Individuals who participated in the auction for the REAL (REAL) token, promoted by former UFC champion Conor McGregor, will receive their full investment back after the initiative failed to meet its minimum fundraising goal of $1 million.

“We need to face facts. We didn’t achieve our minimum raise,” the developers from Real World Gaming acknowledged in an April 6 post, stating that “All bids will be refunded in full.”

“This is not the end,” the team remarked.

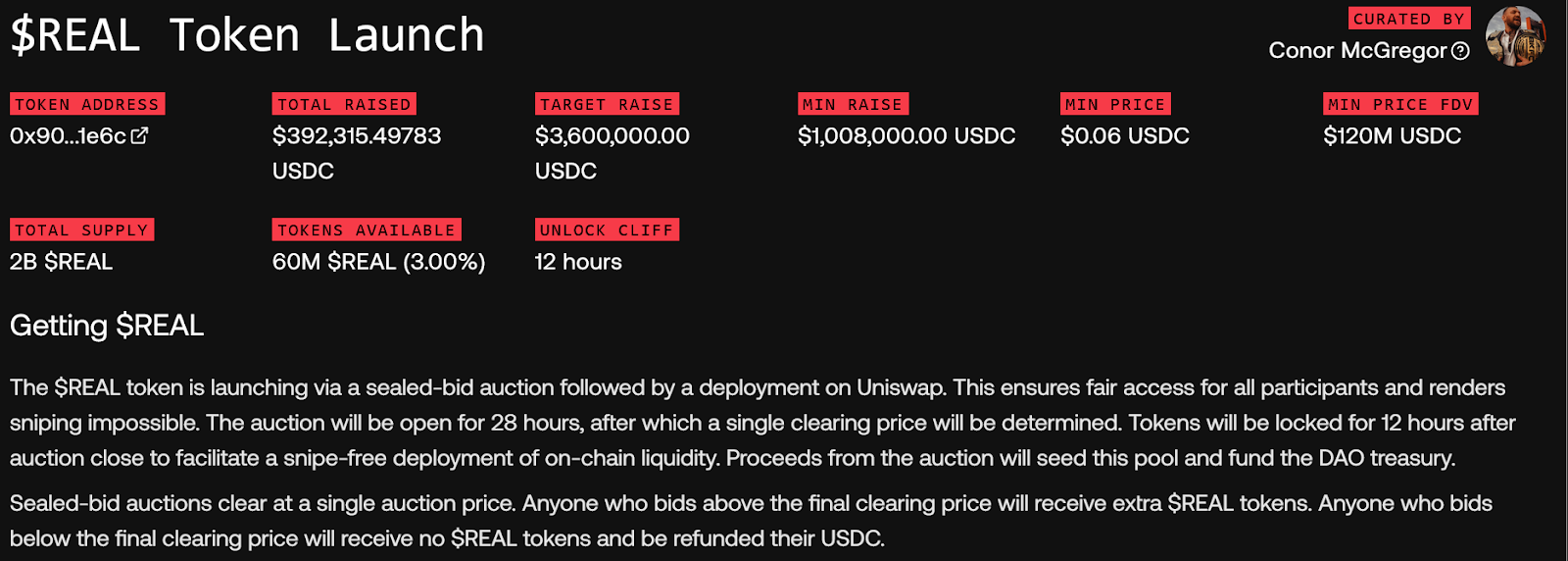

During a presale held on April 5 and 6, they were only able to secure $392,315 in USDC (USDC)—less than half of the required threshold and about 11% of the total $3.6 million sought through a sealed-bid auction.

The public sale aimed to release 60 million REAL tokens (which is 3% of the total supply of 2 billion REAL), with an anticipated fully diluted valuation of $120 million, starting at $0.06 per token.

Overview of the REAL token launch.

According to the data provided by RWG, there were just 668 participants involved in the auction.

Related: Celebrity tokens that shone brightly, then faded away in 2024

McGregor, who has transitioned from MMA fighter to entrepreneur and political candidate in Ireland, had initially asserted that his token would stand out as more reliable compared to other celebrity-backed tokens often associated with rug pulls:

“This isn’t just another celebrity-endorsed gimmick; it’s a REAL game changer that will enhance the crypto ecosystem and bring about REAL change globally,” McGregor stated in a communication shared with the media.

Conor McGregor.

Did REAL launch at an inopportune moment?

The REAL token was introduced during a significant downturn in the market, marked by a decline in Bitcoin (BTC) alongside US stocks which experienced an estimated loss of $6.6 trillion over April 3 and 4—recording the largest two-day drop ever, fueled by growing recession concerns tied to tariff plans announced by US President Donald Trump.

Additionally, the memecoin market has been cooling down since the Official Trump memecoin was launched on January 18, 2025. The controversy surrounding the Libra (LIBRA) token and Argentine President Javier Milei in late February also contributed to the downward market trend.

The once $100 billion memecoin sector has now plummeted below $44 billion and has seen a 13% decline over the last 24 hours, as reported by data from CoinGecko.

Magazine: XRP win leaves Ripple labeled ‘bad actor’ with no legal precedent in crypto