Decentralized cryptocurrency exchanges (DEXs) continue to pose a significant challenge to centralized platforms, despite a recent $6.2 million exploit on Hyperliquid that underscores vulnerabilities in DEX infrastructures.

A cryptocurrency whale reportedly garnered a profit of at least $6.26 million from the Jelly my Jelly (JELLY) memecoin by taking advantage of the liquidation parameters on Hyperliquid.

This incident marked the second major occurrence on the platform within March, as pointed out by Bobby Ong, co-founder of CoinGecko.

“The $JELLYJELLY incident was particularly significant, with Binance and OKX offering perpetual contracts, leading to allegations of coordinated attacks against Hyperliquid,” Ong commented in an April 3 post, adding:

“It’s evident that centralized exchanges feel threatened by DEXs and are determined to protect their market share.”

DEX evolution impacts derivatives market

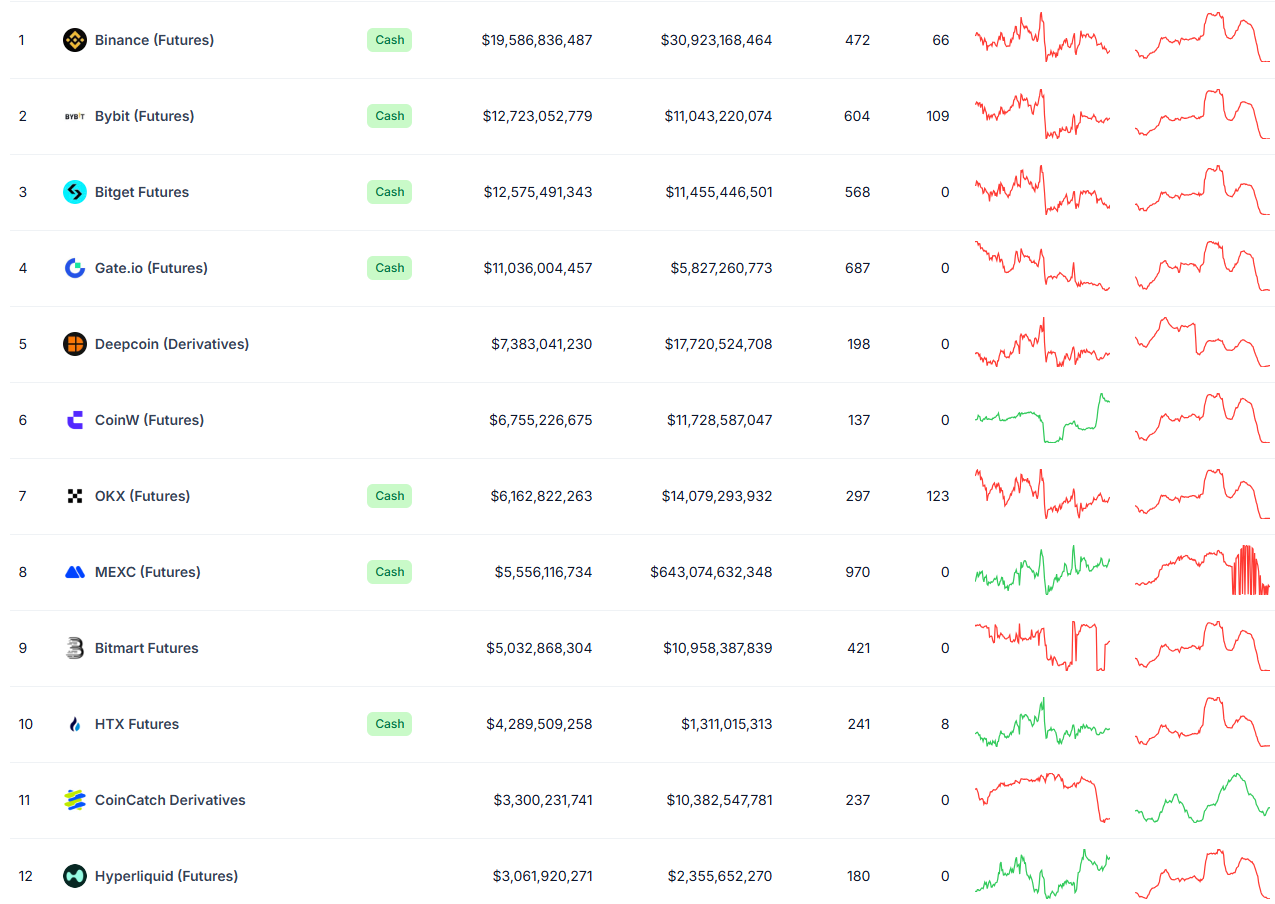

Hyperliquid stands as the eighth-largest perpetual futures exchange by trading volume among both decentralized and centralized platforms, ahead of notable exchanges like HTX, Kraken, and BitMEX, as mentioned in a research report from April 4.

Related: Bitcoin projected to reach $110K, Hyperliquid whale nets $6.2M ‘short’ exploit: Finance Reimagined

As Hyperliquid’s trading volume increases, it starts to erode the market share of other centralized exchanges.

Leading derivative exchanges by open interest. Source: CoinGecko

Currently, Hyperliquid ranks as the 12th-largest derivatives exchange, possessing over $3 billion in 24-hour open interest, although it still falls significantly short of Binance’s $19.5 billion, according to data.

As per Ryan Lee, an analyst at Bitget Research, the incident could undermine user confidence in emerging decentralized platforms, especially if any post-exploit actions seem overly centralized.

“The measures taken by Hyperliquid have faced criticism for being centralized despite promoting a decentralized ethos, potentially making investors hesitant about similar platforms,” Lee stated.

Whale capitalizes on Hyperliquid’s trading mechanics

The unidentified whale on Hyperliquid successfully exploited the DEX’s liquidation parameters by deploying substantial trading positions.

The whale opened two long positions worth $2.15 million and $1.9 million, alongside a $4.1 million short position that effectively counterbalanced the longs, according to an analysis from a blockchain analytics firm.

Transaction details from the Hyperliquid exploiter. Source: Blockchain analytics firm

When JELLY’s price skyrocketed by 400%, the $4 million short position was not immediately liquidated due to its volume. Instead, it was absorbed by the Hyperliquidity Provider Vault (HLP), which is intended to manage large positions.

Related: Polymarket under scrutiny over $7M bet on Ukraine mineral deal

As of March 27, the anonymous whale still possessed 10% of the total supply of the memecoin, valued at nearly $2 million, even after Hyperliquid froze and delisted the memecoin, citing “evidence of suspicious market activity” involving trading instruments.

The exploit on Hyperliquid occurred just two weeks following the collapse of a memecoin inspired by the Wolf of Wall Street, which saw an 80% insider supply and dropped over 99% shortly after its launch.

Magazine: Memecoins are fading — yet Solana proves ‘100x better’ despite revenue decline