Decentralized cryptocurrency exchanges (DEXs) are increasingly positioning themselves as competitors to centralized platforms, despite a recent $6.2 million security breach on Hyperliquid that underscores vulnerabilities within DEX infrastructure.

A major investor reportedly made over $6.26 million profit from the Jelly my Jelly (JELLY) memecoin by manipulating the liquidation terms on Hyperliquid, as noted in a report from March 27.

This incident marked the second significant event on the platform within March, according to comments from a co-founder in the analytics space.

“The attack on $JELLYJELLY was particularly noteworthy, as it coincided with listings on Binance and OKX, leading to allegations that these platforms coordinated an offensive against Hyperliquid,” the co-founder mentioned in a post on April 3, adding:

“It’s evident that centralized exchanges are feeling the pressure from DEXs and won’t relinquish their market dominance without a fight.”

DEX growth transforms the derivatives landscape

Hyperliquid ranks as the eighth-largest perpetual futures exchange by volume, surpassing well-established names such as HTX, Kraken, and BitMEX, as highlighted in an April 4 report.

Related: Bitcoin projected to reach $110K as Hyperliquid whale profits from $6.2M short trade: Financial Overview

The surge in trading volume on Hyperliquid is beginning to impact the market share of various centralized exchanges.

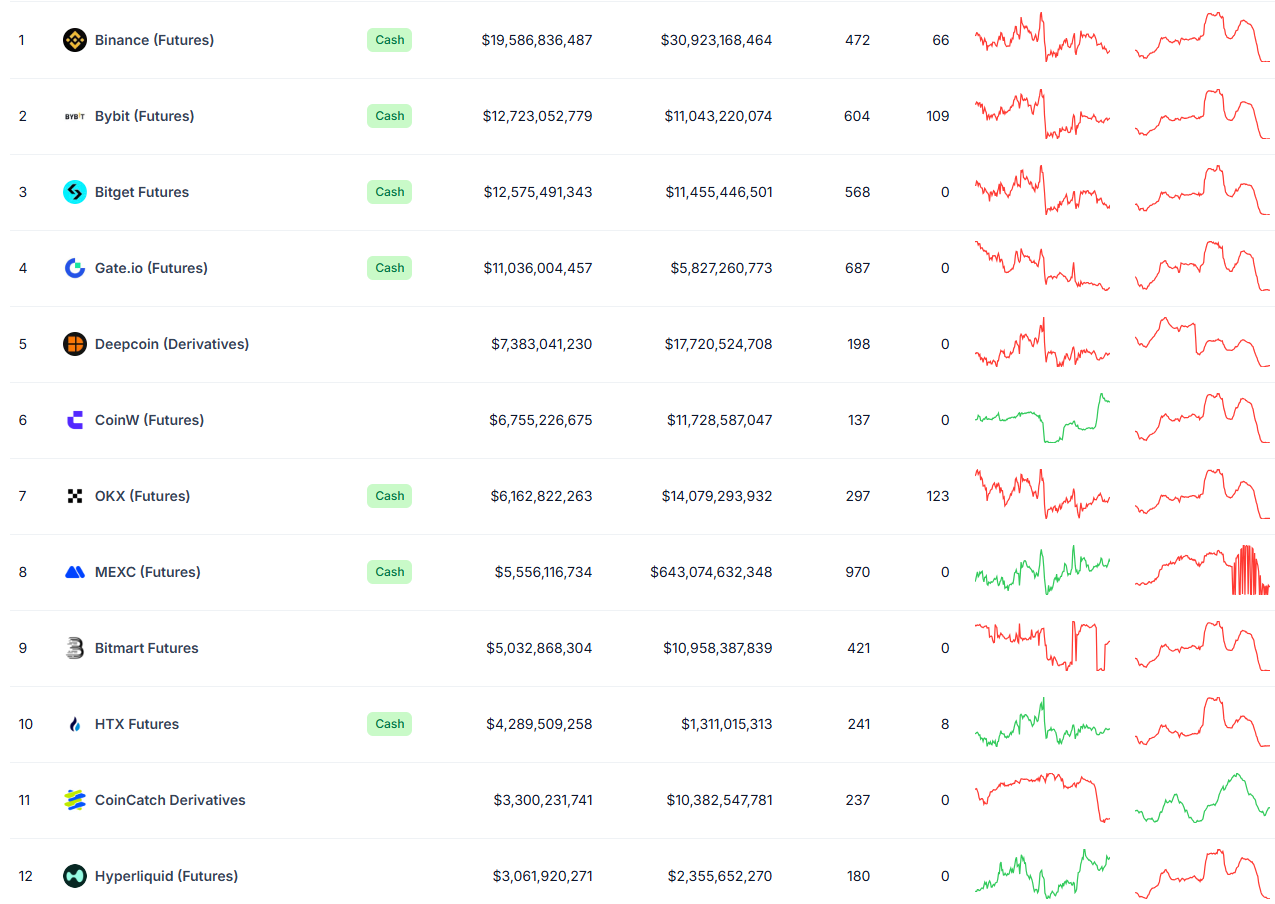

Leading derivatives exchanges ranked by open interest.

Currently, Hyperliquid stands as the 12th largest derivatives exchange, boasting over $3 billion in 24-hour open interest, although it still significantly trails Binance, which has $19.5 billion, according to data.

A research analyst indicated that this incident could undermine user trust in up-and-coming decentralized platforms, particularly if responses following the exploit seem overly centralized.

“Hyperliquid’s actions — viewed as centralized instead of aligned with its decentralized principles — may cause investors to exercise caution with other similar platforms,” stated the analyst.

Whale takes advantage of Hyperliquid’s trading mechanics

The unidentified investor successfully exploited Hyperliquid’s liquidation mechanics by initiating substantial trading positions.

This particular whale executed two long positions worth $2.15 million and $1.9 million, alongside a $4.1 million short position that effectively counterbalanced the long trades, as detailed by a blockchain analytics firm analyzing the incident.

Transactions linked to the exploiter on Hyperliquid.

When the value of JELLY surged by 400%, the sizeable short position wasn’t liquidated immediately, as it was absorbed into the Hyperliquidity Provider Vault (HLP), which is meant to handle significant positions.

Related: Polymarket under scrutiny over $7M bet linked to Ukraine mineral deal

As of March 27, the unidentified whale retained 10% of the total supply of the memecoin, which was valued at nearly $2 million, even after Hyperliquid suspended and removed the memecoin, citing “evidence of suspicious market activities” related to trading instruments.

This breach on Hyperliquid transpired just two weeks after a meme-based cryptocurrency inspired by the Wolf of Wall Street—created by the co-founder of the Official Melania Meme and Libra tokens—plummeted over 99% following an 80% insider supply launch.

Magazine: Memecoins are disappearing — but Solana is ‘100x better’ despite revenue declines