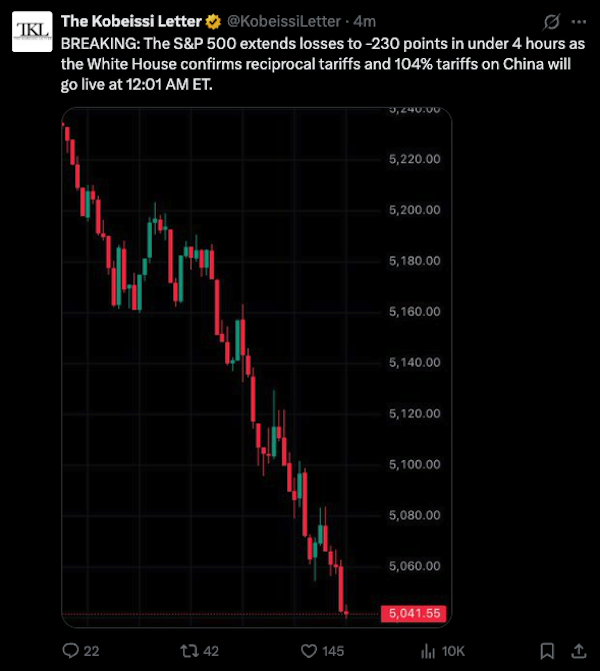

Bitcoin’s unexpected climb to $81,180—prompted by misinformation about a potential pause in US tariffs—has largely dissipated after official confirmation from the White House that 104% tariffs on China will take effect at 12:01 am on April 9.

S&P 500 experiences a drop in intra-day gains following the White House announcement of tariffs. Source: X / Kobeissi Letter

After first falling below the $75,000 threshold since November 6, 2024, Bitcoin has revisited an important demand zone that traders believe could serve as a refuge for bullish investors.

This refuge is identified as a fair value gap ranging from $77,000 to $73,400, which was formed during the November 2024 surge associated with Trump’s policies.

BTC/USD daily chart. Source: Cointelegraph/TradingView

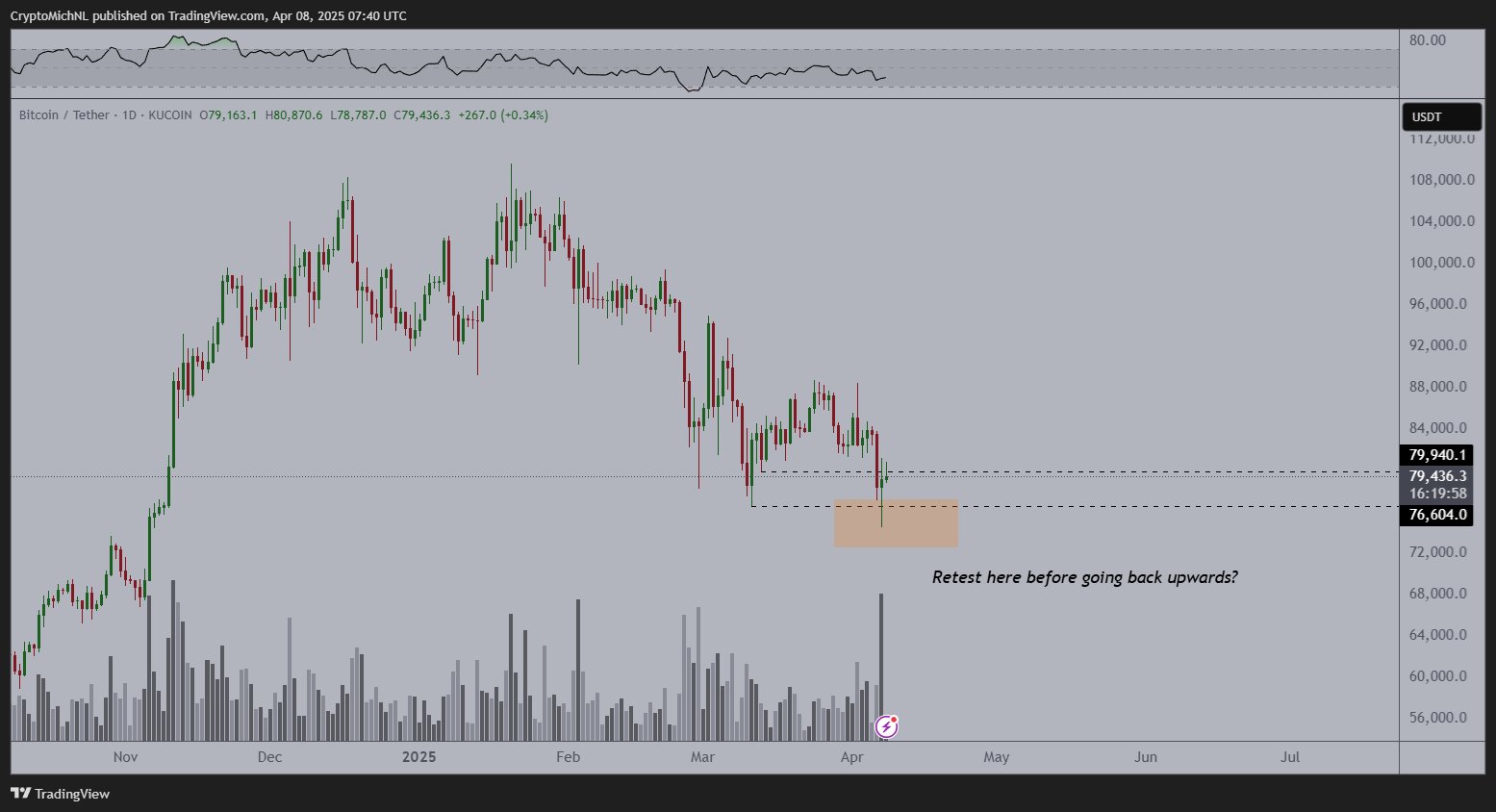

Michael van de Poppe, founder of MN Capital, earlier emphasized the need for Bitcoin to revisit this area “before making another upward move.”

In another post on April 8, van de Poppe stated, “Bitcoin approaching $80,000 is a positive indication,” adding:

“I’m uncertain whether we’ll experience additional declines or if the worst is over.”

BTC/USD daily chart. Source: Michael van de Poppe

Another analyst, Jelle, shared comparable views, noting that Bitcoin’s close above $79,000 on April 7, after a dip to $74,400, was notable when compared to the performance of equities.

“Waiting for the situation to stabilize – anticipating a price increase once that occurs.”

Related: Bitcoin may rival gold as an inflation hedge over the next decade

Long-term holders’ actions could signal trouble for BTC prices

Recent data from an on-chain analytics platform indicates that long-term holders—those who have kept their Bitcoin for over 155 years—might be gearing up to sell their assets, particularly following the recent downturn.

The Exchange Inflow Coin Days Destroyed (CDD) metric assesses the volume of Bitcoin transferred to exchanges, factoring in the duration those coins have been inactive, suggesting potential selling pressure from long-term holders.

A significant spike in this metric was noted on April 7, indicating that dormant coins are becoming active, which historically tends to be a bearish sign.

A chart shared by a contributor in a “Quicktake” article highlighted that a previous spike on April 2 coincided with a drop in Bitcoin price from $88,000 to $81,000.

Another notable spike occurred on March 27, which preceded a 7% decline in price over two days.

With a similar spike observed on April 7, the analyst questioned whether Bitcoin’s long-term holders were indeed getting ready to sell once again.

Bitcoin: Exchange Inflow CDD. Source: CryptoQuant

If historical trends hold, Bitcoin’s sell-off may extend for a few more days, with the March 2024 all-time high around $74,000 serving as the first significant level of support.

This article does not offer investment advice or recommendations. All investments and trading activities carry risks, and readers should conduct their own research before making decisions.