What is the BUIDL fund?

The BUIDL fund is the first tokenized money market fund offered by a leading asset management firm. This fund allows traditional financial instruments to be traded on blockchain networks as cryptographic tokens.

A money market fund is a type of mutual fund that focuses on short-term, high liquidity debt instruments. These funds provide a temporary place for investors to keep their money while generating some income without significant capital growth. They typically invest in cash, cash equivalents, and high-rated debt securities, such as US Treasury bonds.

This firm is recognized as the largest asset manager globally. It now offers blockchain-based money market options via networks like Solana and Ethereum. In essence, the company has combined traditional money market ideas with blockchain’s distributed ledger and payment capabilities.

The fund has experienced remarkable growth, experiencing a surge from $667 million to $1.8 billion in assets under management within just three weeks. As of March 31, 2025, the fund continues to see a consistent influx of capital, with a growing number of crypto-savvy investors opting to invest in BUIDL through the seven blockchains on which it operates:

- Ethereum

- Solana

- Aptos

- Arbitrum

- Avalanche

- Optimism

- Polygon

The launch of BUIDL represents a pivotal institutional step in merging traditional finance (TradFi) with blockchain-based products. It signifies another advancement in the crypto strategy aimed at achieving widespread financial acceptance of both cryptocurrency and blockchain.

This institutional foray into cryptocurrency from a well-established asset manager with trillions in assets under management adds further credibility to the space and may catalyze a wave of new capital from institutional investors.

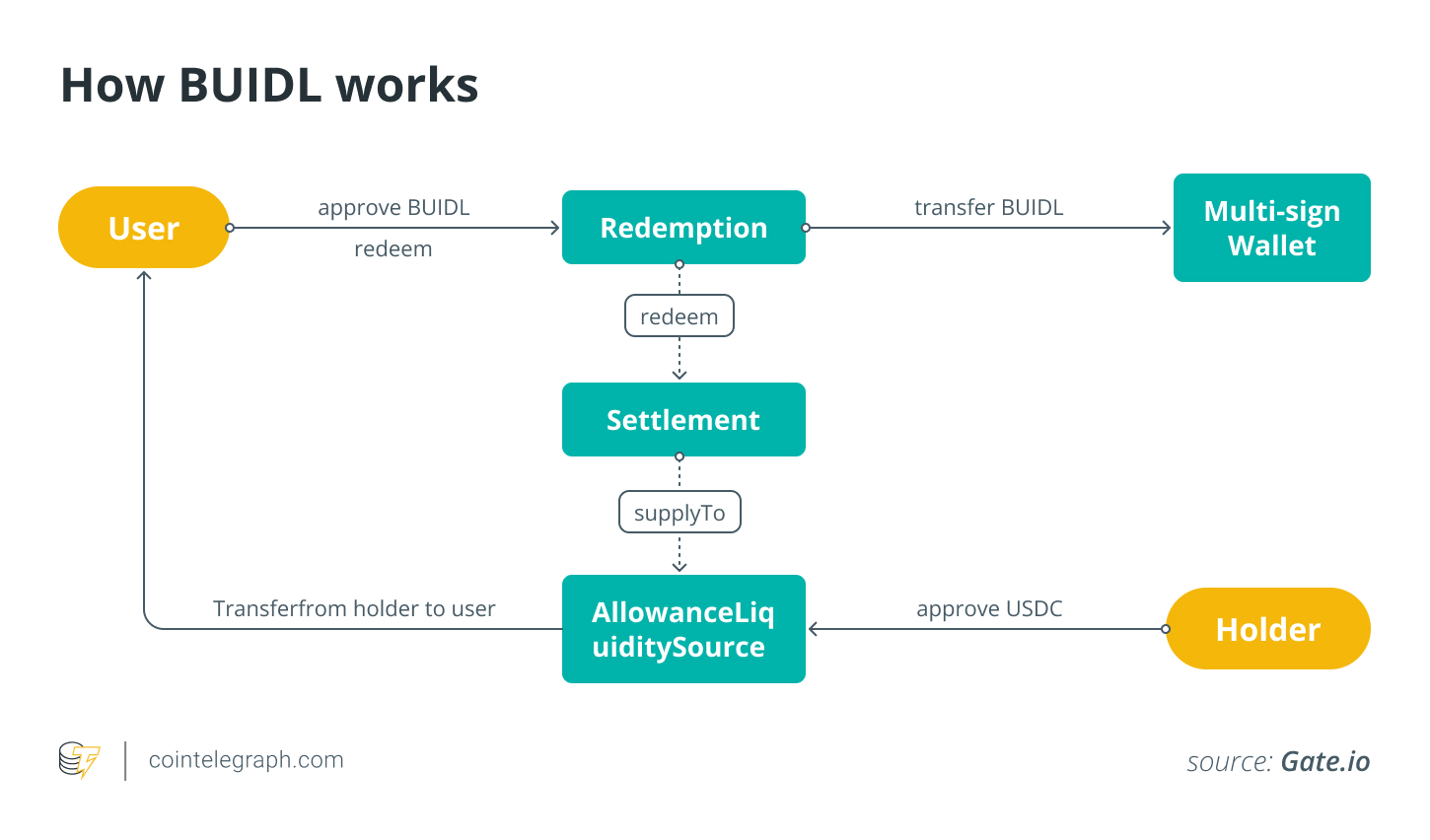

How does BUIDL operate?

BUIDL functions as a tokenized fund that invests in dollar-equivalent assets such as US Treasury bills, cash, and repurchase agreements. Investors can buy and sell BUIDL tokens that are dollar-pegged, with daily dividends distributed to their wallets monthly as new tokens.

By offering a yield while maintaining the stability of traditional financial instruments, investors can engage in real-world asset tokenization (RWA), which entails creating a digital representation of an asset.

This digital representation exists as a blockchain-based token, akin to cryptocurrency, capable of being traded across relevant decentralized networks. Unlike traditional asset transfers that may take several days to settle, tokenized assets facilitate nearly instantaneous trades and settlements, thus enhancing capital efficiency and enabling automated processes to reduce costs.

A blended approach creates a cohesive bridge between TradFi and crypto, providing investors with a unique combination of regulated product stability and blockchain efficiency.

Did you know? Part of a recent $1 billion RWA allocation, a specific company secured roughly $200 million to $300 million in March 2025, elevating its AUM past $400 million. The tokenized Treasury market’s $5 billion milestone underpins this growth.

Why BUIDL is significant for cryptocurrency

The BUIDL fund elevates institutional credibility within the crypto ecosystem. Regulated organizations can now confidently enter the blockchain domain, particularly on established networks like Ethereum and Solana.

This fund illustrates practical, real-world applications of blockchain technology beyond mere speculative investments. Historically, crypto investments were primarily for those willing to navigate the complexities of direct token trading and decentralized finance (DeFi).

For many, engaging with DeFi posed too great a risk for their valuable assets. Furthermore, nebulous regulatory frameworks rendered these options inaccessible to institutional fund managers.

For years, the cryptocurrency sector has sought the endorsement and validation of traditional financial establishments. BUIDL signifies not only acceptance but a green light for active engagement from one of the industry’s most prominent financial entities. The fund’s early achievements could serve as a catalyst for a surge in institutional investment as mainstream crypto adoption advances.

BUIDL’s influence on traditional finance (TradFi)

The BUIDL fund stands as a high-profile illustration of how tokenization and blockchain can enrich traditional financial products.

This fund showcases the potential design opportunities for further tokenizing money markets and RWAs.

“In the year since the inception of BUIDL, we’ve witnessed substantial growth in demand for tokenized real-world assets, emphasizing the importance of providing institutional-grade offerings onchain,” remarked a company executive affiliated with the technology partner that helped establish BUIDL on Solana. “As the market for RWAs and tokenized treasuries accelerates, expanding BUIDL to Solana—renowned for its speed, scalability, and cost-effectiveness—was a logical progression.”

Whereas traditional money markets allow investors to earn yields from unutilized cash, these funds often come with trading limitations, such as restricted operational hours. The advent of blockchain versions offers investors continuous access and liquidity around the clock.

This firm is not alone in the tokenized fund space. Another asset management firm launched a comparable blockchain product, achieving a market cap exceeding $600 billion by February 2025. Additionally, a company in this space introduced an interest-yielding stablecoin.

Did you know? In addition to traditional financial institutions, blockchain-native organizations have expressed interest in BUIDL, looking to leverage its onchain features. A notable early investor, Ondo Finance, allocated $95 million from its own tokenized bond fund into BUIDL shortly after its March 2024 launch.

Advantages of BUIDL for investors

Traditional money market funds have been established for decades; however, BUIDL introduces multiple advantages, including speed and accessibility, to modernize these financial products.

- Increased speed and efficiency: BUIDL investments reduce settlement times compared to traditional finance, minimizing administrative workload and costs while ensuring operational efficiency.

- Enhanced liquidity and accessibility: Investors can trade their fund tokens 24/7, eliminating limitations on trading hours and ensuring constant liquidity for improved capital efficiency.

- New yield generation: By maintaining a stable $1 value per token, BUIDL enables investors to receive daily dividends in the form of new tokens monthly, potentially providing higher returns than traditional fixed-income investments.

- Transparency and security: All transactions and holdings within BUIDL are tokenized and recorded on the relevant blockchains, offering investors enhanced visibility and accountability regarding their assets.

Risks and challenges of BUIDL

The rapid expansion of BUIDL is promising for advancing the synergy between TradFi and blockchain, yet it also presents risks that may be unfamiliar to many investors. These considerations are vital for money markets as liquidity and technological concerns continue to evolve.

It’s crucial for investors to recognize these new factors:

- Liquidity concerns: Liquidity is essential for any thriving asset class, particularly with derivative products. BUIDL faces some liquidity challenges, given its current investor base comprises qualified investors, limiting broader market adoption.

- Technical vulnerabilities: BUIDL relies on smart contracts from the Ethereum network to tokenize US Treasurys. Vulnerabilities within smart contracts could pose risks, leading to fund failures or breaches.

- Market manipulation: Cryptocurrency markets are well-known for their volatility, often stemming from manipulation tactics like wash trading and pump-and-dump schemes. As a relatively new tokenized product, BUIDL could be susceptible to these risks due to its limited trading volumes and liquidity.

- Counterparty risk: While the firm behind BUIDL is a reputable financial institution, counterparty risk remains significant in the crypto realm. For example, if a platform facilitating the trading of BUIDL encounters financial difficulties, it could jeopardize the token’s reliability.