Cryptocurrency markets may be poised for a rebound as investor sentiment starts to stabilize following the recent announcement of sweeping tariffs by President Trump—an event some analysts identify as marking a peak in recent market instability.

On April 2, Trump introduced reciprocal import tariffs, triggering significant waves across global markets. The S&P 500 experienced a record loss exceeding $5 trillion, surpassing the drop seen during the pandemic-induced turmoil in March 2020, according to various reports.

Nevertheless, certain analysts suggest there could be a positive aspect to this tariff announcement.

“In my view, the tariffs symbolize the prevailing uncertainty in the markets,” said Michaël van de Poppe, founder of MN Consultancy. “Liberation Day marks the peak of this tumultuous period—the height of uncertainty. It’s now out in the open, and everyone is aware of the new dynamics at play.”

Van de Poppe elaborated that he thinks Trump is employing tariffs strategically to boost domestic growth and reduce yields. “Tariffs are essentially the sole means to achieve that,” he noted. “I wouldn’t be shocked if they get reversed within the next six to twelve months.”

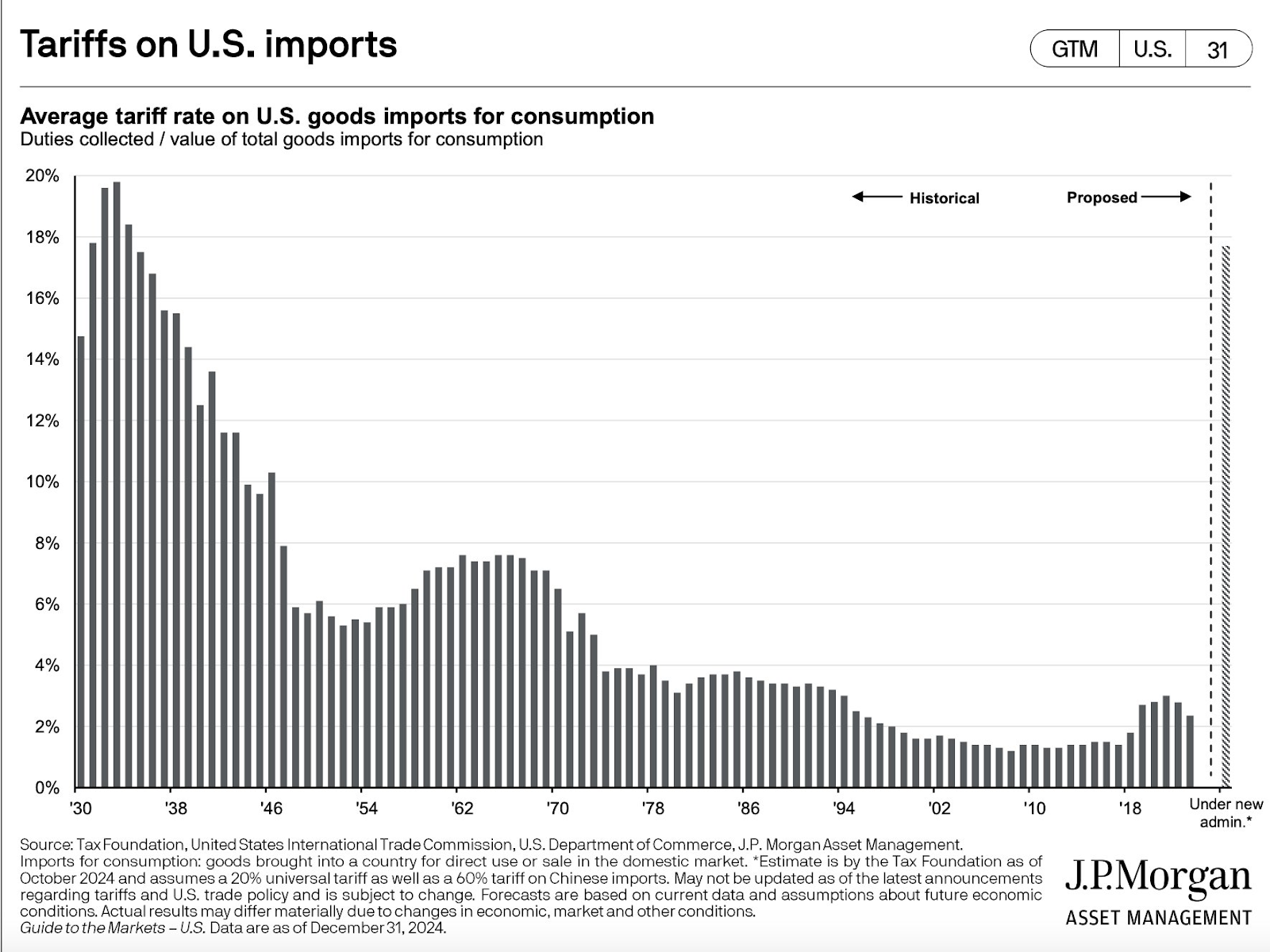

Average tariff rate on US goods and imports.

Trump’s plan imposes a baseline tariff of 10% on all US imports starting April 5, with a higher “reciprocal tariff” up to 54% on specific countries with larger trade deficits beginning April 9.

Import tariffs could lead to Fed easing

Despite this, the resolution of uncertainty may prompt renewed investment in the cryptocurrency markets, potentially fostering a recovery, according to Van de Poppe:

“We’ll likely observe a shift towards the crypto markets in the upcoming period, where a sense of calm returns, and investors begin to buy the dip as they recognize that some assets are undervalued.”

He indicated that the economic ramifications of the tariffs might ultimately encourage the Federal Reserve to decrease interest rates and initiate a new cycle of quantitative easing (QE), a monetary policy involving the purchase of bonds to enhance liquidity in the economy.

Arthur Hayes, co-founder of BitMEX, predicts that Bitcoin could soar to $250,000 should the Fed formally embark on a QE cycle.

Tariff uncertainty still affecting sentiment

On the downside, the uncertainty surrounding the tariffs may continue to pressure appetite for risk assets in the weeks to come, according to Noelle Acheson, author of the Crypto is Macro Now newsletter.

“We can expect President Trump to change his stance multiple times within the first couple of weeks,” Acheson remarked. She further stated:

“Given the heightened uncertainty in these markets, we can anticipate more risk-averse behavior, even if some short-term rebounds provide temporary relief.”

“In the short term, BTC continues to behave like a risk asset, while its counterpart gold reaches new all-time highs,” a trend that may influence crypto investor sentiment in the near term, Acheson noted.

Meanwhile, a crypto intelligence firm has estimated a 70% likelihood that the market could reach a bottom by June, contingent on how the tariff negotiations unfold.