With the price of Bitcoin indicating that capital inflows are losing momentum and investors are pulling back from significant purchases, on-chain data offers insights into how Bitcoin holders are responding to current market conditions.

The sell-side risk ratio (SSR) serves as a key indicator of holder behavior. The SSR assesses the potential “risk” of sell-side pressure affecting the market. Essentially, it indicates the likelihood or intensity of a wave of distribution in relation to both price movements and the prevailing liquidity environment.

When SSR trends are elevated, it often signifies a considerable supply waiting to enter the market: large holders might be eager to take profits or short-term investors might be keen on selling into price strength. On the flip side, when the SSR is low or stabilized within a balanced range, it suggests that investors are less inclined to sell their coins, lacking any compelling reason to liquidate at current price levels.

From a fundamental perspective, the SSR is significant as it can signal important turning points in the market. A spike in the SSR generally points to heightened profit-taking or fear-induced selling. Conversely, a flat or decreasing ratio often indicates that the market has found a tentative equilibrium between buyers and sellers, which may result in reduced near-term volatility until a new catalyst emerges.

Bitcoin is well-known for its sensitivity to fluctuations in global liquidity. When liquidity is abundant, risk assets like Bitcoin tend to thrive; in contrast, as liquidity tightens, these assets often struggle as capital is less inclined to pursue higher-risk opportunities.

Since the SSR reflects the psychology of current holders—whether they are inclined to sell large amounts or prefer to hold—monitoring it alongside market volume can provide a valuable gauge of incoming or outgoing liquidity. A low or stable SSR in a declining liquidity environment often indicates that most “weak” hands have already sold off, leaving a relatively robust base of holders who are more comfortable with market volatility.

The SSR appears relatively flat within a mid-range during the latter half of March. This steadiness suggests a sort of stalemate between buyers and sellers, indicating that neither side has strong motivation to act aggressively.

This reflects a lack of substantial profit-taking. If either long-term holders or short-term speculators viewed Bitcoin as overvalued, we would likely see a noticeable increase in SSR as more coins become available on the market. Instead, the steady ratio suggests that participants are not rushing to liquidate.

The data also reveals a lack of significant sell-offs. Typically, before a bear market, we observe some capitulation as the realized cap declines sharply, often accompanied by a spike in SSR due to panic selling. However, the market has been gradually drifting, with only minor selling events, keeping the SSR comfortably within range without experiencing any major spikes.

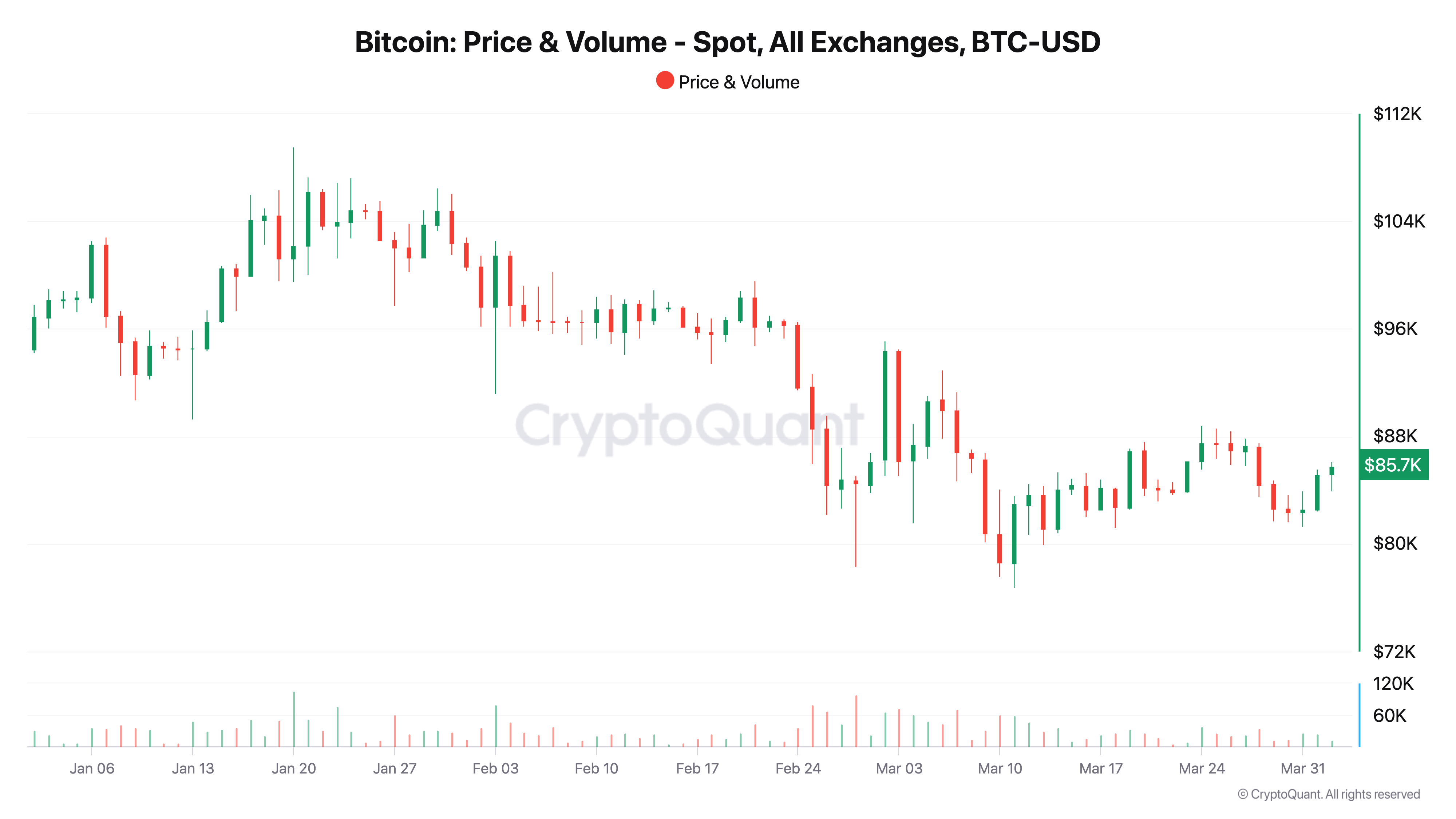

Additional insights from recent data show that spot trading volumes have decreased from the peaks observed late last year and earlier in the first quarter. Spot volumes have dropped from around $15 billion per day to approximately $5 billion daily recently. Simultaneously, Bitcoin’s price has been fluctuating within mid-range levels, indicating insufficient fresh demand to drive prices significantly higher, but no ample supply to push prices down sharply either.

The data implies that as volume decreased, the price entered a sideways consolidation phase, reinforcing the notion that large capital inflows have temporarily slowed. With lower spot volumes, the price struggles to break out decisively in either direction.

On-chain data indicates that long-term holders have not significantly cut back on their positions. A substantial portion of Bitcoin’s realized cap is held by addresses known for their historically low spending behavior. This demonstrates a level of “conviction” that likely keeps the SSR from spiking, as these holders are less likely to sell at current price points.

The flat reading of the SSR ratio suggests a market in a state of uneasy equilibrium: there is not enough new capital to initiate a rally, yet no mass selling that would precipitate a significant downturn. Despite declining spot volumes and ETF outflows, we aren’t witnessing the frantic selling or drastic price drops typical of a full-blown bear market.

Instead, Bitcoin’s long-term holder base continues to support the market, indicating that if global liquidity improves, conditions may be ripe for renewed upward movement. Meanwhile, a low-liquidity environment and a holder-dominated supply keep Bitcoin stable within a mid-range zone, biding time for the next wave of conviction, whether bullish or bearish.