of these inflows is attributed to bridged Tether (USDT), adding:

“It appears more like inactive treasury holding rather than capital actively engaged within Avalanche’s DeFi ecosystem (at least for now). If these stablecoins are not being utilized for lending, swapping, or other DeFi activities that typically stimulate demand for AVAX (such as gas fees, collateral, etc.), their mere presence won’t necessarily drive up the AVAX price.”

The decline of the AVAX token aligns with a broader correction in the cryptocurrency market, as investor confidence is being weighed down by global uncertainties, especially with US President Donald Trump’s impending reciprocal import tariff announcement set for April 2, aimed at curbing the nation’s estimated $1.2 trillion trade deficit.

Analysts estimate 70% likelihood of a crypto market bottom by June

Market analysts anticipate a 70% chance that the cryptocurrency market might find its bottom in the coming two months leading up to June, as ongoing tariff-related discussions evolve and investor anxieties lessen.

“Once the most challenging parts of the negotiations are behind us, we foresee a clearer opportunity for crypto and other risk assets to finally reach a bottom,” said a principal research analyst.

Both traditional and crypto markets have been lacking upward momentum as they await the US tariff announcement.

BTC/USD, 1-day chart.

“The primary US equity indexes and BTC failed to significantly rise above their respective 200-day moving averages, while shorter-term moving averages are declining,” noted market analysts in a recent report.

Magazine: Could Bitcoin reach ATH sooner than anticipated? XRP may drop 40% and more: Hodler’s Digest, March 23 – 29