- Bitcoin has faced a downturn following the White House press briefing that announced 104% tariffs on China after disappointing Q1 results in 2025.

- Ethereum maintained stability throughout the quarter as the DeFi ecosystem and Layer 2 solutions gained traction.

- The WLF, affiliated with US President Trump, expanded its treasury holdings by investing in Bitcoin, Ethereum, and various other tokens.

- ETF issuers showed interest in altcoins such as XRP and Solana, with the ProShares Solana ETF possibly becoming effective as soon as April 16.

During Q1 2025, Bitcoin (BTC), Ethereum (ETH), and XRP experienced a correction, reflecting trends seen across the cryptocurrency sector. Economic uncertainty and a drop in institutional interest have shaken the crypto market.

While many Exchange Traded Funds (ETFs) experienced net outflows, the iShares Bitcoin Trust ETF stood out as an exception. Bitcoin rebounded from sudden price drops observed throughout Q1 2025, leading analysts to believe that the bull market remains intact.

Bitcoin price analysis for Q1 2025 and future projections

According to data from The Block, Bitcoin shows a negative correlation with Gold, while its correlation with the S&P 500 and Nasdaq Composite is increasing.

Bitcoin Pearson Correlation (30 days) | Source: TheBlock

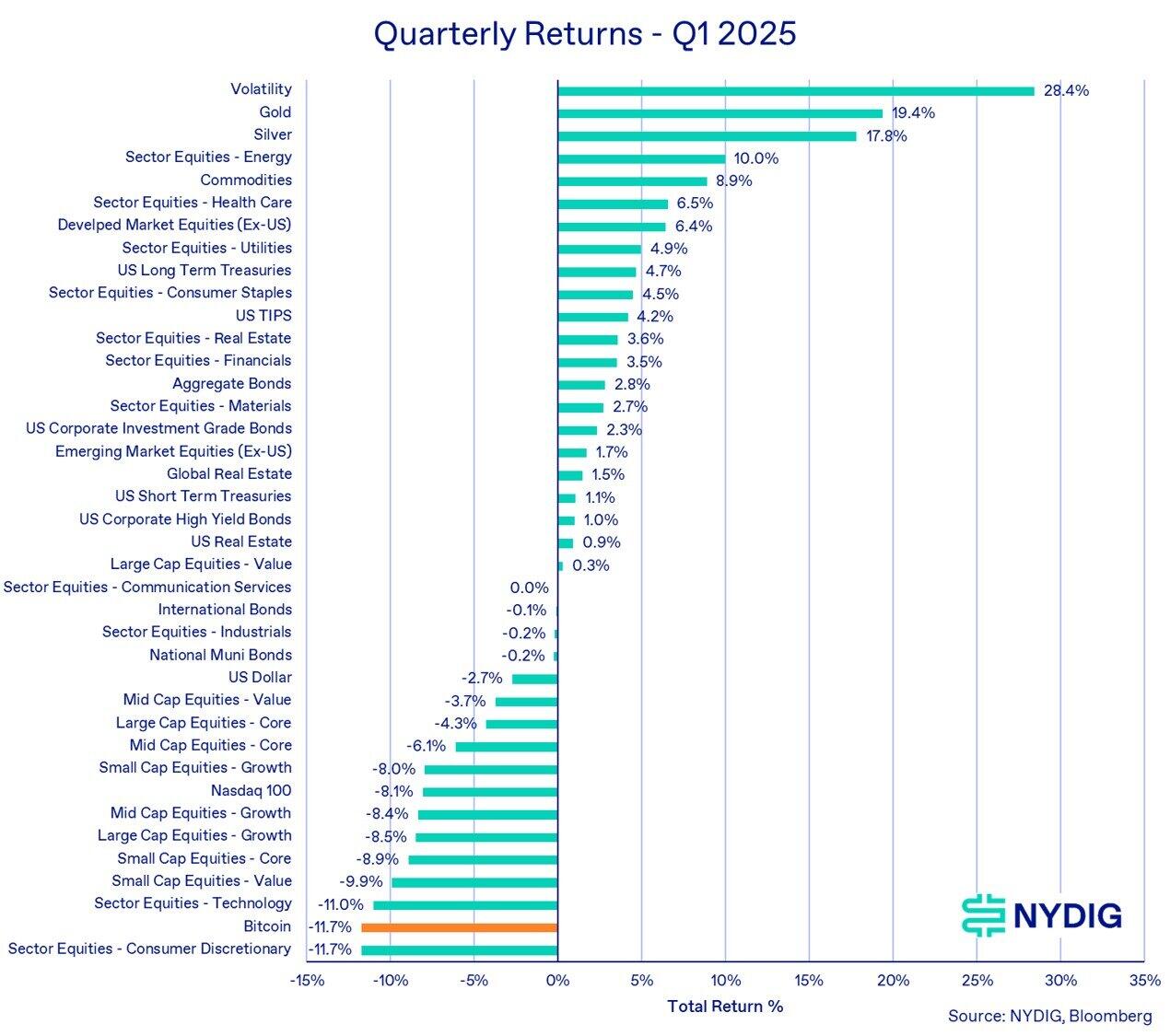

Bitcoin’s value decreased by 11.7% in Q1 2025, marking its worst quarterly performance in years. Nonetheless, BTC is still holding onto nearly 27% gains over the past six months.

The Trump administration’s pro-cryptocurrency policies have aided Bitcoin in recovering from each downturn in Q1 2025. However, Bitcoin has recorded an 18% loss year-to-date and currently trades around $77,000.

Anticipation surrounding the Bitcoin Strategic Reserve and proposed federal measures for cryptocurrency failed to sustain BTC’s price increases. Market sentiment dipped as global markets reacted negatively to US tariff announcements, negatively impacting Bitcoin’s price alongside equities.

A recent report on cryptocurrency’s Q1 2025 performance noted that Bitcoin’s results were near the lowest among various asset categories.

Q1 2025 returns across different asset categories | Source: NYDIG

On Tuesday, following the White House briefing on the 104% tariffs imposed on China, Bitcoin started its downward trend, falling from a high of $80,800 to approximately $76,400. It remains uncertain if Bitcoin will dip below crucial support at $74,500, potentially erasing all gains since the announcement of the presidential election results on November 7, 2024.

Ethereum suffers a 45% drop in Q1 2025, reaching its lowest point since November 2023

In Q1 2025, Ethereum lost 45% of its value, trading at $1,462 at the time of writing. The altcoin reached its lowest level since November 2023 during this quarter, falling to a new cycle low of $1,411 during the market crash this Monday.

Several factors contributed to Ethereum’s decline, including a lack of institutional demand for its ETF, waning interest from both retail and institutional traders, and value being captured by DeFi protocols and Layer 2 networks that utilize Ethereum for security.

Sales of ETH by the Ethereum Foundation also negatively impacted holder sentiment, leading to the altcoin’s failure to maintain critical support levels.

ETH/USDT 1-day price chart

While the Trump-affiliated WLF diversified its cryptocurrency investments to include Ethereum, it failed to generate significant demand for the altcoin among large holders and institutional investors.

XRP faces challenges despite the SEC dropping litigation and concluding its legal disputes

XRP concluded Q1 2025 with a marginal gain of less than half a percent over three months, indicating that the altcoin’s price remained largely unchanged. This quarter was notable for the SEC’s decision to end its legal battle against Ripple, the company behind the XRPLedger, and to settle for a $50 million fine, reduced from an initial $125 million.

Ripple, making progress with its RLUSD stablecoin and partnerships in the US, is led by CEO Brad Garlinghouse, who is committed to expanding operations in the US to enhance the country’s position as the “crypto capital” of the world.

Despite these developments, XRP did not manage to conclude the quarter positively and is currently trading at $1.8225.

Solana nears ETF approval—what lies ahead?

In their Q1 2025 analysis, analysts noted the ProShares Solana ETF’s progress, indicating it could gain effectiveness by April 16. This ETF is set to include CME Solana Futures, and if it becomes effective post-mid-April, trading could begin shortly thereafter.

This development may serve as a positive catalyst for Solana alongside optimistic news within the SOL ecosystem. The ongoing competition between Pump.fun and Raydium, both seeking to capture market share and trade volume from one another, has resulted in increased revenue for the chain. Adoption of a Solana Futures ETF could bolster SOL’s price in Q2 2025.