On April 4, the U.S. stock market suffered a significant loss, amounting to more than the total value of the entire cryptocurrency market. This sharp decline was fueled by growing concerns over tariffs proposed by President Donald Trump.

During that trading day, the stock market plummeted by $3.25 trillion, exceeding the cryptocurrency market’s valuation of $2.68 trillion by approximately $570 billion at the time of the report.

Nasdaq 100 Enters Bear Market

Within the group of Magnificent-7 stocks, Tesla (TSLA) experienced the most considerable drop, falling by 10.42%. Nvidia (NVDA) followed with a decrease of 7.36%, and Apple (AAPL) was down by 7.29%, as per data from TradingView.

This widespread downturn indicates that the Nasdaq 100 has officially entered a bear market, having declined by 6% during the trading session. According to trading commentary from The Kobeissi Letter, this represents the largest single-day drop since March 16, 2020.

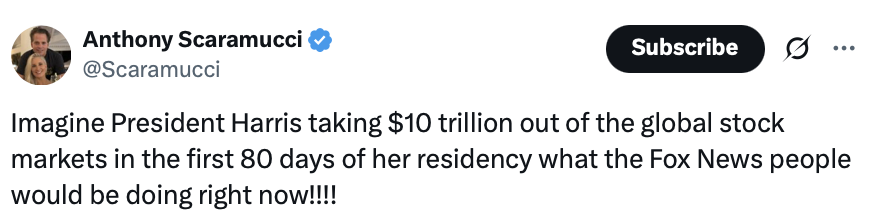

They noted, “U.S. stocks have now lost a staggering -$11 TRILLION since February 19, with recession probabilities exceeding 60%.” Furthermore, they stated that Trump’s tariff announcement on April 2 was “historic,” emphasizing that if tariff measures persist, a recession will be “impossible to avoid.”

Image Credit: Anthony Scaramucci

On April 2, Trump signed an executive order implementing reciprocal tariffs on trading partners, including a 10% baseline tariff on imports from all nations.

Trump indicated that these reciprocal tariffs would be roughly half the rates that U.S. trading partners impose on American products.

Related: Bitcoin holds at $80K support as trade war escalates, affecting U.S. stock market

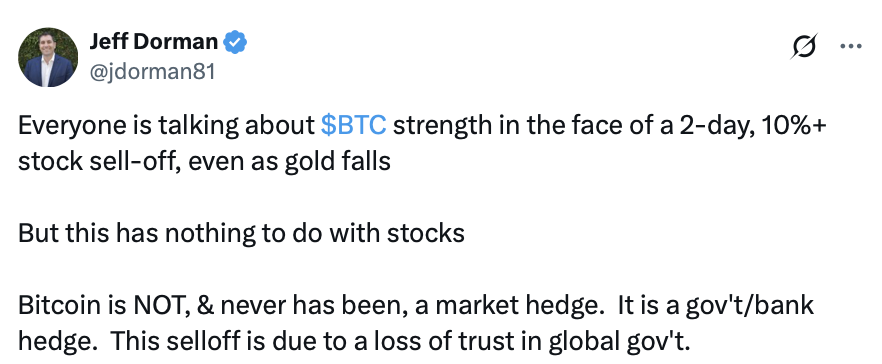

Meanwhile, the cryptocurrency sector has highlighted that, despite the stock market’s downturn, Bitcoin (BTC) is performing better than many anticipated.

Crypto trader Plan Markus noted in a post that, despite the entire stock market “collapsing,” Bitcoin is maintaining its value.

Image Credit: Jeff Dorman

Even individuals who are generally skeptical about cryptocurrency have noted the disparity between Bitcoin’s resilience and the declining U.S. stock market amid this period of macroeconomic instability.

Market commentator Dividend Hero expressed to his followers that, despite his previous criticisms of Bitcoin, he finds it compelling that it has not plummeted alongside the stock market.

Additionally, technical trader Urkel remarked that Bitcoin seems unaffected by the impacts of tariff disputes and market declines. At the time this report was published, Bitcoin was trading at $83,749, reflecting a slight decrease of 0.16% over the past week, based on data from CoinMarketCap.

Magazine: The Ripple Effect: XRP’s Outcome Leaves Ripple in a Unique Position, Lacking Precedent in Crypto Law