A Japanese hotel management firm, now transformed into a Bitcoin treasury entity, has successfully repaid 2 billion yen (approximately $13.5 million) in bonds ahead of schedule as part of its efforts to strengthen its financial standing.

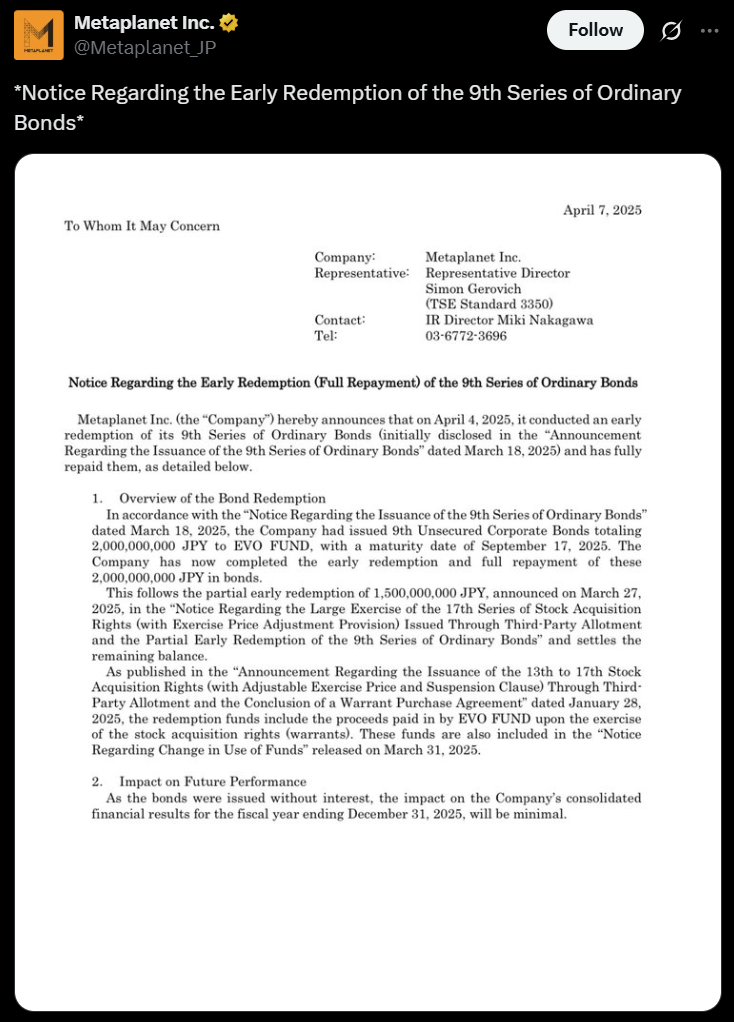

The company initiated an early redemption of its 9th Series of Ordinary Bonds on April 4, which is more than five months prior to the expected maturity date, as announced on April 7.

These zero-interest bonds were issued in March through the company’s Evo Fund to facilitate the acquisition of additional Bitcoin (BTC). Given that there is no interest on the bonds, the repayment is not expected to significantly affect the company’s fiscal results for 2025, it stated.

Image source: Company Announcement

This firm, listed on the Tokyo stock exchange, has made Bitcoin a focal point of its business strategy, evidenced by several acquisitions. Its Bitcoin holdings have increased to 4,206 BTC, positioning it among the top 10 publicly traded entities holding the cryptocurrency.

The acquisitions are part of an overarching strategy revealed in January, which aims for the company to acquire as much as 21,000 BTC by the end of 2026. At that time, it also mentioned ambitions to raise over $700 million to support its Bitcoin purchasing initiatives.

Related: Company’s stock surges 4,800% amid significant Bitcoin accumulation

CEO comments on Bitcoin market fluctuations

The firm appears to be embracing Bitcoin’s price fluctuations, adopting a strategy of purchasing during dips to increase its holdings of the cryptocurrency.

Over the recent weekend, the CEO expressed that Bitcoin’s volatility is “a natural characteristic of an asset that is genuinely rare, diversified, and possesses long-term potential” in a translated social media update.

Image source: CEO’s Statement

Bitcoin’s price faces renewed pressure amid a global sell-off of risk assets triggered by a recent tariff announcement by US President Donald Trump. On April 7, the BTC price dropped below $80,000, as reported by Cointelegraph Markets Pro.

This decline in Bitcoin’s value corresponds with broader downturns in the US stock market, with the S&P 500 Index having lost $5 trillion across just two trading sessions.

Magazine Feature: Is Bitcoin on its way to $70K soon? Insights into funding SpaceX flights: Hodler’s Digest, March 30 – April 5