An Ether investor with a substantial holding on the decentralized finance (DeFi) lending platform Sky faced a liquidation exceeding $100 million as Ether’s price plunged.

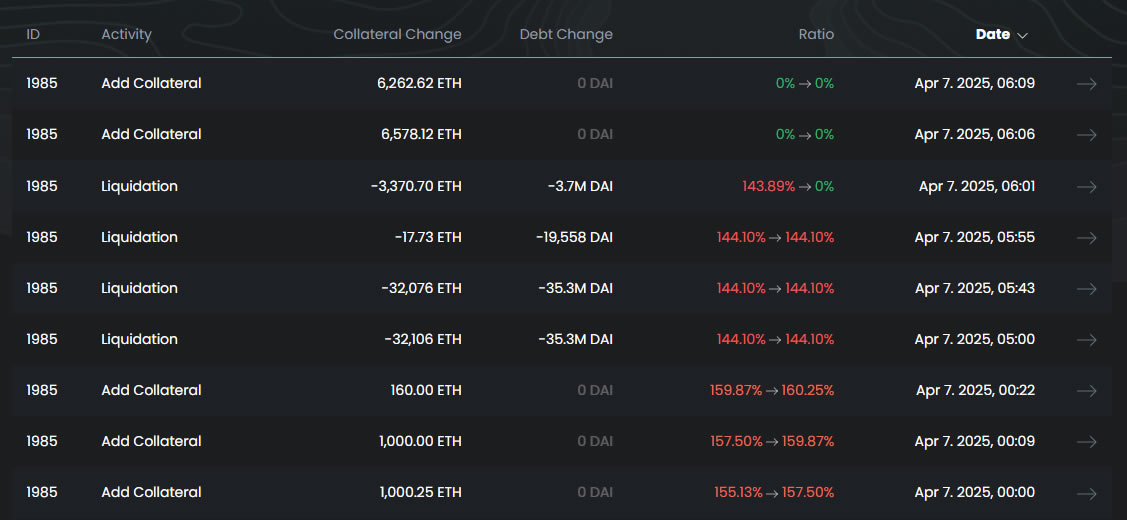

This Ether whale lost 67,570 ETH, valued at approximately $106 million, when the asset dipped by nearly 14% on April 6, resulting in the liquidation of their collateralized debt position on Sky, as noted by DeFi analytics sources.

The Sky platform, which transitioned from Maker in August, allows DeFi users to establish collateralized debt positions by depositing crypto, specifically ETH, in exchange for the platform’s stablecoin, DAI.

The lending model requires overcollateralization, typically at a ratio of 150% or more. This means users must deposit at least $150 worth of ETH to borrow 100 DAI.

The protocol continuously evaluates the value of the ETH collateral against the borrowed DAI. If the value of ETH decreases and the collateral ratio falls below the required threshold, the position may be liquidated.

This particular whale’s position was liquidated when the ratio dropped to 144% as ETH prices crashed.

ETH whale liquidations.

Additionally, reports indicated that another whale who provided 56,995 wrapped ETH, valued at around $91 million, to borrow DAI was also nearing liquidation.

In a liquidation scenario, Sky takes possession of the ETH collateral, which is then auctioned to repay the borrowed DAI plus associated fees. Any leftover collateral after the debt is settled is returned to the user.

Ethereum Price Hits Bear Market Lows

The price of ETH has seen a drastic fall of approximately 14.5% in the last 24 hours, dropping to $1,547 as of this writing, amid a broader downturn in the cryptocurrency market triggered by market reactions to tariffs announced by US President Donald Trump.

This marks the lowest ETH has traded since October 2023, a period when the cryptocurrency market was still firmly in bear territory, nearly a year after the FTX exchange’s collapse.

ETH remains down 68% from its peak in 2021, and continued price declines may lead to further liquidations among DeFi participants unless they can increase their collateral.

Related: Bitcoin Price Dips Below $80K as Stocks Experience 1987 Black Monday Repeat

According to liquidation data, approximately 320,000 traders have been liquidated in the past day, totaling nearly $1 billion. A significant portion of these liquidations has involved ETH positions.

Magazine: Is Bitcoin Heading Toward $70K Soon? Crypto Enthusiast Funds SpaceX Flight: Hodler’s Digest