On April 16, Binance will remove 14 tokens from its platform, a step aimed at eliminating lower-quality projects that fail to meet the exchange’s updated listing standards.

The decision to delist these tokens comes after a thorough assessment of various factors, including the inaugural “vote to delist” outcomes, where community members identified projects that did not perform well metric-wise. This was communicated on April 8.

The evaluation considered several aspects, such as the commitment of the project team, ongoing development activity, trading volumes and liquidity, network stability, and the team’s responsiveness to Binance’s due diligence queries, along with new regulatory norms.

The tokens subject to delisting include Badger (BADGER), Balancer (BAL), Beta Finance (BETA), Cream Finance (CREAM), Cortex (CTXF), Aaelf (ELF), Firo (FIRO), Kava Lend (HARD), NULS (NULS), Prosper (PROS), Status (SNT), TROY (TROY), UniLend (UFT), and VIDT DAO (VIDT).

Image source: Binance

In the past year, Binance has strengthened its listing criteria to enhance investor protections. As of March 2024, the company has lengthened its “cliff period”—the timeframe during which listed tokens cannot be sold—to at least one year.

Related: Binance co-founder clarifies asset listing policies and addresses concerns

As the number of tokens rises, listing standards become stricter across the industry

Binance is not the only cryptocurrency exchange tightening its listing criteria in light of heightened regulatory scrutiny. Last October, Bitget announced a revamp of its token listing approach, focusing on aspects such as fully diluted valuation, investor lock-up periods, and project business strategies.

Similarly, South Korean exchanges have enhanced their listing requirements due to new regulations that restrict the inclusion of tokens that have not been traded domestically for at least two years.

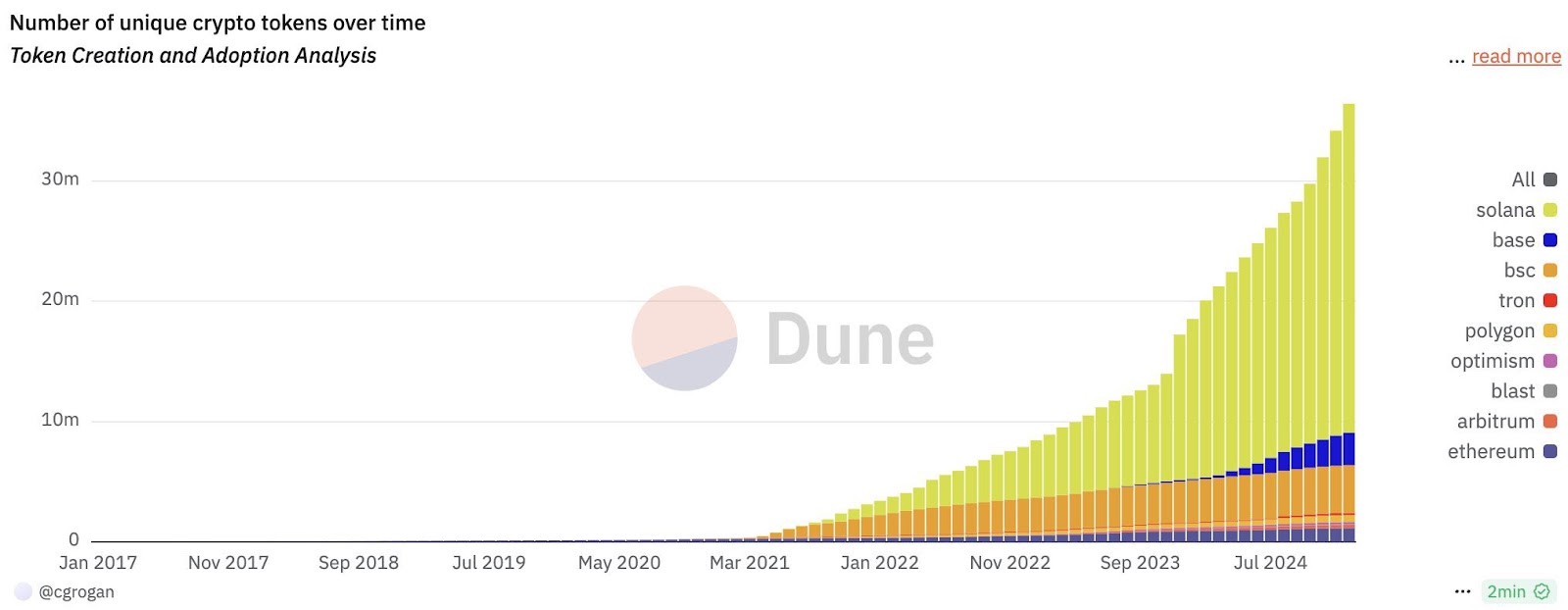

Robust listing standards are essential to manage the influx of new tokens entering the market daily.

In the aftermath of the memecoin craze, platforms like CoinMarketCap are tracking an astounding 13.24 million cryptocurrencies, and the actual number is likely even higher.

Some analysts have suggested that the oversaturation of tokens is partially responsible for the lack of a significant “altseason” this cycle.

The surge in cryptocurrency numbers may have diluted altseason. Source: Ali Martinez

“Today, there are over 36.4 million altcoins, compared to fewer than 3,000 during the 2017-2018 alt season and even fewer than 500 in the 2013-2014 period,” noted crypto analyst Ali Martinez on social media.

Magazine: 3 reasons Ethereum may experience a turnaround: Insights from Kain Warwick, X Hall of Flame