Main Insights

-

Grok 3 updates its forecasts in response to shifting market dynamics by scrutinizing real-time data trends.

-

The integration of technical analysis with sentiment metrics enhances precision; Grok 3 is adept at recognizing prospective trading opportunities.

-

Conducting backtests on strategies prior to live trading is essential; utilizing historical data to assess Grok 3’s suggestions can enhance conditions and boost performance.

-

Even though Grok 3 can facilitate automated trades, continuous human oversight is vital for adjusting to unforeseen market conditions.

Navigating the world of cryptocurrency trading is intricate. Prices can fluctuate dramatically, and even seasoned traders find it challenging to stay in sync. This complexity has led to a rise in the use of automation tools, with many turning their attention towards Grok 3, a sophisticated artificial intelligence model developed by xAI, a company founded by Elon Musk.

Although Grok 3 wasn’t designed purely for trading, its capacity to analyze data, identify trends, and decipher patterns has prompted traders to explore its use for automated strategies. The core concept is straightforward: allow Grok 3 to make decisions based on data, thereby eliminating the emotional factors that can often result in poor trading choices.

But how effective is it? Some traders share remarkable successes, while others experience unpredictability, particularly in turbulent markets.

This article explores the outcomes of automating crypto trades with Grok 3. Covering successful tactics alongside unexpected challenges, it provides a clear overview of what to expect, along with practical advice to enhance your results.

Understanding Grok 3 and its Connection to Crypto Trading

Grok 3 is an AI model created by xAI, a company specializing in artificial intelligence, founded by Elon Musk. Although its main focus is natural language processing, traders are beginning to explore Grok 3 as a potential asset to enhance their crypto trading strategies. Unlike conventional trading bots that follow strict rules, Grok 3’s adaptable framework enables it to assess various data sources and identify patterns that traditional methods might miss.

Why Traders Are Exploring Grok 3

The attraction of Grok 3 revolves around its capability to manage intricate data, which is a crucial asset in crypto markets, where price movements can often stem from unforeseen events or shifts in sentiment.

Here’s what traders find promising about Grok 3:

-

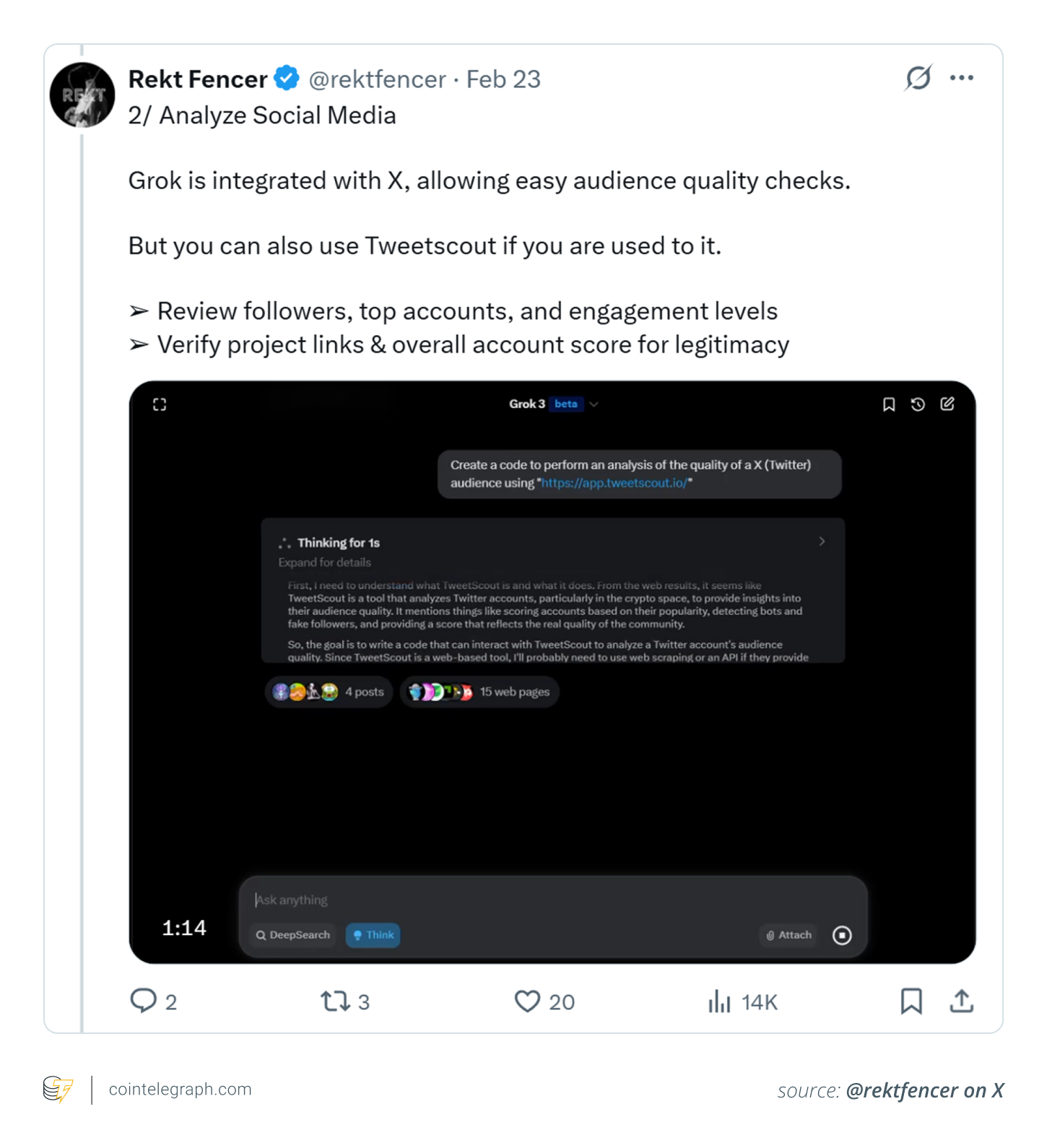

Identifying sentiment dynamics: The crypto markets are strongly swayed by emotions such as FOMO (fear of missing out) and FUD (fear, uncertainty, doubt). Grok 3 can assess social media, news headlines, and community debates to analyze changes in sentiment, a pivotal element of crypto volatility.

-

Spotting obscure correlations: Grok 3’s machine learning abilities enable it to uncover subtle connections between indicators that conventional bots might not recognize. For instance, it can correlate a surge in social sentiment with increased activity among large investors to forecast bullish trends.

-

Dynamic analysis through prompts: Unlike static rules such as “Buy when RSI is below 30,” Grok 3 allows traders to devise more intricate strategies using natural language commands.

The Impact of Automating Crypto Trades with Grok 3

Grok 3 sets itself apart from traditional crypto trading bots. It doesn’t make trades directly or interface with exchanges independently. Rather, it assists traders in creating smarter, quicker, and more flexible automation systems. From formulating trade logic to examining market sentiment, Grok 3 is being utilized in practice to streamline how crypto strategies are developed and tested.

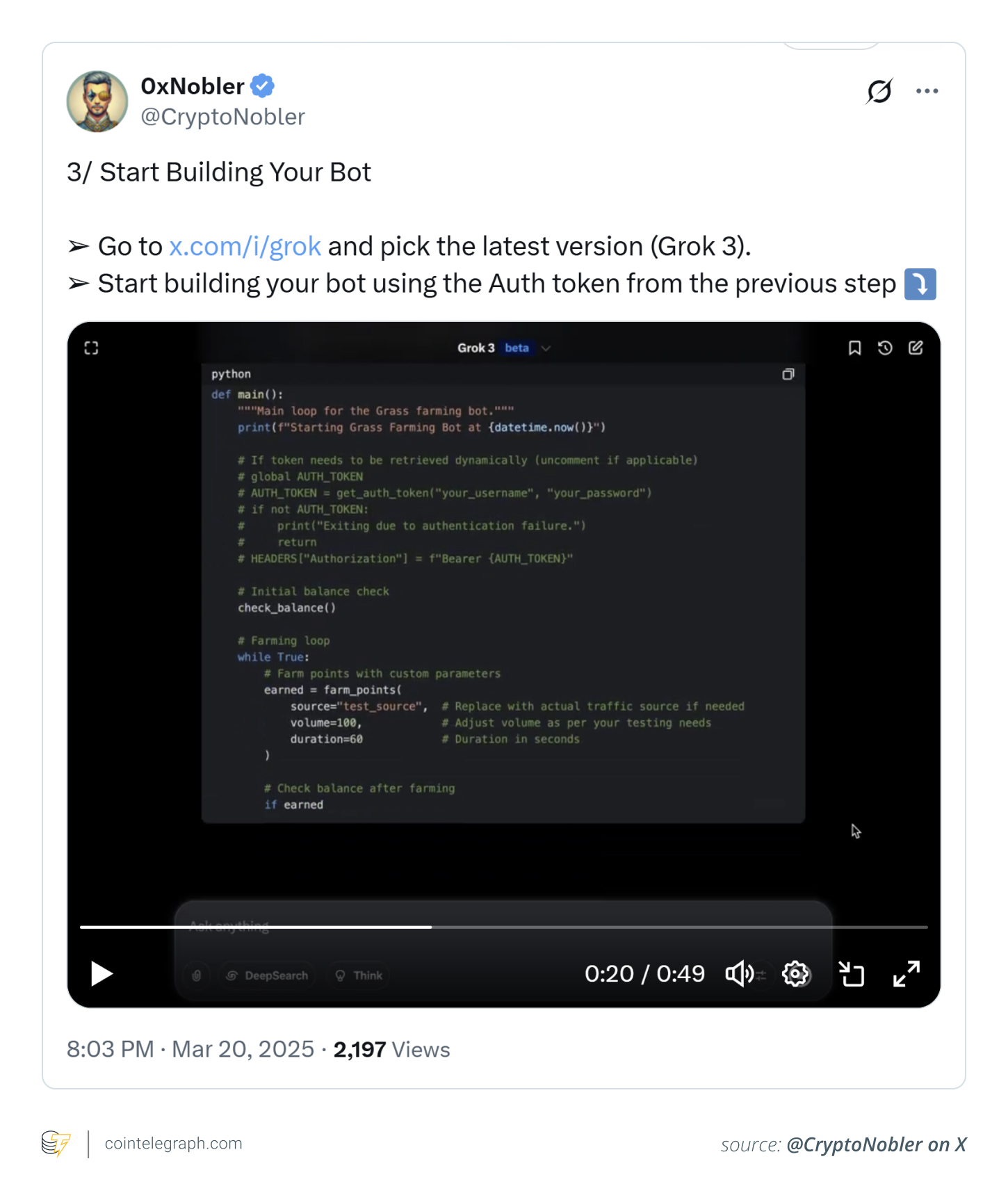

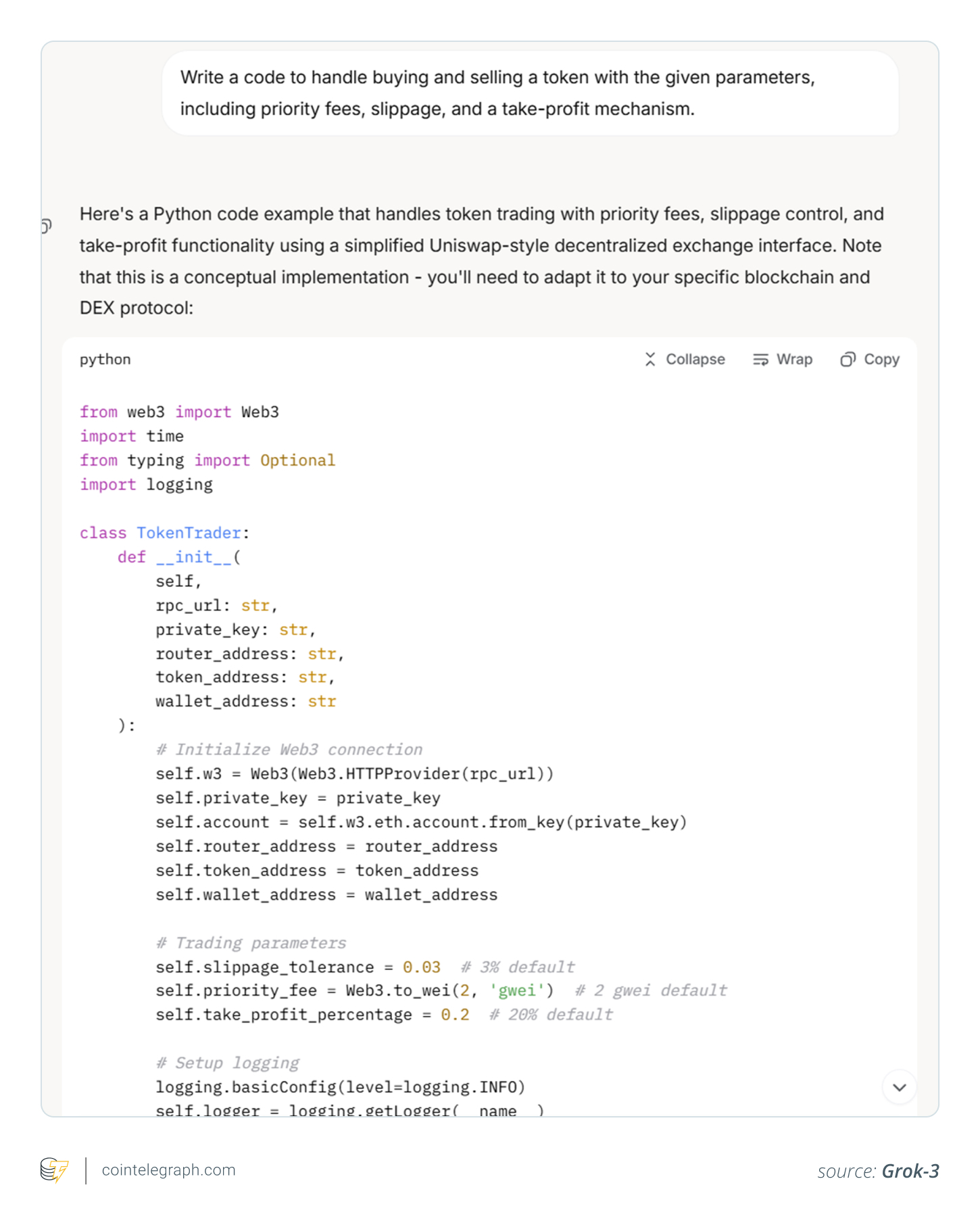

Instead of manually coding every detail, traders are leveraging Grok 3 to produce functional code for their bots. For instance, a user prompted Grok 3 to create buying and selling logic for tokens that included considerations for slippage, profit-taking, and gas fees. It generated a script that could be integrated into decentralized finance tools or extended with APIs from various platforms.

Some traders have employed Grok 3 to construct comprehensive bots designed for specific tokens or particular strategies. In another instance, Grok 3 was utilized to develop an automated system that monitors price movements and executes trades based on predefined criteria. Its capabilities extend beyond just buy/sell logic; Grok 3 also produces scripts for rebalancing portfolios and simulating how positions would behave under varying levels of market volatility.

An example of a prompt given to Grok 3, along with the generated output, illustrates its functionality.

Example Response from Grok 3: High-Frequency Trading Bot Framework for Solana (SOL)

Below is a structured framework outline for a high-frequency trading bot focused on Solana (SOL), emphasizing one-minute price variations, risk management, and execution of trades. This outline provides a modular framework with placeholders for vital components, omitting specific implementation details as per the request.

1. Core Configuration

-

Objective: Establish global settings and constants for the trading bot.

-

Components:

Solana network endpoint (e.g., mainnet RPC URL)

Wallet configuration (private key or keypair for trading)

Trading pair (e.g., SOL/USDC)

Timeframe (one-minute candlestick data)

Trade size ($100 per position)

Maximum trades (10 concurrent or sequential positions)

Profit target ($50 total)

Maximum loss per trade ($20)

2. Data Acquisition Module

-

Objective: Retrieve and process real-time SOL price data.

-

Components:

WebSocket connection to Solana blockchain or exchange API (e.g., Serum, Raydium, or a centralized exchange like Binance)

1-minute OHLCV (Open, High, Low, Close, Volume) data stream

Data buffer for recording recent price history

Error handling for connection issues or latency

3. Volatility Analysis Module

-

Objective: Evaluate SOL’s price volatility to guide trade decisions.

-

Components:

Placeholder: Calculate short-term volatility (e.g., standard deviation or ATR over one-minute candles)

Placeholder: Set volatility thresholds (e.g., states of high/low volatility)

Output: Score or signal indicating adjustments to trade frequency/size

4. Trade Signal Generator

-

Objective: Produce buy/sell signals based on price changes.

-

Components:

Placeholder: Basic momentum strategy (e.g., price crossing a short-term moving average)

Placeholder: Filter signals with volatility analysis

Signal validation (e.g., preventing overtrading within a minute)

Output: Timestamped buy/sell signal

5. Risk Management Module

-

Objective: Implement risk controls and position limits.

-

Components:

Position size calculator (fixed at $100 per trade)

Max loss checker ($20 per trade stop-loss)

Tracker for total profit/loss (halt trading at $50 profit or after 10 trades)

Concurrent trade limiter (capped at 10 active positions)

Emergency stop (pause trading on extreme volatility or connection loss)

6. Trade Execution Module

-

Objective: Carry out trades on the Solana blockchain or exchange.

-

Components:

Placeholder: Create Solana transactions (e.g., swap SOL for USDC using a DEX like Raydium)

Order type (market order for quick execution in a one-minute timeframe)

Slippage tolerance (e.g., 0.5% max slippage)

Signing and submitting transactions

Confirmation listener (await transaction finality)

Error handling (e.g., retry failed executions)

7. Performance Monitoring Module

-

Objective: Record and evaluate bot performance in real time.

-

Components:

Trade log (entry price, exit price, profit/loss, timestamp)

Running total profit/loss calculator

Performance metrics (e.g., win rate, average trade duration)

Notification system (alert on profit target, max loss, or errors)

8. Main Control Loop

-

Objective: Manage bot operations in a continuous cycle.

-

Components:

Initialize bot (load settings, connect to data feed)

Loop:

Retrieve one-minute price data

Analyze volatility

Generate trade signal

Apply risk management checks

Execute trade if criteria are met

Update performance metrics

Exit conditions (achieving profit target, reaching max trades, or manual stop)

9. Shutdown and Cleanup

-

Objective: Safely end bot operations.

-

Components:

Close open WebSocket connections

Finalize any pending transactions

Save trade logs and performance summaries

Release resources (e.g., memory, wallet connections)

Important Notes

-

This framework presupposes integration with Solana’s ecosystem (e.g., using a DEX or liquidity pool). Adjust the execution module if targeting a centralized exchange.

-

Volatility analysis and signal generation are left as placeholders for user-defined customization (e.g., technical indicators or machine learning models).

-

Risk management is designed to adhere to the $50 profit target and $20 max loss per trade, ensuring the bot operates within defined limits.

Warning! The outline above is a customized framework derived from user prompts, specifically focusing on one-minute price movements, risk management, and trade execution. The output varies with the level of detail in prompts, since greater specificity leads to sharper results. Furthermore, placeholders like volatility analysis are awaiting user customization, showcasing Grok 3’s capacity for adaptive learning. This is a conceptual overview, not executable code, and success will depend on implementation and prevailing market conditions. For further refinements, such as Solana-specific adjustments, users can provide additional context, allowing Grok 3 to adapt based on their feedback and the most up-to-date information.

Now, let’s explore the essential steps to set up Grok 3 for automated crypto trading.

Setting Up Grok 3 for Automated Crypto Trading

Establishing Grok 3 for AI-driven crypto trading automation isn’t as simple as installing a standard trading bot. given that Grok 3 wasn’t designed for direct trading, it necessitates thoughtful integration, customization, and setup. Below is a practical guide for effectively configuring Grok 3 for automated crypto trading.

Step 1: Selecting a Compatible Trading Platform

Since Grok 3 does not connect directly to crypto exchanges, it needs to be integrated with third-party platforms that enable API automation, such as:

-

3Commas: Excellent for executing trades via automated strategies.

-

TradingView: Utilized for generating trade signals via Pine Script.

-

CryptoHopper: Provides custom strategy-building features with API integration.

Ensure that the selected platform provides robust API support for trade execution, risk management, and performance tracking.

Step 2: Integrating Grok 3 with the Trading Platform

Grok 3 does not have direct connections to crypto exchanges; integration needs innovative approaches:

-

API integration using automation tools: Platforms like Zapier or Make.com can link Grok 3’s analyses with trading platforms.

-

Custom Python scripts: For those with programming skills, insights from Grok 3 can be processed through Python scripts that execute trades based on what Grok 3 recommends.

-

No-code automation solutions: Services like IFTTT can initiate basic trading actions based on Grok 3’s sentiment analysis.

Step 3: Crafting Trading Strategies with Grok 3

The effectiveness of Grok 3 hinges on clearly defined strategies. In contrast to traditional bots that rely exclusively on technical indicators, the Grok 3 crypto trading bot can harness multiple factors, including:

-

Technical indicators: RSI, MACD, Bollinger Bands, among others.

-

Sentiment analysis: Trends on social media, opinions from influencers, and news headlines.

-

On-chain data: Whale movements, inflows/outflows from exchanges, and large wallet transactions.

Step 4: Backtesting Strategies before Live Trading

Before launching Grok 3’s strategy in real markets, it is imperative to conduct backtesting to assess performance. Backtesting can unveil:

-

Trade signal accuracy: Determine how frequently Grok 3’s suggested trades lead to profitable outcomes.

-

False signal identification: Ensure Grok 3 does not generate excessive buy/sell recommendations in calm or volatile markets.

-

Opportunities for refinement: Tweak parameters such as RSI limits, sentiment thresholds, or conditions to exit trades.

Example tools for backtesting include TradingView and CryptoQuant.

Step 5: Implementing Risk Management Controls

Even with solid insights, the crypto landscape is unpredictable. Incorporating risk controls can help mitigate potential losses:

-

Stop-loss orders: Automatically withdraws from trades if prices surpass a predetermined threshold.

-

Position limits: Restrains trade sizes to minimize exposure during uncertain market conditions.

-

Trailing stops: Secures profits during upward trends while reducing risks during downturns.

Example risk control prompt:

“Generate code to facilitate buying and selling a token, including parameters for priority fees, slippage, and a profit-taking mechanism.”

Please be aware that the output presented above is not complete and is shared for illustration purposes only.

Step 6: Continuous Monitoring and Strategy Adjustments

Grok 3’s flexibility lies in its ability to adapt, but it requires continuous oversight to guarantee optimal results. Regular evaluations should focus on:

-

Performance metrics: Evaluate win rates, profit margins, and signal accuracy.

-

Market conditions: Adjust strategies in response to significant shifts (e.g., regulatory changes or macroeconomic developments) that could influence sentiment or momentum.

Insider tip: Revisiting Grok 3’s prompts consistently can enhance strategy outcomes and bolster long-term performance.

Limitations of Grok 3

Despite its advantages, Grok 3 comes with limitations that traders should keep in mind.

-

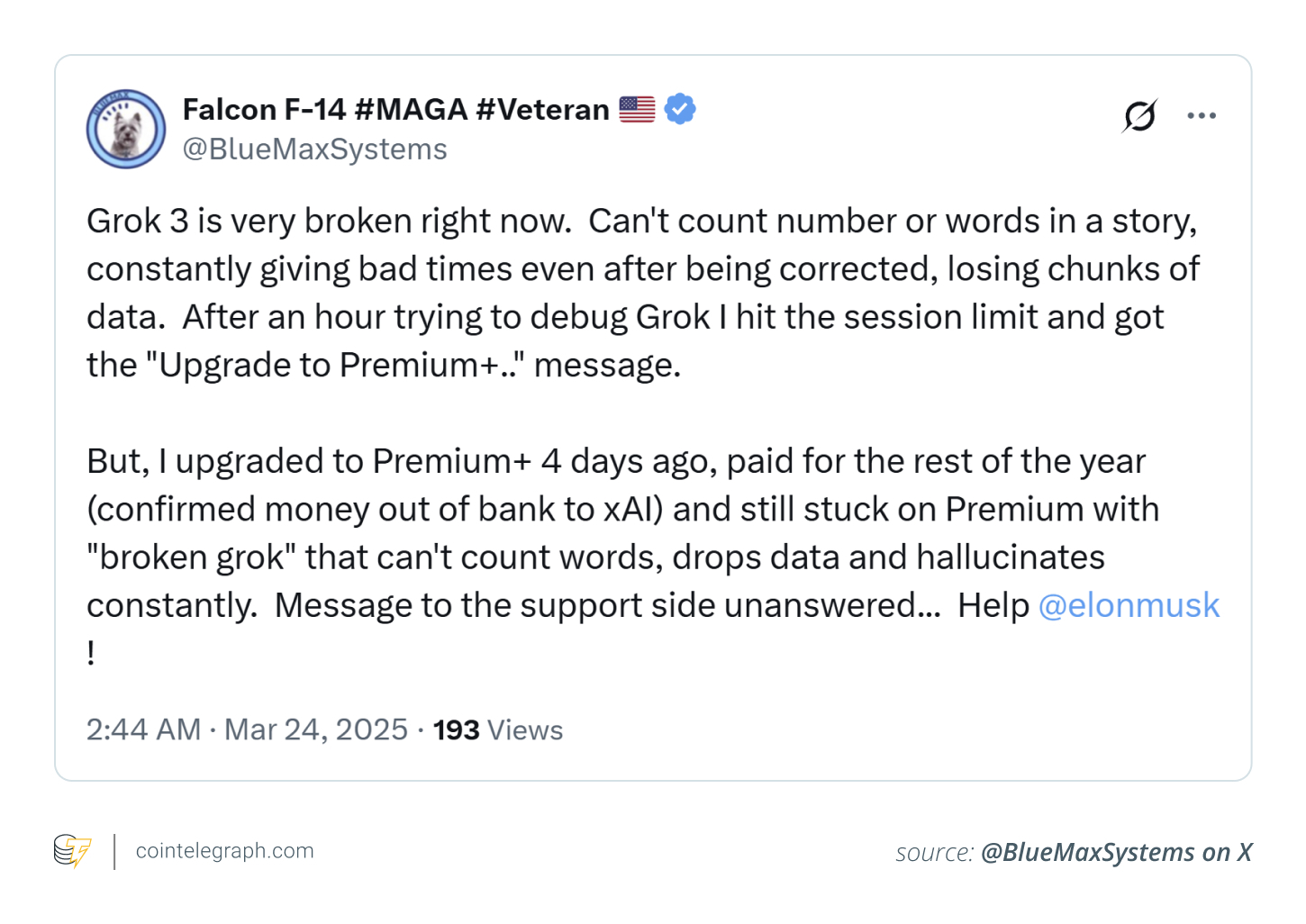

Data integrity issues: Effective crypto trading relies on timely and accurate data. However, users have noted instances where Grok 3 loses considerable data, misinterprets word counts, and provides incorrect time markers, negatively impacting signal detection, response times to market movements, and overall strategy execution.

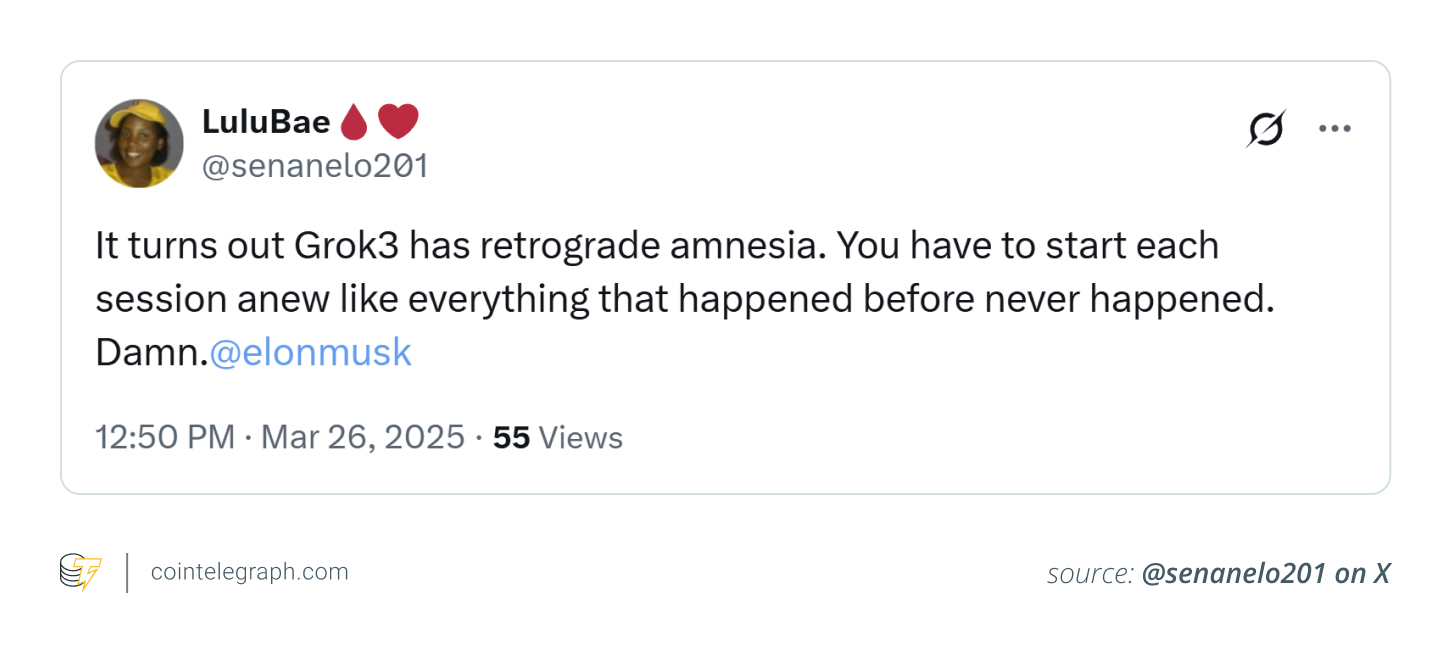

-

Memory lapses: A commonly reported frustration is Grok 3’s tendency to forget previous sessions, often referred to as “retrograde amnesia.” For crypto traders, this poses a significant challenge. Consider investing time into developing a trading strategy only to have Grok 3 start fresh each session, neglecting historical trends and conversations.

-

Bias concerns: Grok 3 may sometimes generate biased outputs, drawing on incomplete or skewed information. For traders relying on impartial sentiment analysis to gauge market trends, this could lead to misleading insights and poor decision-making.

-

Delayed execution speed: With Grok 3 processing input based on detailed commands, its trading signals may lag behind rapid price changes.

-

Reliance on prompts: The precision of Grok 3 is significantly influenced by the quality of input prompts. Ambiguous or poorly constructed requests tend to yield unreliable results.

While Grok 3 and similar AI systems provide valuable tools for automating crypto trading, exercising caution is crucial. Their effectiveness heavily relies on data quality and the strategies they are programmed to execute; thus, unforeseen market changes or inaccurate inputs can lead to considerable losses.

Keep in mind that AI lacks the human touch and may struggle with unprecedented occurrences, so depending solely on it without adequate supervision is risky. Always commence testing strategies with minimal investments and consult experts prior to making substantial financial commitments.