In an extraordinary development, Trump has raised the stakes in the ongoing trade dispute, threatening to increase tariffs on China to a staggering 104%, while the cryptocurrency market remains in a tense state.

Following China’s response to the latest round of U.S. tariffs, President Donald Trump has warned of more punitive actions. On April 7, he took to his social media platform Truth Social, declaring that if China did not retract its countermeasures, it would incur an additional 50% tariff.

Notably, China has enacted a 34% retaliatory tariff on all U.S. goods, reflecting similar measures from the United States. Trump has now issued an ultimatum for China to rescind its retaliatory tariffs by April 8 or face further repercussions.

“If China does not withdraw its 34% increase above their already long term trading abuses by tomorrow, April 8th, 2025, the United States will impose ADDITIONAL Tariffs on China of 50%, effective April 9th.” Donald Trump

The total tariffs imposed on Chinese products entering the United States currently stand at 54%, factoring in existing tariffs alongside Trump’s latest proposals. Should the new tariff come into effect, it would bring the total on Chinese imports to a potential 104%. For certain products, such as automobiles and electronics, the tariff percentages would be even steeper.

Trade tensions escalate with Trump’s latest threats to China

Since the announcement on “Liberation Day” on April 2, average U.S. tariffs on foreign goods have climbed to 18.8%, marking the highest level since the Smoot-Hawley Act of 1930, which has alarmed both stock and cryptocurrency markets.

Since February, the cryptocurrency market has seen a decline of $1 trillion, largely fueled by a risk-averse sentiment. Traders are increasingly concerned about rising inflation, slowing growth, and potential job losses stemming from the economic impact of these tariffs.

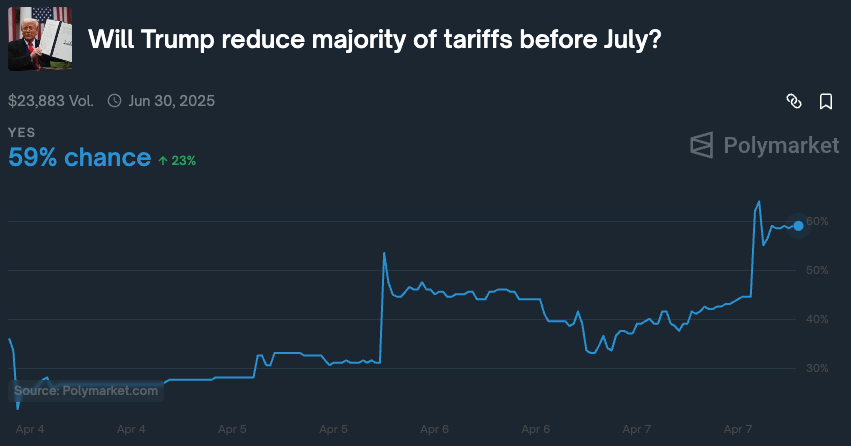

However, the duration and long-term implications of these tariffs remain uncertain. Curiously, 59% of traders on Polymarket anticipate that Trump will lower most tariffs by July. This figure represents a significant increase from just a day earlier when the odds were at 33%.

In the wake of these developments, Bitcoin (B) surged to a peak of $81,119 before retracing to $78,321.

Some traders are hopeful that Trump’s tariffs serve more as a negotiating tactic rather than a permanent fixture. This possibility gained traction after Trump suggested a potential 90-day moratorium on all tariffs, excluding those on China, as trade discussions continue.