Former Binance CEO Changpeng “CZ” Zhao has been appointed as an adviser to Pakistan’s Crypto Council, which is a newly established regulatory organization responsible for managing the country’s adoption of blockchain technology and digital assets.

This appointment was confirmed by the finance ministry of Pakistan and reported on April 7. According to reports, Zhao will provide guidance to the council on cryptocurrency regulation, infrastructure, and its widespread adoption.

Zhao is seen signing documents during his advisory appointment by the Pakistani financial authorities.

Zhao is a prominent figure in the crypto world, having led Binance as its CEO from 2017 until 2023. He stepped down in November 2023 after pleading guilty to violations of U.S. money laundering laws, subsequent to which he received a four-month prison sentence.

Zhao’s involvement is a significant move for Pakistan, as it may assist the country in attracting foreign investment in an increasingly important industry.

“Pakistan is no longer sitting on the sidelines,” Saqib stated. “We want to draw international investment, as Pakistan offers a low-cost, high-growth market with […] a Web3-native workforce ready to innovate.”

Related: Zhao to advise Kyrgyzstan on blockchain technology

Crypto in Pakistan: Adoption and Challenges

Pakistan has long been viewed as a potential center for cryptocurrency adoption due to its expanding population, large diaspora, and vibrant black market for foreign exchange trading.

The amount of cash remitted to Pakistan through official channels surged at the end of the previous year, coinciding with a nationwide effort to clamp down on black market dollar transactions.

“This increase may be attributed to remittances that were once sent via the black market now being channeled through official means,” noted John Ashbourne, an economist at Fitch Solutions.

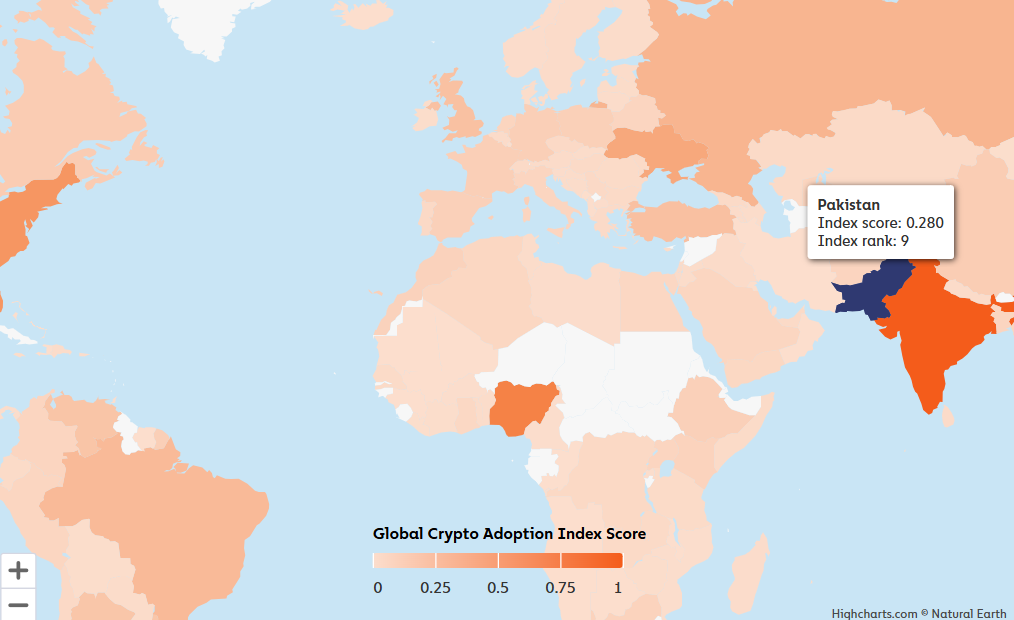

Pakistan ranks prominently on the 2024 crypto adoption index mostly due to strong retail engagement and activity at centralized services.

In 2024, Pakistan secured the ninth position among countries in Central and Southern Asia and Oceania.

Stablecoins have emerged as one of the key use cases for cryptocurrency in regions where demand for US dollars is high, driven by currency depreciation.

While data regarding stablecoin use in Pakistan is limited, a 2023 survey conducted by KuCoin found that 33% of local crypto investors utilize digital assets as a hedge against the devaluation of the rupee.

A more recent survey by Bitget revealed that 46% of South Asian respondents—encompassing countries like India, Pakistan, and Bangladesh—turn to digital assets for the speed and accessibility they offer in transactions.

Magazine: How global crypto laws are evolving in 2025