A Japanese financial institution and a business systems firm, along with the creators of the Avalanche network and a digital asset infrastructure provider, have entered into a partnership to investigate pathways for the commercialization of stablecoins within Japan.

According to a joint statement, the collaborative effort, formalized through a Memorandum of Understanding, aims to devise methods for the issuance and circulation of stablecoins tied to both the US dollar and the Japanese yen.

Moreover, the alliance will also look into utilizing stablecoins as a means of settlement for tokenized real-world assets, such as equities, bonds, and properties.

The regulatory landscape for stablecoins remains a significant area of focus on a global scale, with venture capitalists identifying this sector as one to watch as governments increasingly prioritize stablecoins in their digital asset agendas for 2025.

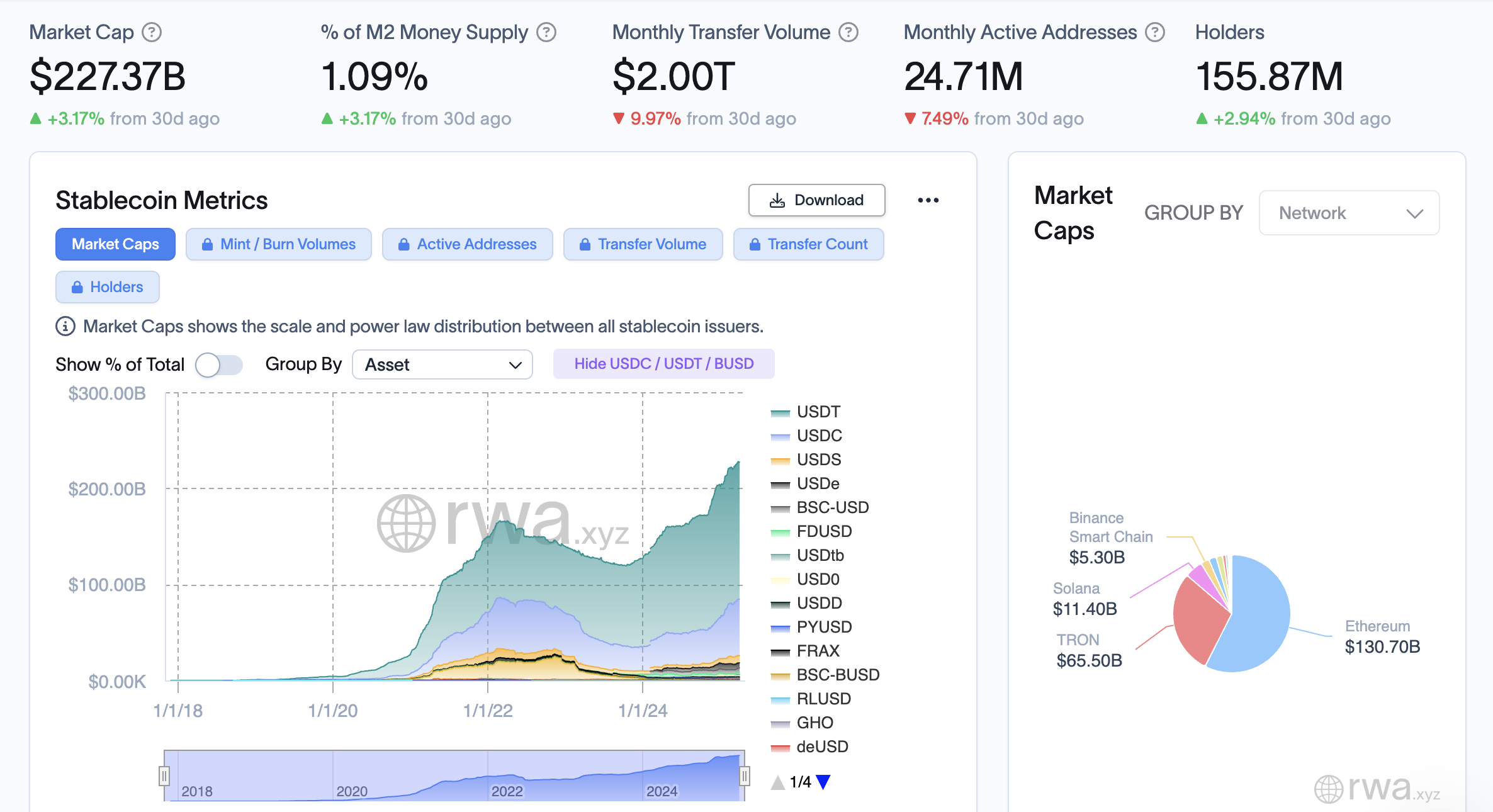

Overview of the stablecoin market. Source: RWA.XYZ

Related: As Trump’s tariffs approach, stablecoins and tokenized assets gain traction

Stablecoins at the core of US digital asset regulations

During the White House Crypto Summit on March 7, a key US Treasury official stated that thorough regulation of stablecoins is pivotal to the government’s ambition of leading the global crypto landscape.

This official emphasized that stablecoins could enhance the dominance of the US dollar in international markets, thereby broadening its usage worldwide.

Centralized overcollateralized stablecoins depend on short-term US Treasury securities and cash reserves in banks to support the value of tokenized real-world assets.

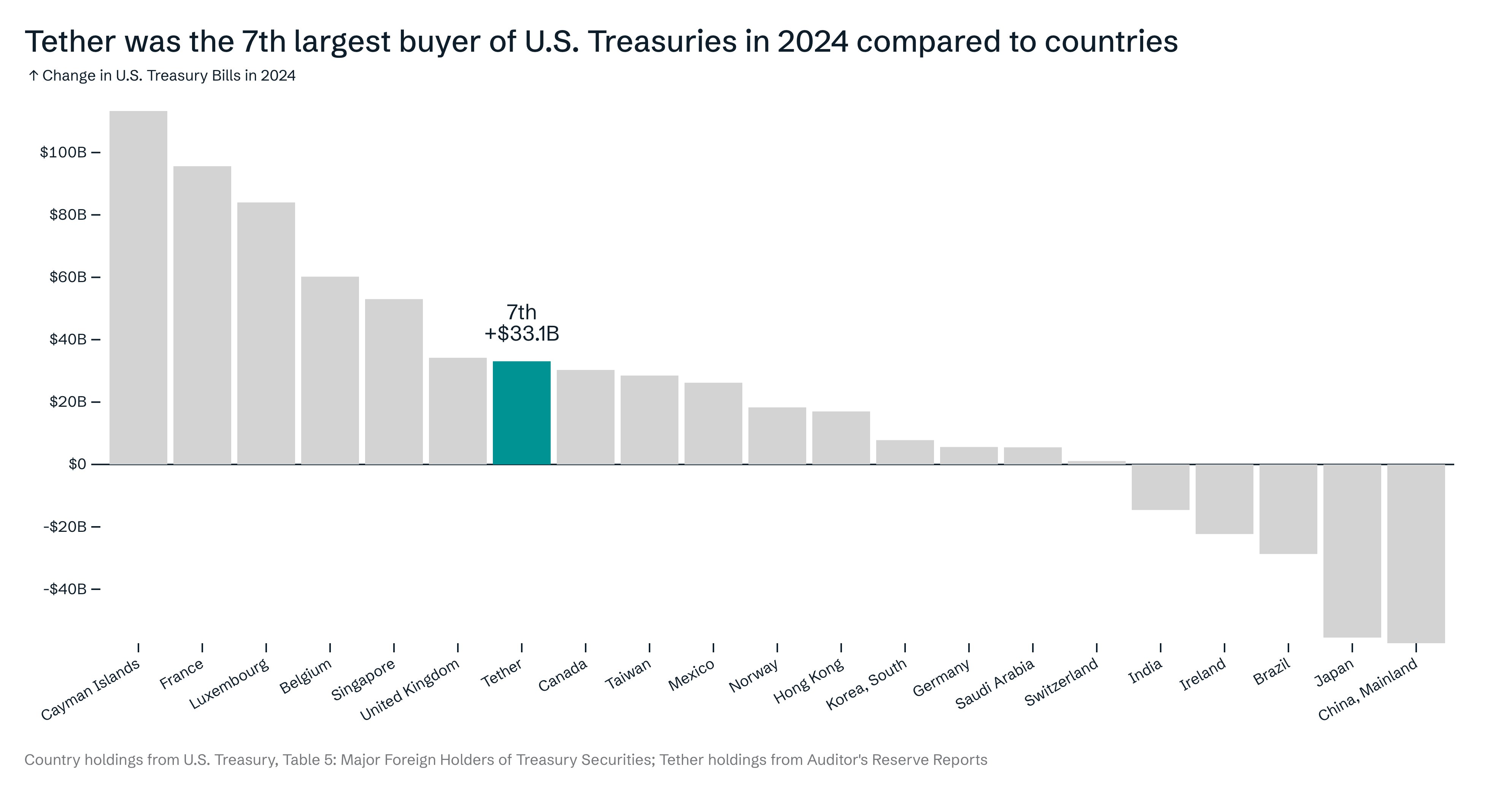

The CEO of a prominent stablecoin issuer recently noted that their company ranks as the seventh-largest purchaser of US Treasury bills, surpassing several nations such as France, Singapore, Belgium, and the UK.

The stablecoin issuer is now the seventh-largest buyer of US Treasury bills. Source: Paolo Ardoino

Stablecoin providers like Tether and Circle generate revenue by earning interest on US debt instruments while issuing tokenized fiat assets to consumers.

Recently, there has been a growing demand for stablecoin companies to share the yield generated with their clients, with industry figures advocating for regulatory changes to facilitate this on-chain distribution.

Conversely, a certain US Senator expressed opposition to these ideas, cautioning that allowing yield sharing could undermine the traditional banking sector and disrupt lending processes for mortgages, small businesses, and local banks.

Magazine: Unstablecoins: Risks of depegging, bank runs, and more