This week, cryptocurrencies, including certain altcoins, outperformed global stocks as the fear and greed index reached its lowest level in years.

Bitcoin (BTC) remains resilient as the stock market experiences a downturn, with several altcoins surging while global markets react to President Trump’s recent tariffs on Chinese imports.

The leading cryptocurrency has officially surpassed the tech-focused Nasdaq 100 in year-to-date performance, despite a relatively stable week. Meanwhile, U.S. equities faced a historic decline. The Dow Jones Industrial Average plummeted a staggering 2,200 points on Friday alone, following a 1,200-point drop the previous day—erasing $5.4 trillion in market value from American stocks over just two days. Since February, the Dow has fallen from $45,000 to $38,200, the Nasdaq 100 has decreased from $22,220 to $13,400, and the S&P 500 has dropped from $6,145 to $5,000.

This chaos followed Trump’s announcement of a sweeping 34% tariff on all Chinese products, prompting immediate retaliation from Beijing. The fear and greed index—a closely monitored gauge of market sentiment—plummeted to 6, its lowest level in years, as investors sought refuge.

Ironically, that refuge may have included cryptocurrency, as altcoins outperformed both Bitcoin and traditional investments.

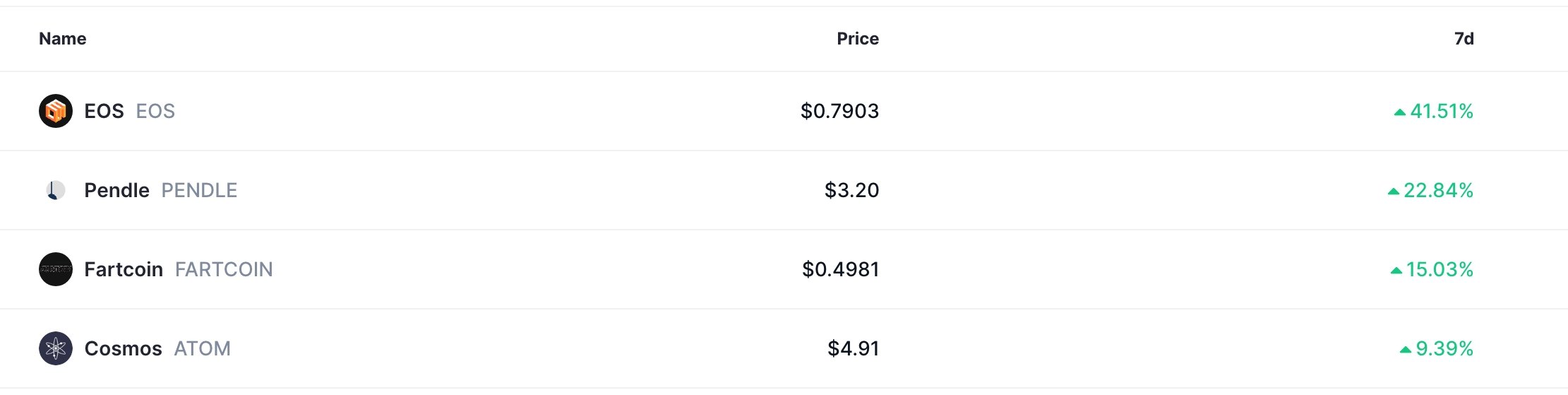

EOS, Pendle, Fartcoin, and ATOM Rise as Stocks Decline

EOS (EOS) led the charge, soaring by 41% after rebranding to Vaulta and announcing a shift toward blockchain banking and asset tokenization.

As part of the rebranding, the project also launched VirgoPay in collaboration with VirgoCX Global, facilitating cross-border payments using stablecoins.

Other notable performers included Pendle (PENDLE), which increased by 22% as yield-seeking investors flocked to its DeFi platform offering annual returns exceeding 7.5% on synthetic stable assets.

Additional top-performing altcoins for the week were Fartcoin (FARTCOIN) and Cosmos (ATOM), which rose by 15% and 9.5%, respectively.

Zcash, OKB, and Raydium also made significant moves.

However, it’s premature to determine whether Bitcoin and these altcoins can be regarded as safe-haven assets, as cryptocurrencies remain highly speculative.

Moreover, while some altcoins performed well this week, many others experienced declines. Berachain (BERA) fell by 27%, while Pi Network (PI), Immutable X, and Movement (MOVE) all dropped by over 15%.