Bitcoin is once again in the spotlight as a potential safeguard against financial turbulence, especially after it maintained relative stability during a historic stock market plunge that erased $5 trillion from the S&P 500.

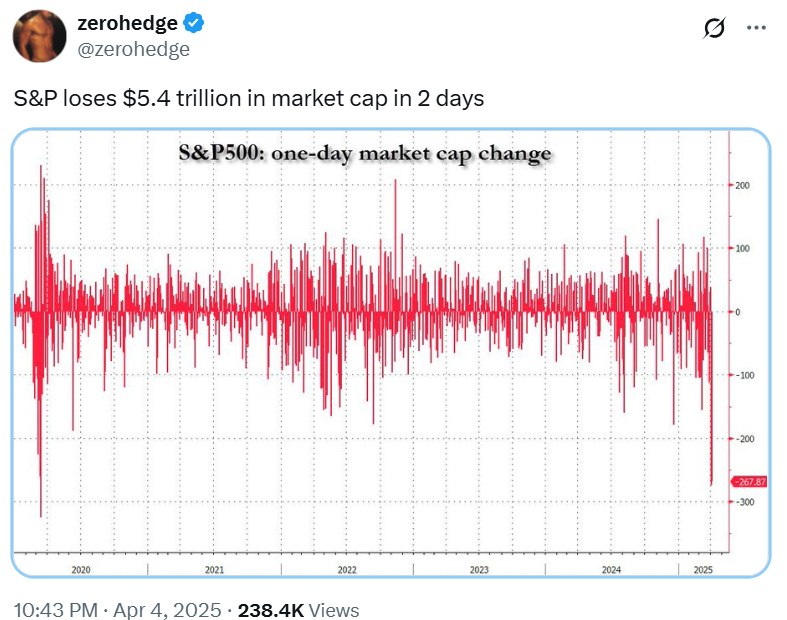

Over a two-day period, the S&P 500 experienced its largest drop ever, losing $5 trillion in market capitalization. This decline eclipsed the previous record of a $3.3 trillion loss witnessed in March 2020 during the early days of the COVID-19 pandemic, according to a report from early April.

The dramatic sell-off was triggered by the announcement of reciprocal import tariffs by US President Donald Trump on April 2, aimed at reducing the country’s estimated $1.2 trillion trade deficit in goods and boosting local manufacturing.

S&P 500 records a loss of $5.4 trillion. Source: Zerohedge

After the tariff announcement, Bitcoin’s (BTC) decline was notably less severe compared to traditional markets, indicating its increasing maturity as a global asset, as stated by Marcin Kazmierczak, co-founder and COO of a blockchain oracle company.

“What we might be observing is a shift in Bitcoin’s market stance,” the co-founder remarked, adding:

“In the past, Bitcoin has closely followed risk assets during macroeconomic shocks, but this divergence could indicate a changing mindset among investors.”

He also noted that “Bitcoin’s fixed supply model stands in stark contrast to fiat currencies that could experience inflationary pressures due to tariff-induced economic shifts.”

Related: 70% likelihood of crypto bottoming out before June amid trade anxieties: Nansen

While stocks were in freefall, Bitcoin’s price only dipped by 3.7% during the same two-day span, hovering around $83,600 as of early April, according to TradingView data.

BTC/USD, 1-hour chart. Source: Cointelegraph/TradingView

Even with the monumental $5 trillion sell-off in traditional markets, “BTC proves its value by remaining above the $82,000 key support level, indicating that structural demand continues to exist despite forced liquidation and heightened volatility,” commented Iliya Kalchev, an analyst at Nexo.

Related: Michael Saylor’s Strategy buys Bitcoin dip with $1.9B purchase

Bitcoin could rise as “digital gold” amid tariff discussions

Although Bitcoin seems to be distancing itself from traditional equities, its initial price drop reflects that some investors still view Bitcoin as a risk asset, said James Wo, founder and CEO of a venture capital firm.

“With the advent of Bitcoin ETFs allowing for increased institutional adoption, it is now influenced even more by macroeconomic shifts,” Wo explained, adding:

“Yet, if Bitcoin maintains its resilience amid ongoing uncertainty, its capped supply and decentralized characteristics could reinforce its narrative as ‘digital gold’ and enhance its role as a reliable store of value.”

Despite the current absence of upward momentum, analysts remain optimistic about Bitcoin’s potential for growth throughout 2025.

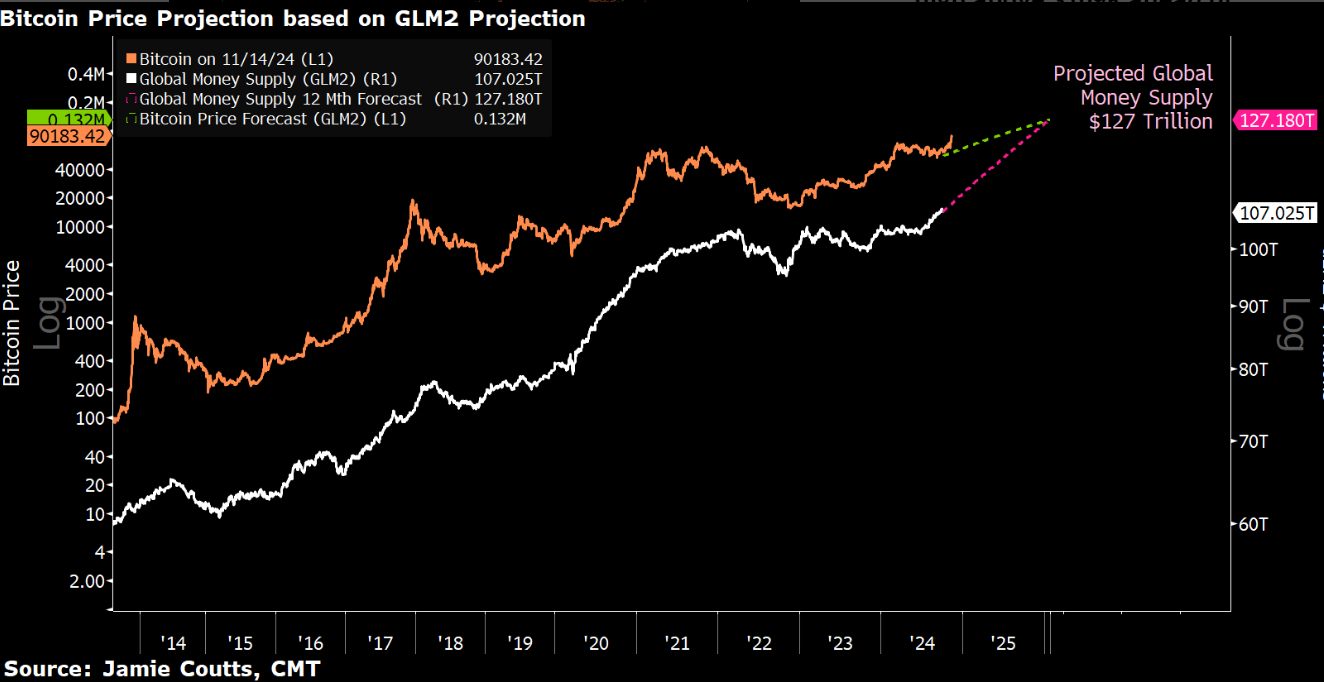

BTC projected to reach $132,000 based on growth in M2 money supply. Source: Jamie Coutts

The expanding money supply could propel Bitcoin’s price beyond $132,000 before the close of 2025, according to predictions from a chief crypto analyst.

Magazine: Bitcoin ATH sooner than expected? XRP could decline by 40%, and more: Hodler’s Digest, March 23 – 29