Global financial markets took a significant downturn on April 7, with US stocks declining over 3%, erasing more than $2 trillion in market value at the open. The S&P 500 fell by 2.79%, officially entering a bear market after a 20% drop from its most recent peak.

Despite this, the S&P 500 experienced a brief surge of 6% when rumors circulated on social media that former President Donald Trump was considering a 90-day suspension of tariffs. Bitcoin (BTC) also climbed above $80,000, but the positive trend was short-lived; within half an hour, the White House confirmed that the rumors were unfounded.

Image Source

Currently, the S&P 500 is showing positive movement for the day. However, the sustainability of this uptick remains questionable due to persistent bearish sentiment that existed before the tariff pause rumors emerged.

In Asia, where many economies rely heavily on advantageous global trade, stock markets experienced severe declines. Hong Kong’s stock index faced a dramatic 13% fall, marking its worst performance since the financial crisis in the late ’90s. Major indices in Shanghai, Taipei, and Tokyo also registered steep losses, varying from 7% to 10%.

Additionally, trading for the Nikkei 22 futures was halted after triggering circuit breakers during the session.

US-China tensions escalated after the former President announced a looming 50% tariff on Chinese exports if China did not retract its initial 34% tariffs on the US by April 8.

Bitcoin reaches yearly lows, while large holders are accumulating

After briefly showing signs of decoupling from US indices on April 3 and 4, Bitcoin’s price fell by 6.5% over the weekend, dropping to a new yearly low of $74,457 on April 7. This marks Bitcoin’s lowest point since November 7, with market observers predicting additional downward movements. Julio Moreno, head of research at a crypto analytics firm, remarked,

“It’s not advisable to jump in yet. Conditions for Bitcoin haven’t improved. Currently, only one bullish indicator is active on the Bull Score Index.”

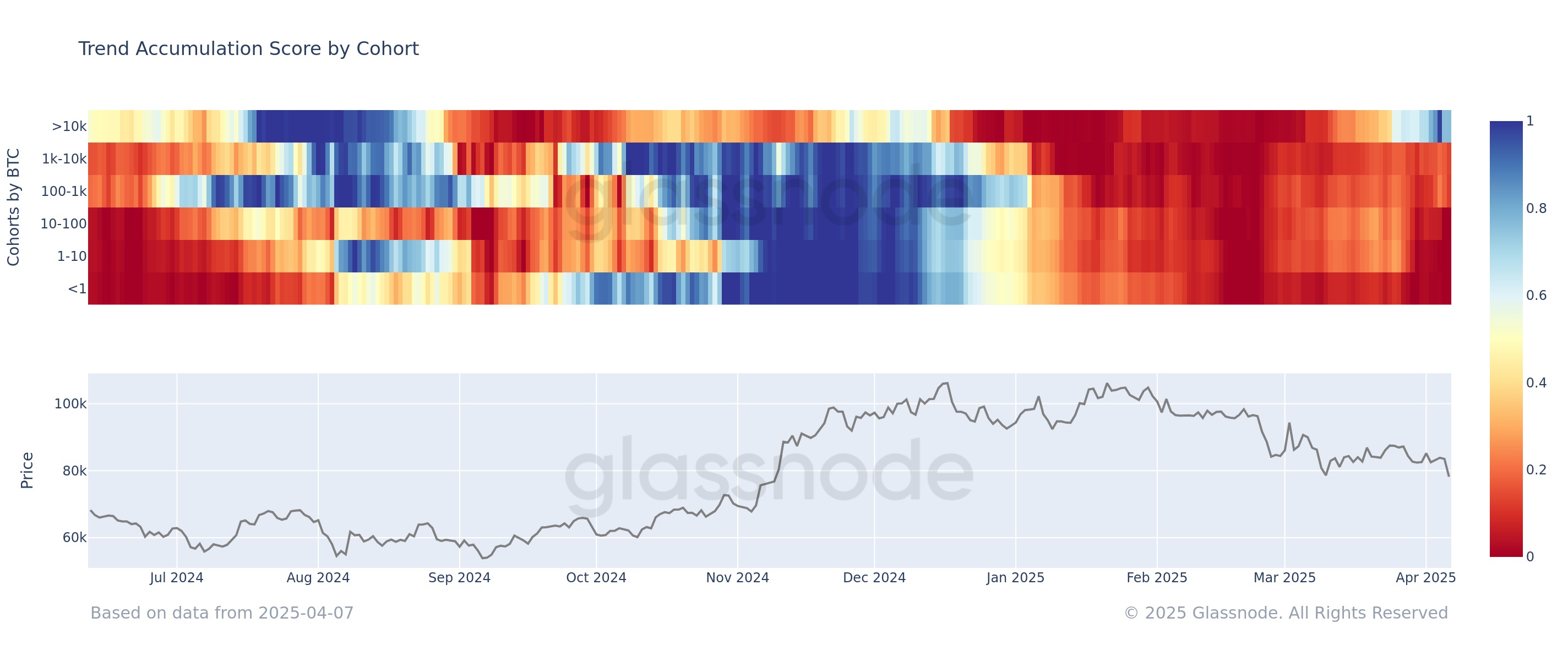

On a brighter note, data revealed that larger Bitcoin holders (those with over 10,000 BTC) are increasing their accumulation while smaller holders are selling off. The Accumulation Trend Score for large investors hit a solid 1.0 around April 1, indicating a 15-day buying spree that was the most significant since late August of 2024.

Trend Accumulation Score by Bitcoin holders.

Since March 11, whales have accumulated 129,000 BTC, reflecting steady interest with a score of 0.65. In contrast, smaller cohorts holding between 1 and 100 BTC have shifted to distribution, with scores decreasing to around 0.1–0.2 for much of 2025.

This behavior aligns with Bitcoin finding support at $74,000, a price level backed by over 50,000 BTC held by investors since March 10.

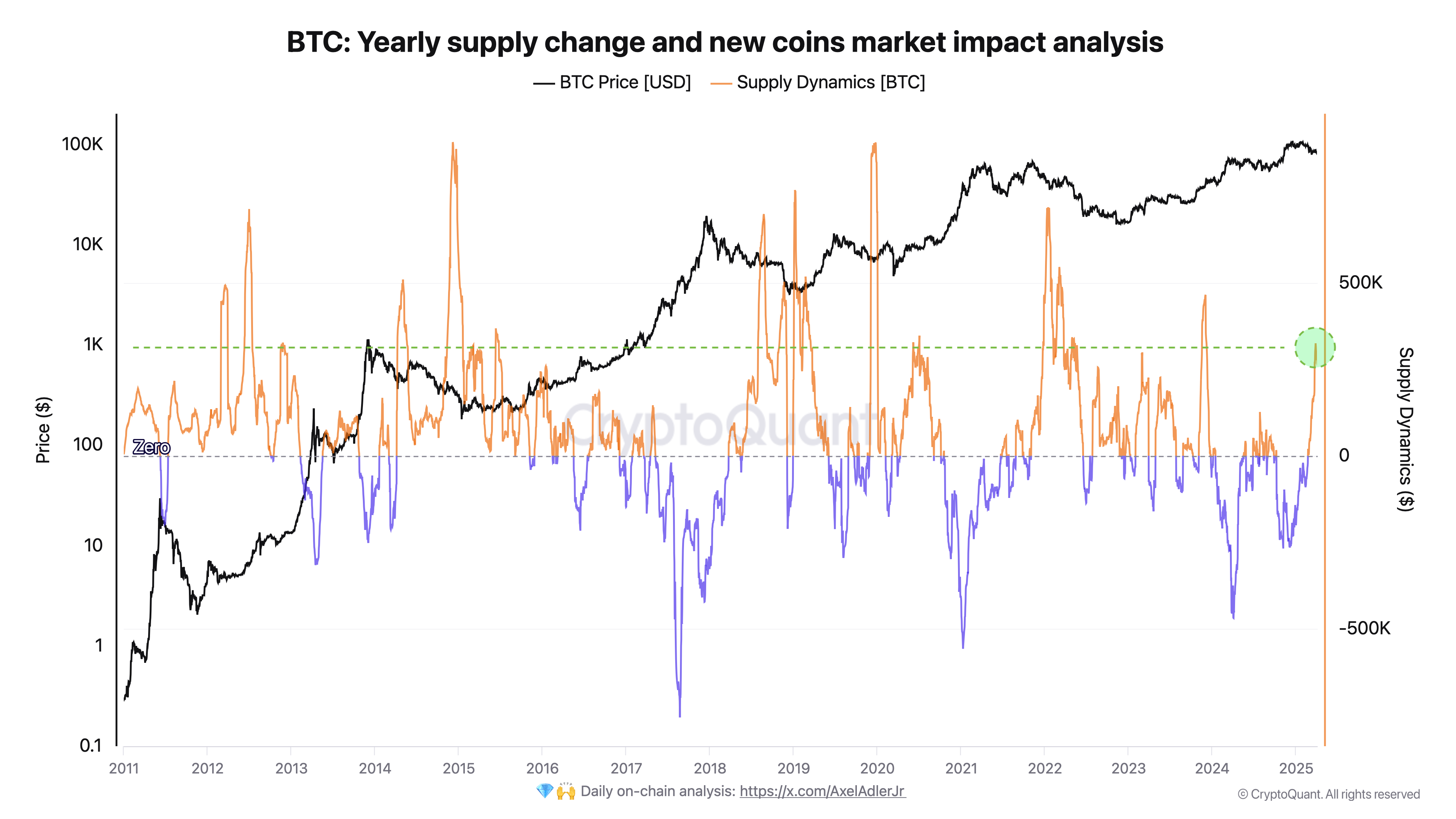

Furthermore, a Bitcoin researcher pointed out that supply dynamics metrics suggest the new Bitcoin supply is currently outpacing the annual changes in active coins. An upward trend in this metric hints at increasing demand or accumulation in the market, which historically coincides with Bitcoin price recoveries.

Yearly supply change and supply of new Bitcoin.

This article serves only informational purposes and does not provide investment advice. All investment and trading endeavors come with risks, and readers should conduct their own research before making decisions.