Asset management giant BlackRock is collaborating with Anchorage Digital to offer cryptocurrency custody services, a strategic response to the growing demand for digital assets among both retail and institutional investors.

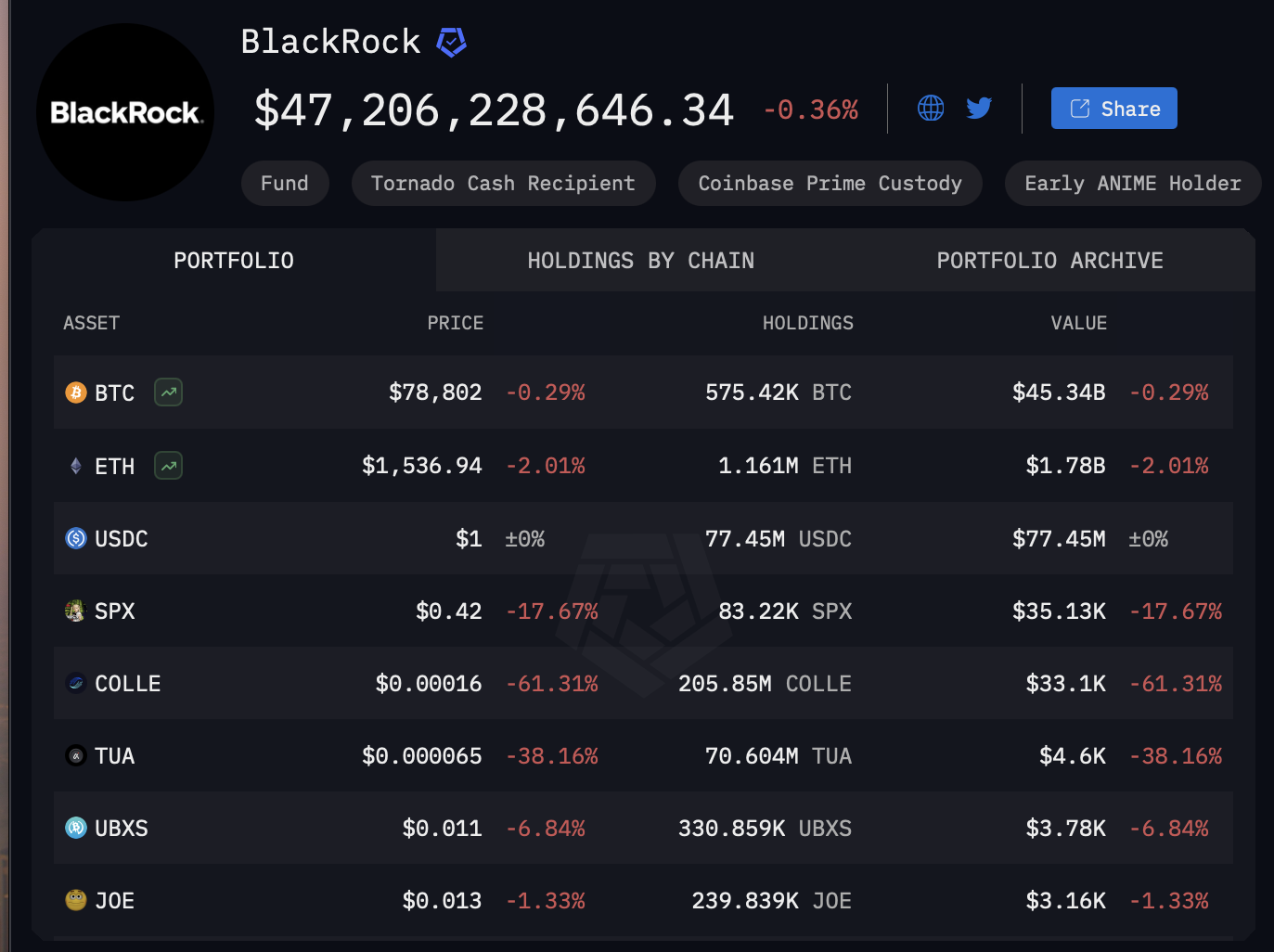

In a statement released on April 8, it was revealed that BlackRock, the largest investment firm globally, manages $11.6 trillion in assets. The firm is a key player in the crypto exchange-traded product (ETP) market, boasting holdings of $45.3 billion in Bitcoin (BTC) and $1.7 billion in Ether (ETH), as indicated by data from Arkham.

BlackRock’s crypto holdings.

Anchorage holds the distinction of being the only federally chartered crypto bank in the U.S. In addition to custody services, it will offer BlackRock solutions for digital asset staking and settlement. Currently, Anchorage also supports BlackRock’s BUIDL fund, a $2 billion tokenized fund affiliated with US Treasurys and focusing on real-world assets.

For its Bitcoin holdings in the iShares Bitcoin Trust ETF, BlackRock relies on Coinbase for custody services.

Related: Understanding BlackRock’s BUIDL fund: Its significance for both crypto and traditional finance

The Journey of Bitcoin ETFs in 2025

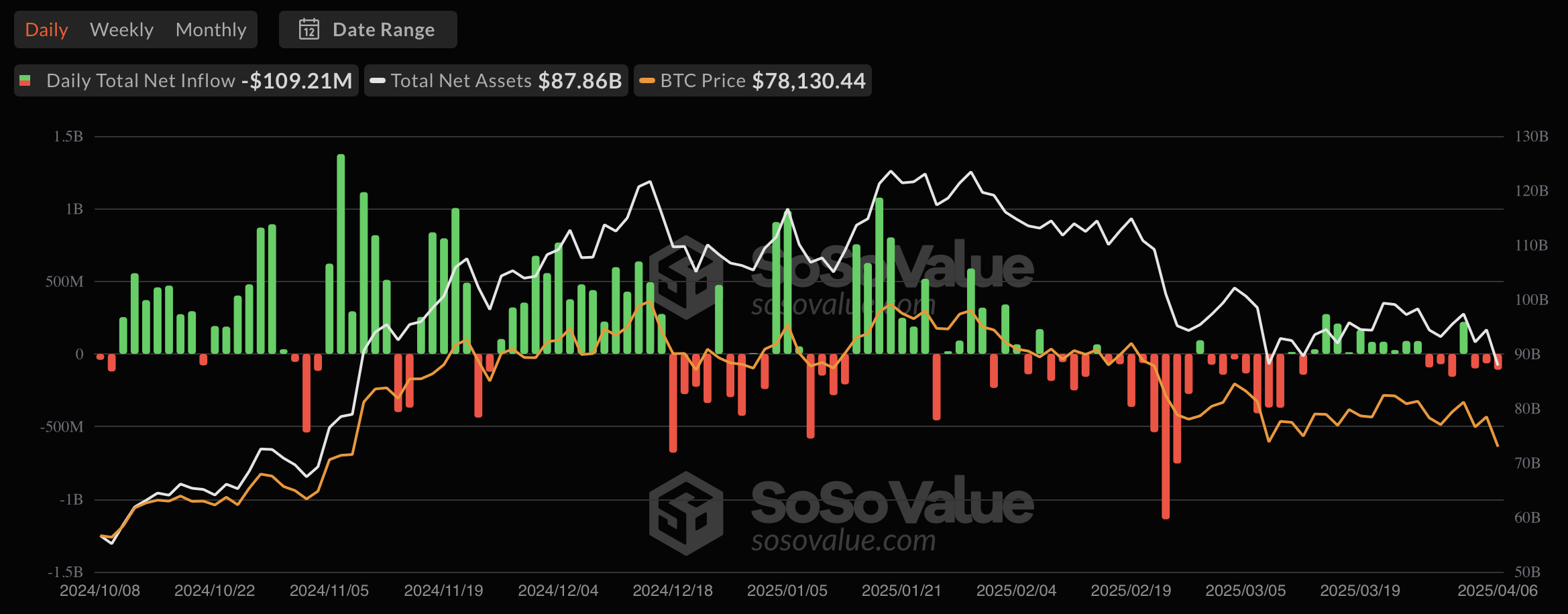

Since launching in January 2024, Bitcoin funds have garnered a total of $36 billion in inflows. However, data from Sosovalue, which monitors ETF performance, suggests that 2025 has been characterized by notable volatility, experiencing both substantial inflows and significant outflows.

Daily inflows and outflows for Bitcoin ETFs.

Bitcoin funds have emerged as some of the most remarkable ETF launches ever, with BlackRock’s iShares Bitcoin Trust ETF leading the pack by achieving a net inflow of $39 billion, as reported by Sosovalue. The firm has since introduced a new crypto ETP in Europe.

Magazine: X Hall of Flame: Bitcoin $500K prediction, spot Ether ETF ‘staking issue’— Thomas Fahrer