- The cryptocurrency market continued its downward trend on Monday, with Bitcoin dropping below $78,000 following last week’s tariff announcement from Trump.

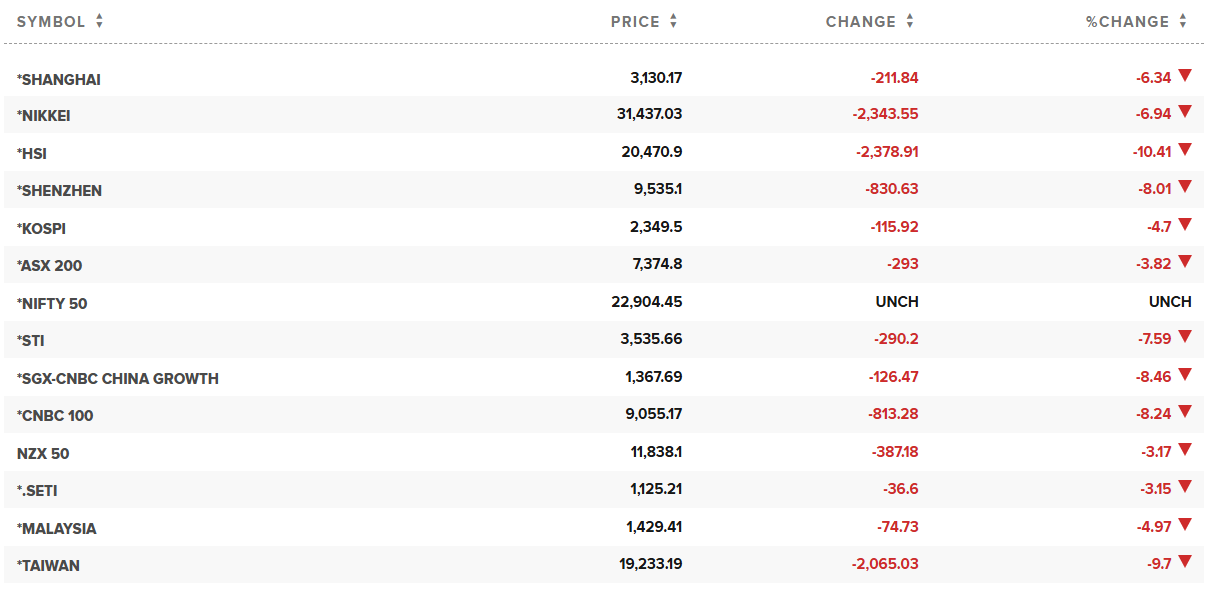

- Asian markets were also in decline, with Japan’s stock market experiencing a loss of 8.5%, marking its lowest point since October 2023.

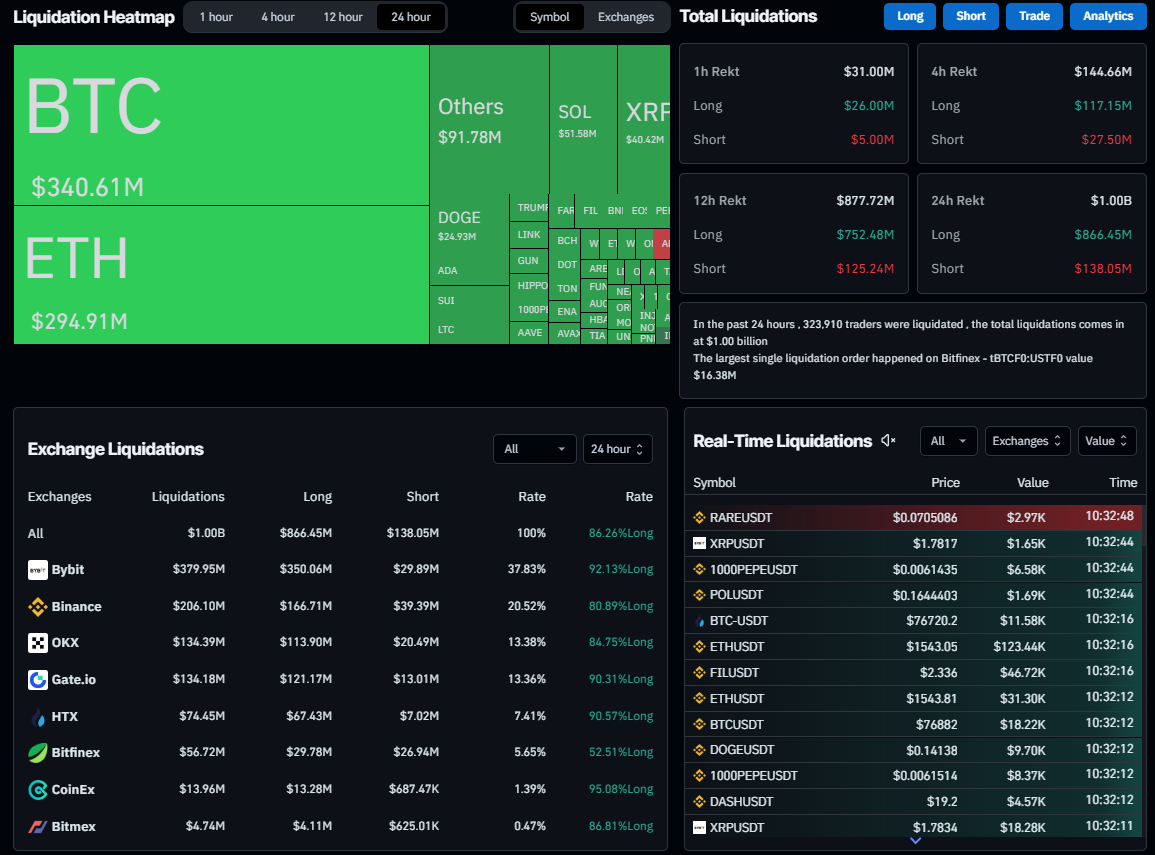

- The Coinglass liquidation heatmap indicates over $1.01 billion in liquidations occurred within the last 24 hours.

Crypto and Asian markets plunge amid intensifying trade conflict

Top 10 cryptocurrencies chart. Data source: CoinGecko

The Kobeissi report highlighted that Asian markets followed suit in this decline. Japan’s stock market now shows an 8.5% loss, hitting its lowest point since October 2023.

Further details from the report indicate that global stocks have wiped out over $20 trillion since February 19, primarily driven by uncertainties surrounding tariffs and ongoing trade conflicts.

BREAKING: Japan’s stock market has dropped to -8.5% today, reaching its lowest level since October 2023.

Global stocks have shed well over $20 trillion since February 19th. pic.twitter.com/dkBzySxD7P

— The Kobeissi Letter (@KobeissiLetter) April 7, 2025

Former US President Trump declared tariffs last week on April 1, including a 10% tariff on all imports alongside additional punitive taxes affecting around 60 countries. This move has ignited a global trade conflict, with China responding by imposing a 34% tax on US goods. Japan, which heavily depends on exports particularly to the US and China, finds itself caught in the middle.

This sharp decline in market value reflects a widespread sell-off incited by the US-China trade tensions, stemming from Trump’s tariff announcements last week, naturally impacting Asian markets.

The ramifications of the ongoing global trade conflict are also evident in crypto markets, eliciting a wave of liquidations. The Coinglass Liquidation Map shows that in the last 24 hours, 24,146 traders faced liquidation, leading to a total of $1.01 billion in liquidations. The largest single liquidation order occurred on Bitfinex, valued at $16.38 million.

Bitcoin’s liquidation totaled over $340 million, while Ethereum experienced about $294.91 million. Such significant liquidations could create Fear, Uncertainty, and Doubt (FUD) among investors, potentially increasing selling pressure and resulting in further declines in prices.

Liquidation Heatmap chart. Data source: Coinglass