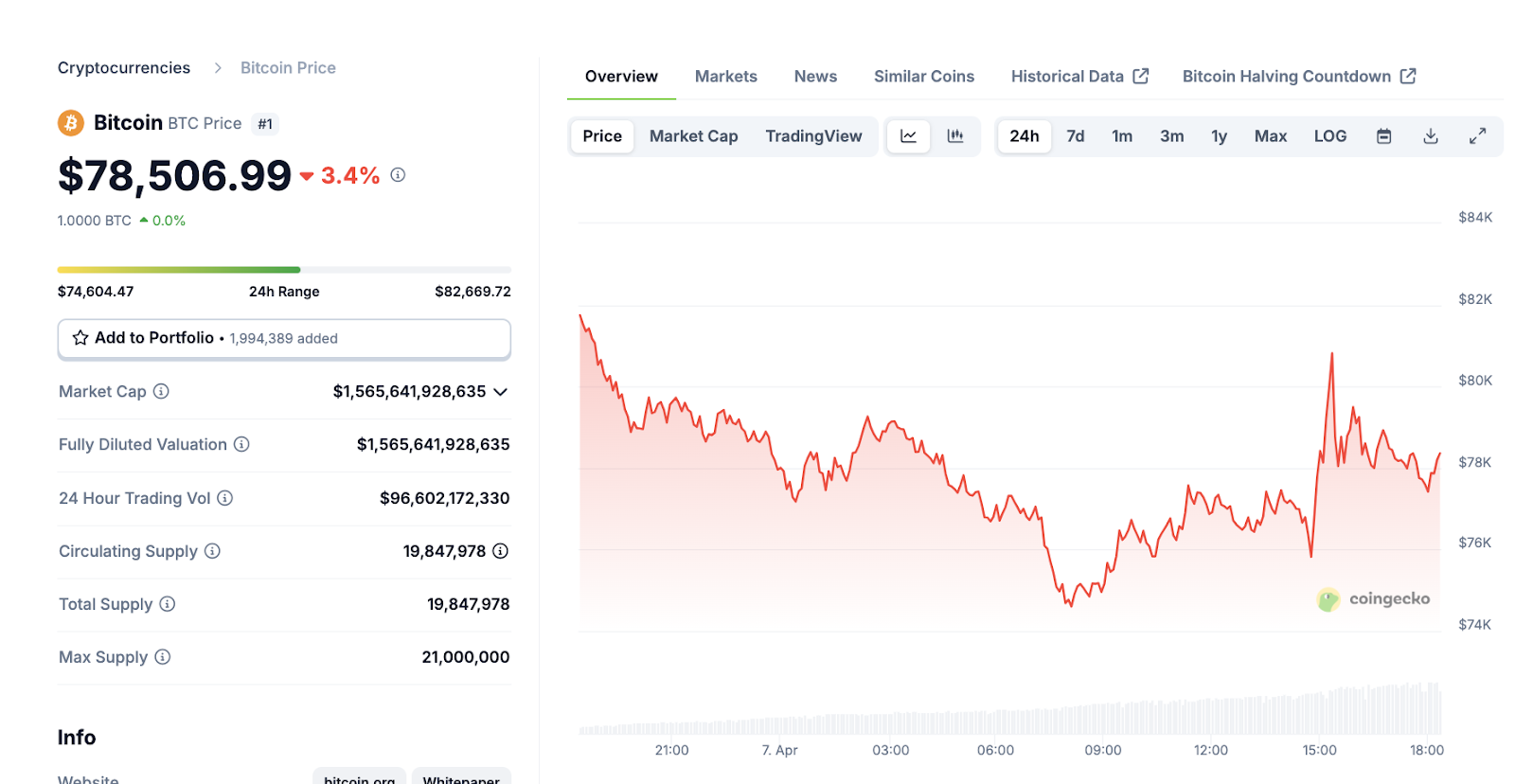

- Bitcoin’s price has stabilized at $79,000 after a turbulent trading period that saw the cryptocurrency drop to a new 2025 low of approximately $74,500.

- A crypto analyst has highlighted that Strategy has noticeably halted its BTC purchases since March 31.

- Bitcoin detractor Peter Schiff takes a jab at Michael Saylor, cautioning that prices could plummet toward Saylor’s average acquisition cost of $68,000.

During Monday’s American trading session, Bitcoin (BTC) remained around $79,000 after experiencing significant volatility over the weekend, which resulted in new lows for 2025 nearby $74,500.

The ongoing decline, coupled with Strategy’s inactivity in BTC purchases and pointed remarks from Bitcoin opponent Peter Schiff, has intensified negative market sentiment.

Strategy halts Bitcoin acquisitions amidst market decline

A market report mentioned that Strategy did not make any Bitcoin purchases from March 31 to April 6.

Previously, the firm employed an aggressive weekly buying strategy, particularly on Mondays, which had built its BTC holdings to over $7.67 billion.

Despite Founder Michael Saylor continuing to share optimistic outlooks on his X account, the halt in purchases by Strategy has attracted attention.

$MSTR – *STRATEGY BOUGHT 0 BITCOIN DURING MARCH 31 TO APRIL 6

— *Walter Bloomberg (@DeItaone) April 7, 2025

As Bitcoin struggled to remain above $78,000, traders interpreted the firm’s pause in buying as a possible sign of hesitation—or a wait-and-see tactic as the market seeks stability.

Peter Schiff cautions Saylor about potential downturns

“Hey @saylor, with Bitcoin dropping below $80K, if you want to prevent it from plummeting beneath your average of $68K, now is the time to invest heavily with borrowed funds,” Schiff commented.

Schiff’s remarks come amid ongoing discussions regarding Strategy’s market position.

Strategy (MSTR) Total Bitcoin Holdings as of April 7, 2025

As of this writing, Michael Saylor has yet to respond to Schiff. According to on-chain records, Strategy remains the largest institutional Bitcoin holder with over 528,185 BTC on its balance sheet.

BTC stabilizes at $79K as White House refutes tariff pause speculation

Bitcoin found stability around $79,000 on Monday after significant fluctuations earlier in the day saw prices plummet to $74,500. This recovery happened amidst rampant speculation that the White House might consider pausing recently introduced tariffs on all countries except for Chinese imports—a rumor that was promptly dismissed by officials on Monday morning.

Bitcoin price action (BTCUSD), April 7, 2025.

Bitcoin price action (BTCUSD), April 7, 2025.

These contradicting reports provided temporary relief to crypto markets before sentiment turned negative again upon confirmation that trade penalties would persist.

Bitcoin had previously dropped over 7% over the weekend, primarily due to escalating US-China trade tensions and a diminished risk appetite.

Following the rumors of a tariff halt, BTC experienced an initial surge of 8%, rebounding from a 24-hour low of $74,600 to briefly reclaim the $80,800 mark.

However, this rebound was short-lived, as BTC prices sank again, settling around $78,500 at the time of writing.

In conclusion

According to reports, Strategy has not made any new Bitcoin acquisitions since March 31. This pause, along with pointed disapproval from crypto skeptic Peter Schiff—who cautioned CEO Michael Saylor about the potential for a decline in average costs toward $68,000—could further hinder Bitcoin’s chances for a short-term recovery.