The Consumer Financial Protection Bureau is likely to experience a diminished role in cryptocurrency regulations as other federal bodies, such as the Securities and Exchange Commission and state regulators, take on a more significant part in shaping crypto policy, as noted by Ethan Ostroff, a partner at a law firm.

“Given the current administration, my impression is that we are quite likely to witness a notable retreat by the Bureau in light of the activities of other regulatory bodies,” Ostroff mentioned in a recent interview.

State regulators possess the authority under the Consumer Financial Protection Act to take over some regulatory responsibilities from the Bureau, according to the attorney. However, he also pointed out that certain regulatory functions will remain under the Bureau’s jurisdiction based on established legal frameworks.

Ostroff identified the New York Department of Financial Services and the California Department of Financial Protection and Innovation as key state regulators to watch as potential frontrunners in cryptocurrency regulations.

Nonetheless, the attorney emphasized that even though the Bureau may see its role lessen during the current administration, it will not be completely dismantled due to “statutorily mandated obligations and requirements” that would necessitate Congressional action to amend.

Current administration aims to streamline Bureau operations

The current administration has singled out the Bureau as part of a broader initiative from the Department of Government Efficiency to cut government spending and alleviate federal debt.

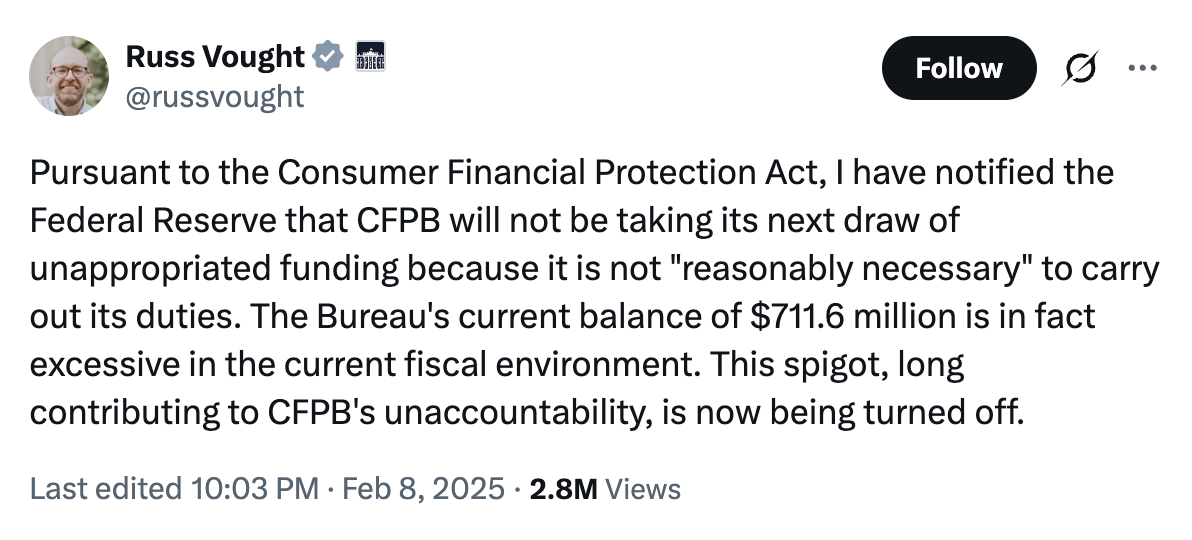

Russell Vought, recently appointed to lead the Bureau, announced significant funding reductions and operational rollbacks shortly after taking the reins in February.

Source: Russell Vought

Massachusetts Senator Elizabeth Warren criticized Elon Musk for his role in undermining the Bureau, which she co-founded in 2007.

Warren condemned Musk as a “bank robber” and alleged that the current administration’s efforts to dismantle the Bureau were aimed at reversing consumer protection regulations and gaining further control over the financial system.

In a February 12 interview, Warren emphasized that the Executive Branch lacks the legal authority to entirely dismantle the Bureau, highlighting that such an action requires approval from Congress.

Magazine: SEC’s change in stance on crypto leaves important questions unresolved