The intensifying trade conflict is impacting both Bitcoin and the stock market, prompting traders to reevaluate their exposure to risk assets and seek refuge in gold.

The cryptocurrency market capitalization has contracted by $1 trillion amid concerns regarding a potential US trade war, leading traders to liquidate their Bitcoin (BTC) holdings in favor of gold. Recent analysis indicates that the rise in US tariffs is fueling anxieties across both the cryptocurrency and stock markets.

Recently, the administration announced a sweeping 10% tariff, effective April 5, applicable to all nations, with some countries facing much steeper tariffs—34% on China, 20% on the EU, and 24% on Japan.

Specific sectors will be subjected to additional levies, notably the automotive industry, which will incur an extra 25% duty. Consequently, the average US tariffs have surged to 18.8%, marking the highest levels since the Smoot-Hawley Tariff Act of 1930.

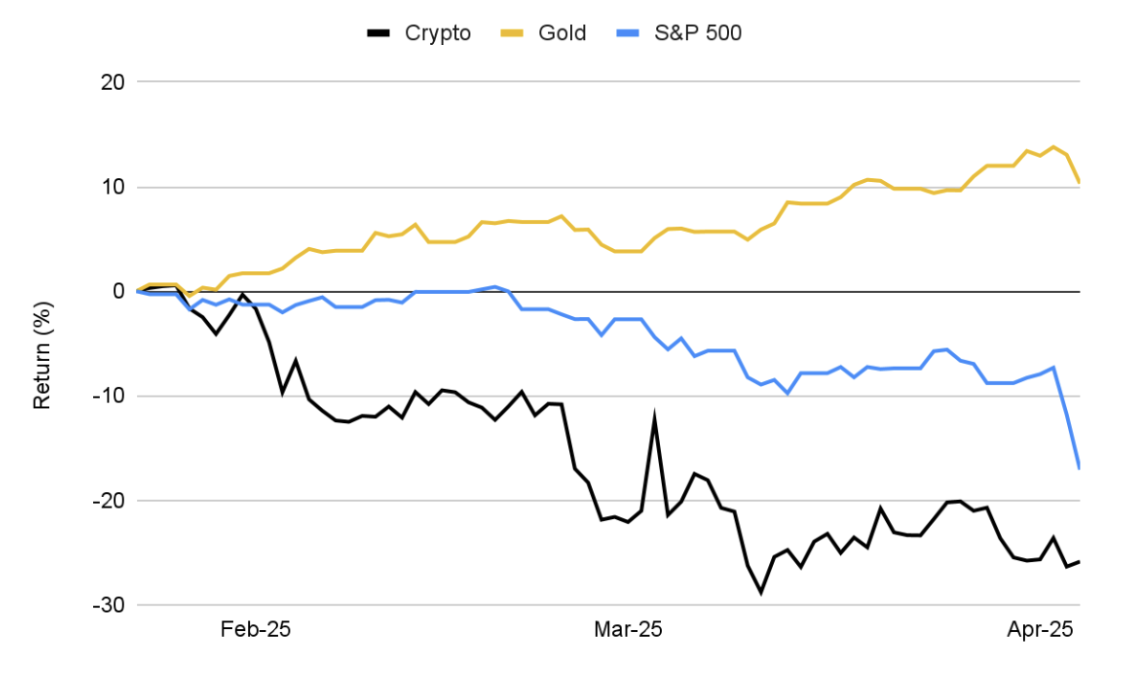

Since February 2025, the total market cap of cryptocurrencies has declined by 25.9%, amounting to $1 trillion. Bitcoin’s value has decreased by 19.1%, while Ethereum has experienced a sharper decline of 40%. Memecoins and AI tokens have performed even worse, with overall losses exceeding 50%.

Bitcoin behaves more like a risk asset than a safe haven

The downturn in Bitcoin’s value has increased its correlation with the S&P 500 index, rising from –0.32 to 0.47. This shift indicates that during market declines, Bitcoin is acting more like a risk asset rather than a protective investment.

In contrast, gold has solidified its position as a safe haven amid market risks and inflationary pressures. It has appreciated by 10.3% since February, while its correlation with Bitcoin has decreased to –0.22. This separation has occurred despite inflation expectations rising to an annual rate of 3–5%.

The increasing negative correlation challenges Bitcoin’s standing as “digital gold” and a reliable hedge against inflation. Consequently, institutions may be less motivated to incorporate Bitcoin into their portfolios as a defensive asset.