Close to 400,000 creditors of the bankrupt cryptocurrency exchange FTX are at risk of missing out on $2.5 billion in repayments due to their failure to initiate the required Know Your Customer (KYC) verification process.

Approximately 392,000 FTX creditors have not completed, or even initiated, the necessary KYC verification, as noted in a court filing dated April 2 in the US Bankruptcy Court for the District of Delaware.

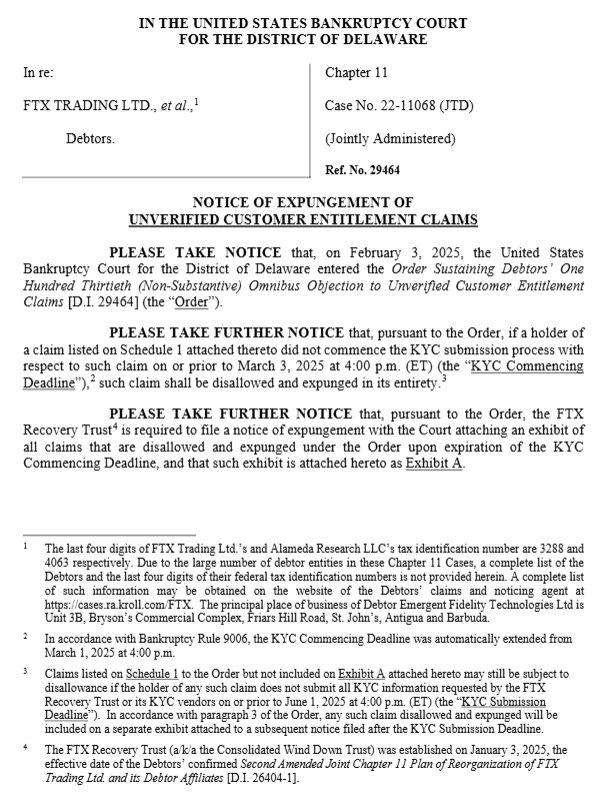

Initially, FTX users had until March 3 to start the verification process to reclaim their debts.

“If a claimant listed on Schedule 1 did not begin the KYC submission process with respect to their claim by March 3, 2025, at 4:00 PM (ET) (the ‘KYC Commencing Deadline’), that claim shall be entirely disallowed and expunged,” states the filing.

FTX court filing.

The KYC deadline has now been extended to June 1, 2025, allowing users an additional opportunity to verify their identities and confirm their eligibility for claims. Those who do not comply with the new deadline may face permanent disqualification of their claims.

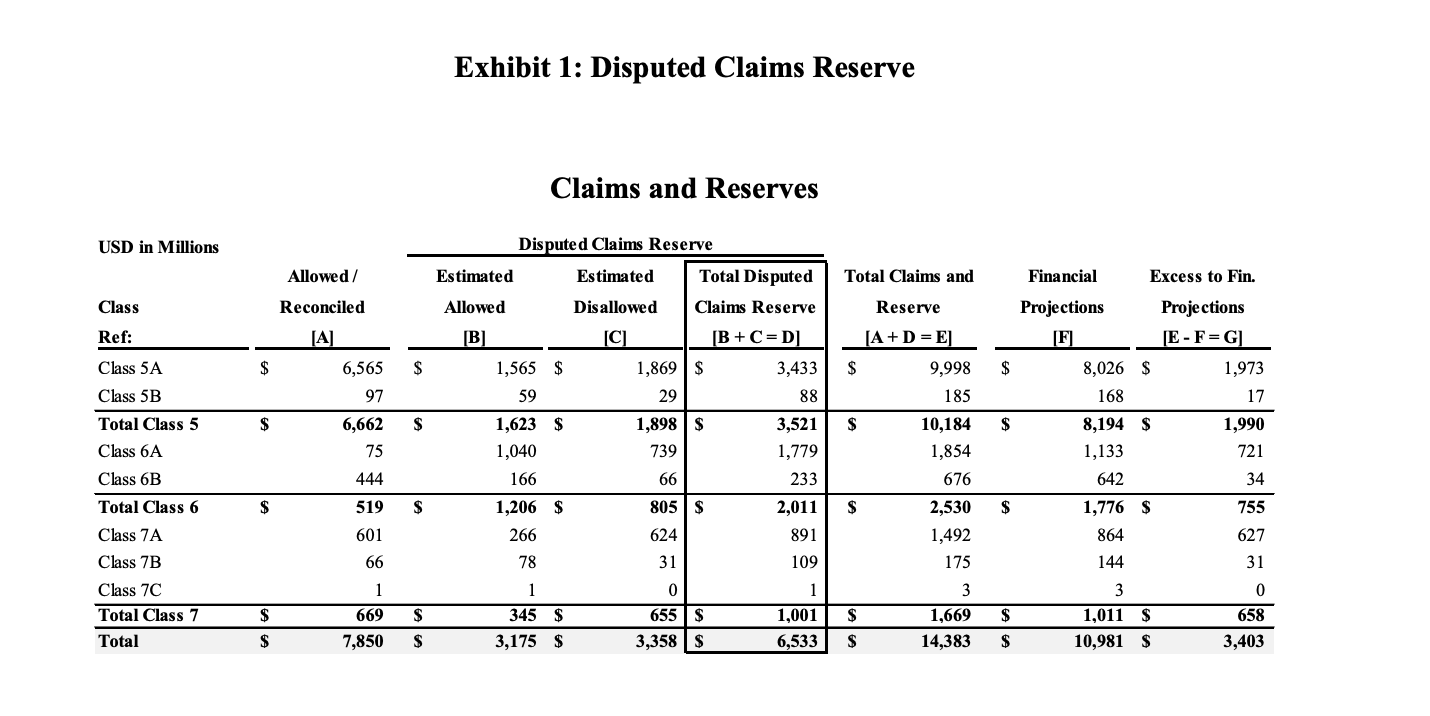

According to court documents, claims under $50,000 could lead to approximately $655 million in unpaid repayments, while claims exceeding $50,000 could total around $1.9 billion, resulting in a total potential loss of over $2.5 billion.

FTX court filing, estimated claims.

The next distribution round for FTX creditor repayments is scheduled for May 30, 2025, with over $11 billion anticipated to be paid to creditors holding claims of more than $50,000.

FTX’s recovery strategy estimates that 98% of creditors are expected to receive at least 118% of their original claim value in cash.

Completing the KYC Process for FTX Users

Many users have reported difficulties with the KYC process.

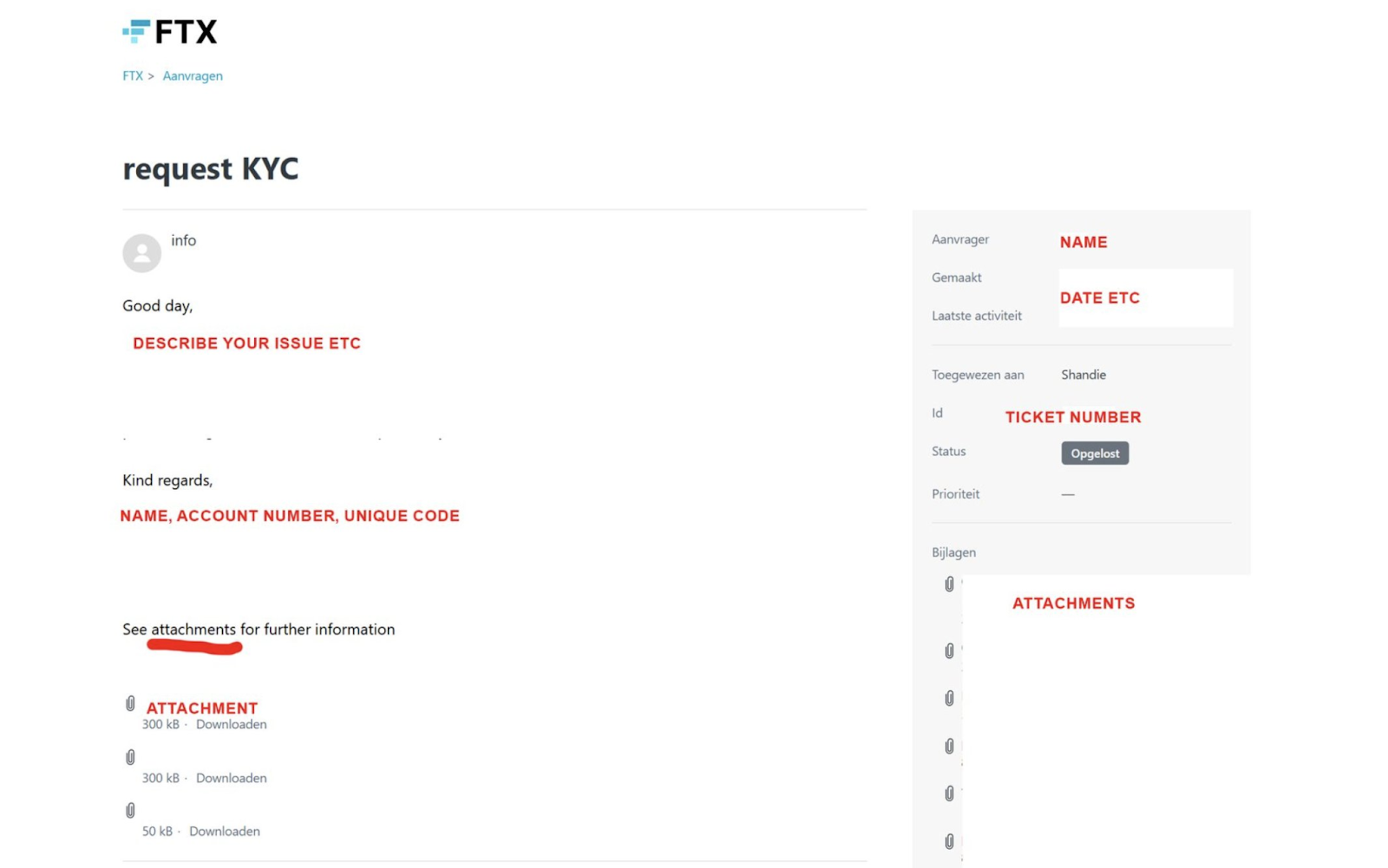

However, those who have not submitted their KYC documentation can reapply and restart the verification process, as indicated in an April 5 post from an FTX creditor who is part of the Customer Ad-Hoc Committee.

FTX KYC portal.

Affected users should reach out to FTX support to obtain a ticket number, then access the support portal, create an account, and upload the required KYC documents again.

FTX’s Bahamian subsidiary, FTX Digital Markets, completed the first round of repayments in February, distributing $1.2 billion to creditors.

The cryptocurrency sector is currently recovering from the fallout of FTX’s collapse, which triggered insolvencies for over 130 subsidiaries, leading to the industry’s longest crypto winter that saw Bitcoin’s price drop to around $16,000.

While not a direct “market-moving catalyst,” the commencement of repayments is viewed as a positive indicator for the maturation of the crypto sector and could lead to a “significant portion” being reinvested into cryptocurrencies, according to the chief operating officer at a cryptocurrency wallet firm.