According to Blockstream’s CEO, Adam Back, Bitcoin could start to capture market share from gold over the coming decade as a safeguard against inflation and geopolitical instability.

During a conversation with Cointelegraph managing editor Gareth Jenkinson at Paris Blockchain Week 2025, Back indicated that the rise in inflation and monetary instability worldwide is likely to encourage broader adoption of Bitcoin (BTC).

He likened the cryptocurrency to gold, highlighting its scarcity and increasing acceptance as a valuable asset, even with a 30% decrease from its peak above $109,000.

“Bitcoin has the benefit of being similar to gold — it’s a limited resource and is currently experiencing an adoption curve,” he remarked.

Inflation remains a significant issue for global economies, with major currencies like the US dollar and the euro seeing their supplies increase by over 50% in the last five years — a reality that could propel Bitcoin’s use as a hedge against economic instability, according to Back.

“Ultimately, this influx of money will be used to purchase products, leading to price increases, especially for tangible assets like real estate and other physical items in the long run,” he explained. “The inflation rate could reach around 10% or 15% over the next decade, presenting a return on investment that is challenging to achieve with traditional stocks or rental properties.”

“Thus, there is a genuine potential for Bitcoin to compete with gold and claim some of its roles, such as serving as a geopolitical safeguard, drawing investment away from gold.”

Adam Back discussing various topics with Gareth Jenkinson.

Related: The evolving significance of Bitcoin as it enters a new phase in the financial landscape.

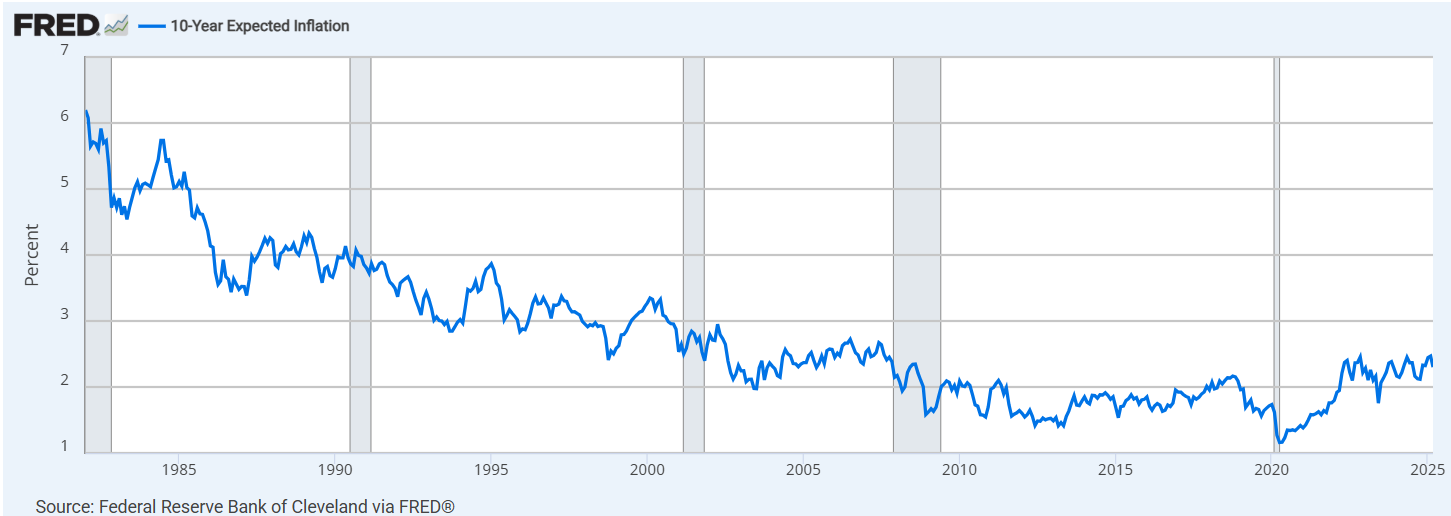

The Federal Reserve Bank of Cleveland anticipates an average annual inflation rate of 2.18% over the next decade, according to data released on March 12.

Projected inflation rates. Source: Federal Reserve Bank of Cleveland

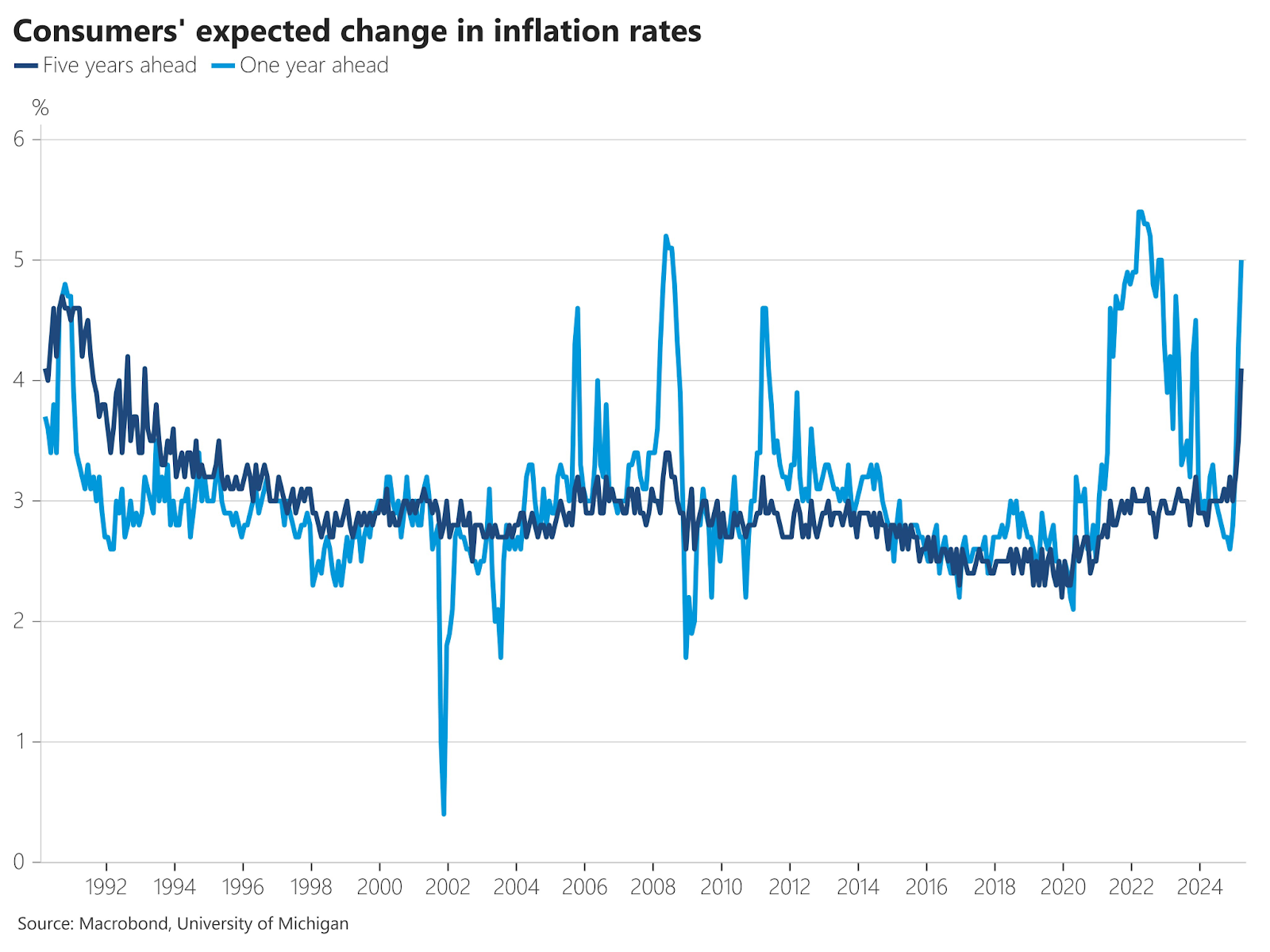

Nonetheless, some alternative analyses suggest a possible rise in inflation over the next five years.

Consumer expectations for inflation jumped to 5% for the coming year and 4.1% over the next five years, a situation that heightens economic worries, based on a survey conducted by the University of Michigan released on March 28.

Consumer expectations regarding inflation rates. Source: University of Michigan

Related: The potential impact of Bitcoin’s price on wealth disparity in the digital era.

Factors Influencing Bitcoin Adoption: ETFs and Policy Changes

In addition to increasing monetary uncertainty, the introduction of US-based spot Bitcoin exchange-traded funds (ETFs) and the more crypto-friendly stance of the current US administration may further stimulate Bitcoin adoption as an inflation hedge.

“US regulators have finally approved the ETFs, and the present administration is moving to eliminate many restrictive regulations aimed at hindering crypto adoption,” Back stated.

He suggested that the adoption of Bitcoin among retail investors should come before any institutional or governmental investments:

“It’s preferable for private individuals to purchase Bitcoin before governments, as their entry could trigger a competitive rush among other nations.”

Insights from recent discussions on Bitcoin’s future.

On March 7, an executive order was signed to establish a Bitcoin reserve funded by Bitcoin confiscated from criminal activities, a development that industry figures have called a significant advancement toward integrating Bitcoin into the mainstream financial system.

Magazine: Could Bitcoin reach $70K soon? Insights and developments in the crypto space: Hodler’s Digest, March 30 – April 5