- Bitcoin’s price continued its decline by 4% on Monday, following a nearly 5% correction in the previous week.

- The intensification of the global trade war has resulted in the liquidation of 452,976 leveraged traders, leading to a total of $1.39 billion lost from cryptocurrency markets in the past 24 hours.

- Spot Bitcoin ETFs in the US experienced a combined net outflow of $172.69 million last week.

As of Monday, Bitcoin (BTC) has partially recovered from its earlier losses, trading around $76,000 after hitting a new yearly low of $74,508 during the Asian trading session. Nevertheless, BTC is still on a downward trajectory, following a nearly 5% correction the previous week. The global trade conflict has escalated dramatically, resulting in significant liquidations and wiping out 452,976 leveraged traders within the last 24 hours. Furthermore, institutional interest in the US has diminished, as evidenced by a net outflow of $172.69 million from spot Exchange Traded Funds (ETFs) last week.

Global trade tensions cause $1.39 billion loss in crypto markets

Bitcoin hit a new yearly low of $74,508 during the early Asian trading hours but stabilized around $76,000 during the European session on Monday. This decline was primarily triggered by US President Donald Trump’s announcement of new tariffs last Wednesday, which resulted in a nearly 5% drop in BTC last week.

The announcement has ignited a global trade war, as China responded with a 34% tariff on US goods. This escalating trade conflict has negatively impacted not just the cryptocurrency market but also Asian financial markets, with Japan’s stock market reaching its lowest point since October 2023 on Monday.

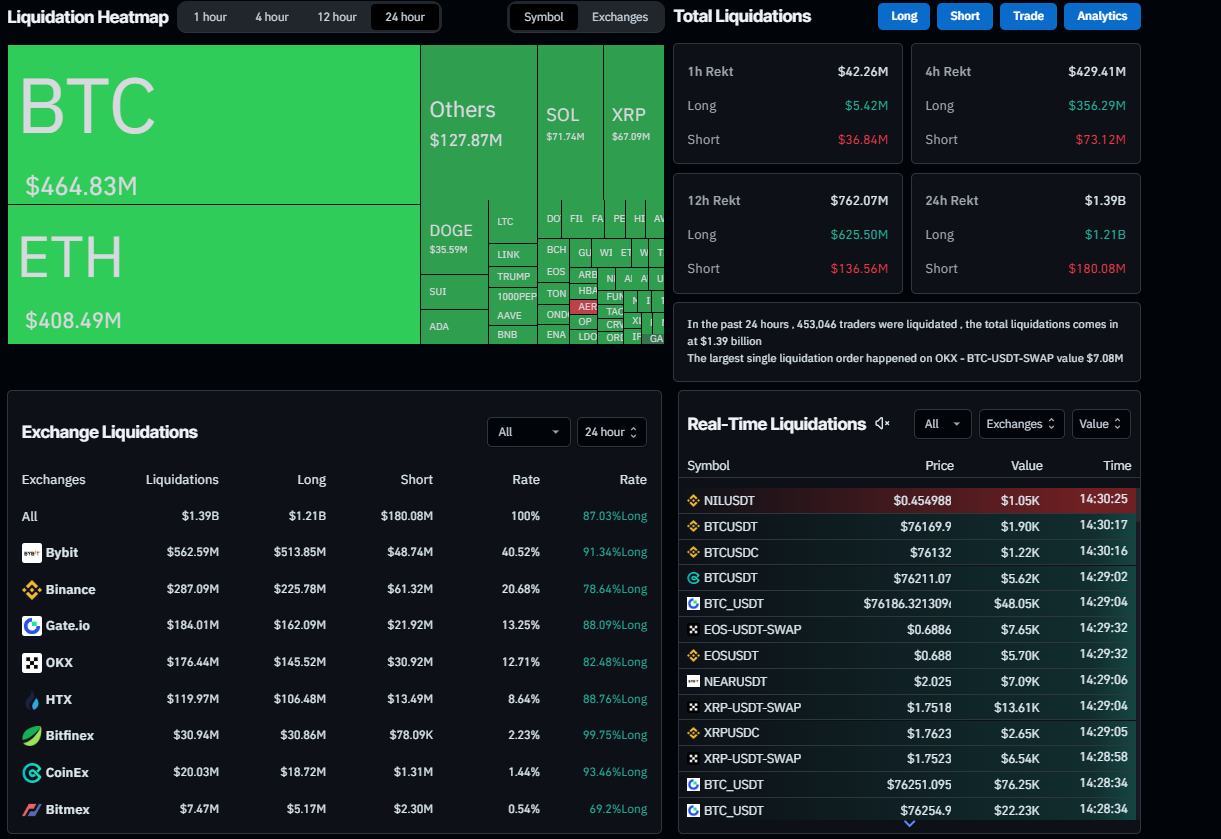

The ramifications of the global trade war triggered a significant wave of liquidations in the cryptocurrency sector. As reported by the Coinglass Liquidation Heatmap, in just the last 24 hours, 452,976 traders faced liquidation, with total losses reaching $1.39 billion. The largest single liquidation occurred on OKX with the BTC-USDT-SWAP, amounting to $7.08 million.

Illegitimately, Bitcoin saw liquidations exceeding $464 million, while Ethereum accounted for $408.49 million. Such major liquidations can create an atmosphere of Fear, Uncertainty, and Doubt (FUD) among Bitcoin investors, potentially resulting in increased selling pressure and further price drops.

Liquidation Heatmap chart

Decrease in institutional demand

Institutional demand has shown signs of weakness amid increasing market uncertainty. According to recent data, US spot Bitcoin ETFs experienced a net outflow totaling $172.69 million last week, following a previous inflow of $196.48 million. Weekly net flows have remained low since mid-February, approximately one month after Trump’s inauguration on January 20. If this trend of net outflow continues and intensifies, Bitcoin’s price could face additional downward pressure.

Total Bitcoin spot ETF inflow weekly chart

Glimmers of hope in the market

Amid the rising tensions of the global trade conflict and a decline in institutional demand, there are still signs of hope. The Securities and Futures Commission (SFC) of Hong Kong issued new guidelines for licensed virtual asset trading platforms (VATPs) and crypto ETFs, allowing them to offer staking services, in an effort to enhance the region’s ambitions as a cryptocurrency hub amid fierce global competition.

This move to enable staking on licensed platforms and ETFs is generally a positive development for Bitcoin, as it suggests a maturing crypto ecosystem that can benefit Bitcoin indirectly by promoting institutional adoption, regulatory clarity, and global competitiveness. Although Bitcoin does not directly gain from staking, the expansion of infrastructure in Hong Kong could drive demand for Bitcoin through ETFs and institutional investments.

Bitcoin hits new yearly low of $74,508

Bitcoin’s value fell nearly 5% last week after facing resistance at the critical level of $85,000. As of Monday, BTC dropped below the daily support level of $78,258 and broke its previous yearly low of $76,606 (set on March 11), reaching a new year-to-date low of $74,508.

Should BTC maintain its downward trajectory, it may retest the next daily support level at $73,072.

The Relative Strength Index (RSI) on the daily chart currently reads 33, indicating a strong bearish trend, but it remains outside of oversold conditions. Additionally, the Moving Average Convergence Divergence (MACD) indicator displayed a bearish crossover on Sunday, providing a sell signal and reinforcing the prevailing downward trend.

BTC/USDT daily chart

If BTC rebounds, it might push towards its daily resistance at $85,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin remains the largest cryptocurrency by market capitalization, designed to function as a form of digital money. This currency operates without the control of any individual or organization, eliminating the need for intermediaries during financial transactions.

Altcoins refer to any cryptocurrency other than Bitcoin; however, some consider Ethereum as an exception because it is from these two currencies that forking occurs. If that’s the case, then Litecoin, the first altcoin derived from the Bitcoin protocol, is viewed as an “improved” version of Bitcoin.

Stablecoins are cryptocurrencies designed to maintain a stable value, usually backed by a reserve of the asset they represent. To achieve this, a stablecoin’s value is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply managed by an algorithm or market demand. The primary objective of stablecoins is to provide a reliable on/off-ramp for investors interested in trading and investing in cryptocurrencies. Additionally, stablecoins allow investors to securely hold value amid the overall volatility of cryptocurrencies.

Bitcoin dominance refers to the ratio of Bitcoin’s market capitalization to the total combined market capitalization of all cryptocurrencies. It offers a transparent view of Bitcoin’s appeal among investors. A high BTC dominance is typically observed before and during a bull market, where investors opt for relatively stable and large-cap cryptocurrencies like Bitcoin. Conversely, a decrease in BTC dominance often indicates that investors are reallocating their investments or profits into altcoins in pursuit of greater returns, which can catalyze a surge in altcoin activity.