On April 8, as the Wall Street markets reopened, Bitcoin (BTC) fluctuated around $80,000 while US stock markets demonstrated a notable recovery. However, ongoing tensions between China and the US continue to overshadow potential gains for BTC.

BTC/USD 1-hour chart.

Insights: Bitcoin Could See a Repeat of Past Inflows from China

Market data indicated a decrease in BTC price volatility while the S&P 500 and Nasdaq Composite Index surged by as much as 4.3% shortly after trading began.

The stock markets capitalized on a robust rebound that had begun with the week’s traditional financial trading, easing concerns of a significant market crash reminiscent of 1987’s “Black Monday.”

Despite this, US trade tariffs remained a pressing topic among traders, especially as they monitored the ongoing rhetorical conflict with China.

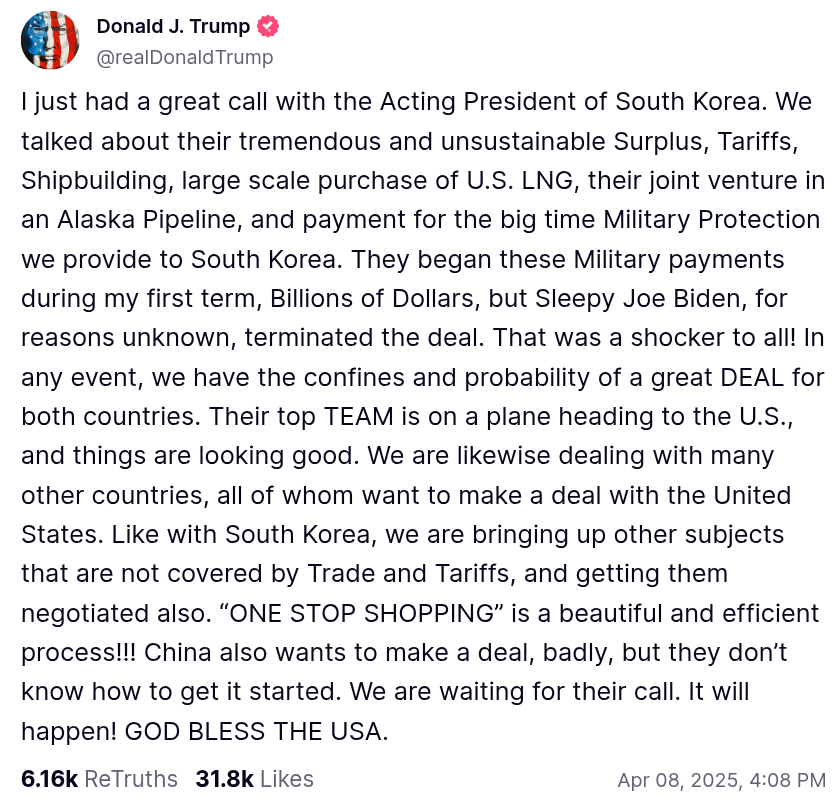

In a statement made via social media, the US President suggested that Beijing “is eager to reach an agreement, but they are unsure how to initiate it.”

“We are awaiting their call,” he conveyed to his audience.

Source: Social Media

Proponents of Bitcoin were watching the yuan’s depreciation as a response to China’s tariffs, noting the likely flows into alternative hedges like BTC due to this scenario.

“China’s leverage lies in its independent monetary policy, which calls for a weaker yuan,” remarked a former crypto exchange CEO, referencing broader market dynamics.

The individual proposed that either the People’s Bank of China (PBoC) or the US Federal Reserve would ultimately drive a BTC price rally.

“If it’s not the Fed, then the PBoC will supply the necessary elements for a significant upswing,” they stated in their characteristic manner.

“A depreciation of the CNY creates a narrative that Chinese investors will flee to $BTC. This trend proved effective in 2013, 2015, and could repeat in 2025. Ignoring China’s market movements could be a costly mistake.”

USD/CNY 3-day chart.

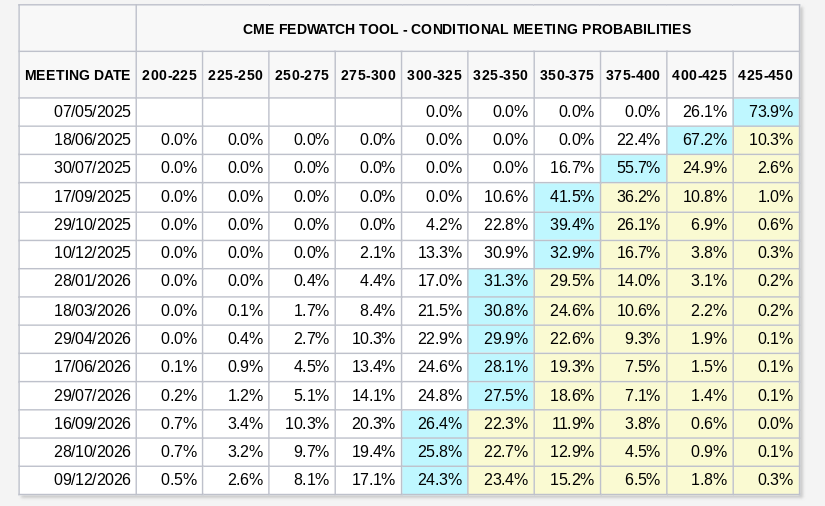

Meanwhile, the Fed could bolster Bitcoin and other risky assets by cutting interest rates to spur growth. A financial analysis from a leading firm anticipated this action despite the impact of tariffs on rising inflation.

“If the economy decelerates, which we anticipate, the Fed is likely to lower rates even in a high-inflation environment,” asserted the director of Developed Market Economic Research at the firm.

“Current inflation figures reflect past economic activity and do not predict future trends. The Fed has previously cut rates in a high-inflation context, and we predict it might do so again—unless inflation expectations become unsettled.”

Fed target rate probabilities (screenshot).

They added that the organization anticipates 75 basis points in rate cuts in 2025, with recent data indicating that markets expect the initial cut could occur during the Fed’s June assembly.

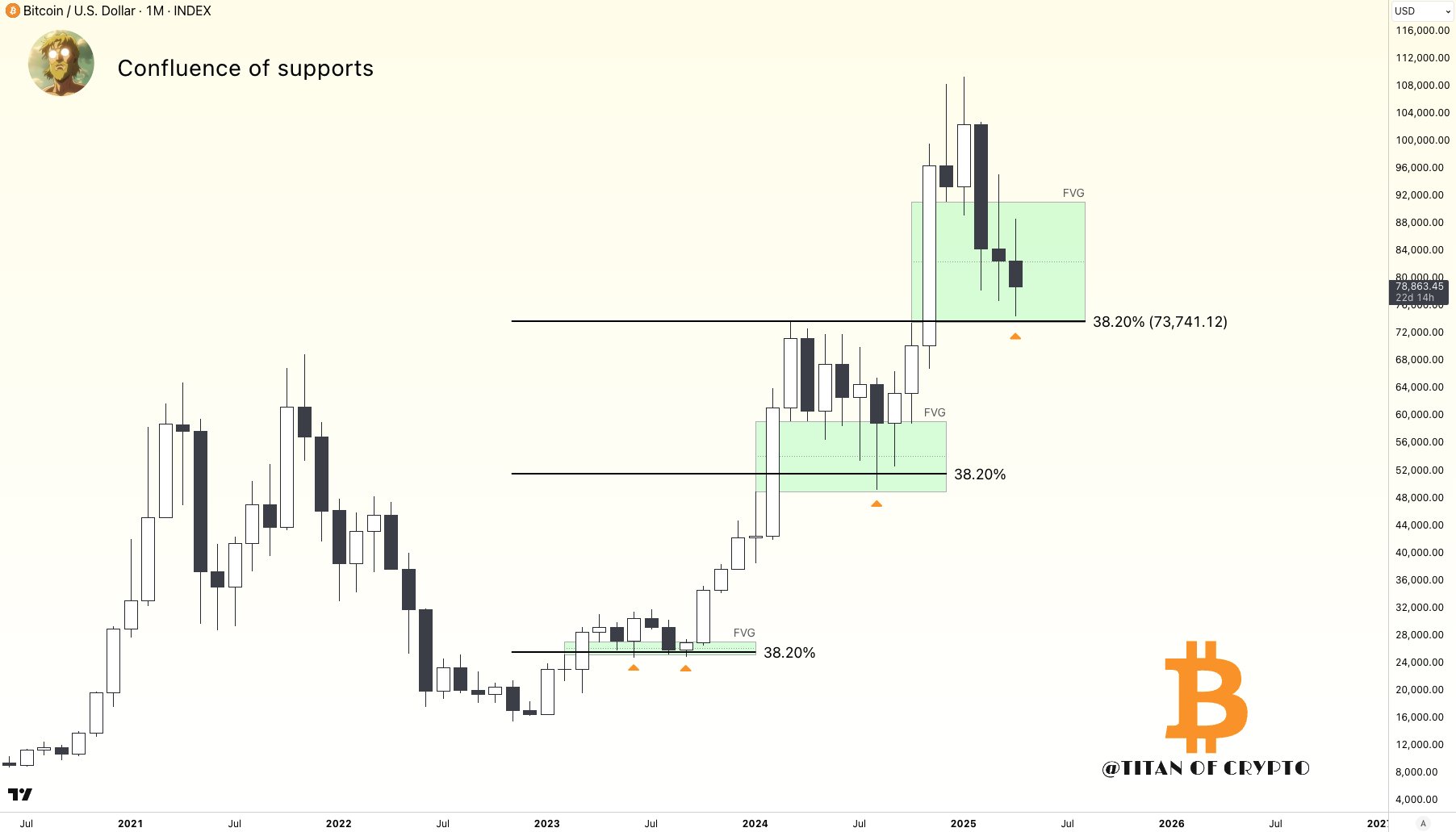

Fibonacci Levels: A Key Point of Interest for BTC Price

Amid the recent global market upheaval, Bitcoin’s price movements have remained surprisingly stable on shorter timeframes, transitioning from sharp fluctuations to consolidation.

For traders, a crucial level to monitor is the 0.382 Fibonacci retracement level, currently situated around $73,500.

“In a bullish market, the 38.2% Fibonacci line serves as an essential support level,” noted a prominent trader, describing BTC/USD as being in a reversal zone.

“As long as BTC remains above this level at closing, the upward trend remains valid, even if there are temporary dips below it.”

BTC/USD 1-month chart with Fibonacci levels.

Another trader also highlighted the importance of this level, as it aligns with previous all-time highs recorded in March 2024.

“$BTC has successfully adhered to its .382 Fibonacci retracement levels, calculated from the cycle low to the local peaks, thus far,” they explained to their followers.

“This marks the third time this cycle we’ve encountered such a test, and now it coincides with the highs from 2024. A significant level to keep an eye on.”

Additional important trend lines include the 200-day simple moving average (SMA), traditionally recognized as a support line during bull markets, which was breached when BTC first fell below $82,000.

BTC/USD 1-day chart with 200 SMA.

Note: This article does not offer investment advice or recommendations. Every investment and trading action comes with risks, and readers should conduct their own due diligence when making financial decisions.