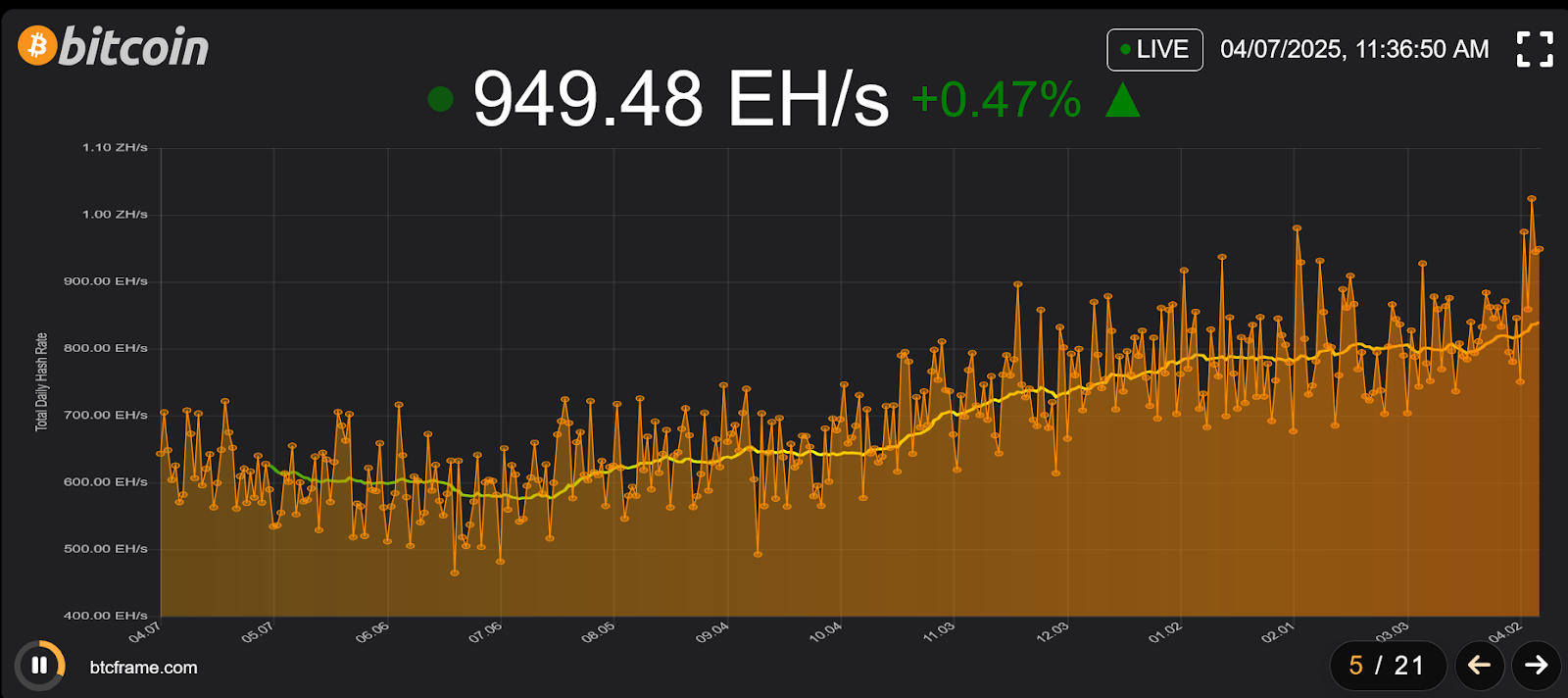

The hashrate of the Bitcoin network has exceeded 1 Zetahash per second (ZH/s) for the very first time in the cryptocurrency’s 16-year existence, as reported by various blockchain data platforms.

Bitcoin reached this significant milestone on April 5, peaking at 1.025 ZH/s, while data from another platform indicated it had reached 1.02 ZH/s a day prior.

Additional information from another analytics service noted that the hashrate peaked at 1.1 ZH/s on April 4 when block height 890,915 was recorded; however, it was mentioned that Bitcoin first surpassed the 1 ZH/s mark on March 24.

Bitcoin’s hashrate dropped back below 0.95 ZH/s on April 7 after reaching the 1 ZH/s milestone.

Variations in Bitcoin Hashrate Measurements

The inconsistencies arise from the different methodologies employed to calculate hashrate, including factors such as the timing of blocks and difficulty adjustments, as well as the specific Bitcoin nodes and mining pools utilized for data collection.

A cryptocurrency expert previously highlighted that estimating Bitcoin’s hashrate using one “trailing block” compared to five might lead to discrepancies exceeding 0.04 ZH/s.

“Looking at the raw hashrate figure can be misleading due to random fluctuations in block intervals,” stated an analyst from a major mining research firm, who also noted that the 30-day moving average hashrate for Bitcoin remains around the 0.845 ZH/s level.

A Significant Milestone for the Network

Despite the variations in reported figures, this accomplishment underscores the vast computational power backing the Bitcoin network and its growing decentralization, enhancing security and significantly lowering the risk of a 51% attack.

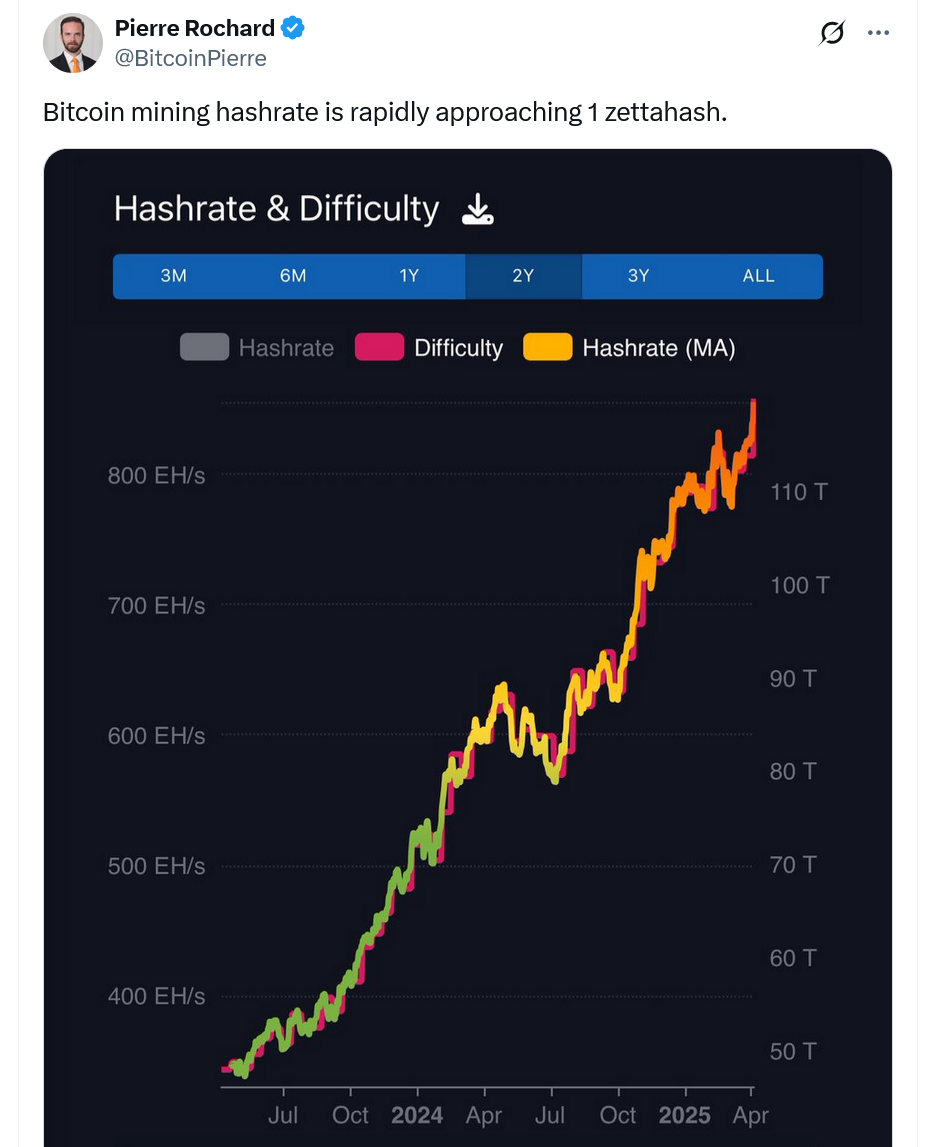

This recent ascent to 1 ZH/s, or 1,000 Exahashes per second, represents a thousandfold increase since January 2016, when Bitcoin first reached 1 EH/s.

For comparison, the second-largest proof-of-work crypto network, Litecoin, has a hashrate of 2.49 Petahashes per second, making it approximately 40,000 times less powerful than Bitcoin.

Noteworthy observations from the Bitcoin community.

The significant growth in hashrate corresponds with an increasing number of commercial Bitcoin mining operations striving to solve blocks more effectively in recent years.

“Miners are intensifying their efforts: expanding facilities and adopting more efficient machinery,” the analyst remarked, adding that less competitive miners may find it challenging to survive unless Bitcoin’s price sees an upward trend in the upcoming months.

One of the largest Bitcoin miners, MARA Holdings, boasts over 50 EH/s of computing capability, while the majority of the hashrate is concentrated within major mining pools.

At least 24 publicly traded Bitcoin companies are actively involved in mining, contributing to the overall hashrate.

Other significant participants include numerous prominent mining firms.

Bitcoin’s Hashrate Rises Amidst Market Challenges

This new all-time high for Bitcoin’s hashrate emerged during a notable market decline, with Bitcoin experiencing a nearly 10% drop over four days down to $78,750, while US equities recorded a staggering $6.6 trillion loss—the largest two-day decline in history.

This downturn is largely attributed to tariff plans that have sparked recession concerns among industry analysts.

Magazine: Financial pessimism in crypto has ended—Now is the time to envision big possibilities again.