Cathie Wood’s investment firm is expressing mixed feelings regarding the latest trade tariffs introduced by the United States, as it divests from its spot Bitcoin ETF while boosting its investment in Coinbase.

The firm has invested $26.6 million in Coinbase (COIN) stock since the announcement of new trade tariffs by President Donald Trump on April 2, according to trading data reviewed.

This acquisition includes a $13.2 million purchase of COIN on April 7, along with another $13.3 million buy on April 4.

In spite of this optimistic move toward Coinbase, the firm also sold $12 million worth of its ARK 21Shares Bitcoin ETF (ARKB) on April 7. ARKB was among the spot Bitcoin ETFs that debuted in the U.S. in January 2024.

ARKW still holds $142 million in indirect Bitcoin exposure

The $12 million sale of ARKB from the Next Generation Internet ETF (ARKW) is one of the largest daily transactions of ARKB by the firm.

This recent sale occurred after an $8 million ARKB divestment on March 3, another $8.6 million sale in February, and two smaller dispositions from January totaling $3.5 million.

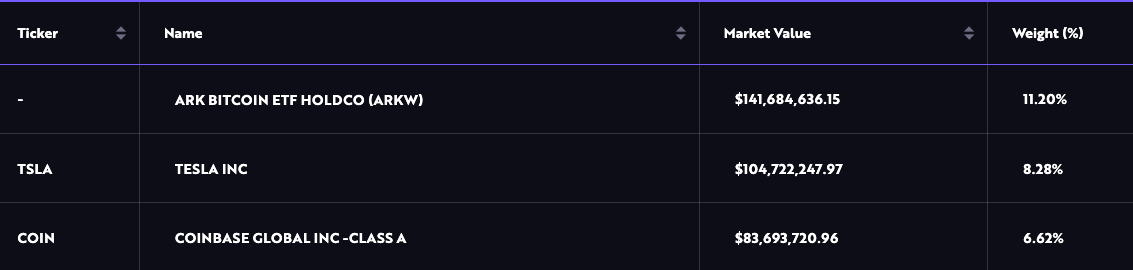

Top three holdings in ARK’s Next Generation Internet ETF.

Despite these sell-offs, ARKW continues to provide indirect exposure to Bitcoin (BTC) via its ARK Bitcoin ETF Holdco, which remains its largest position by market value. As of April 8, it held $142 million in ARKB, constituting 11% of the fund’s weight, as reported on the firm’s website.

Bitcoin ETFs face ongoing declines amidst tariff news

The new transactions coincided with a significant market sell-off, leading to BTC briefly dropping 11% to a low of $74,700 following the tariffs announcement, according to data.

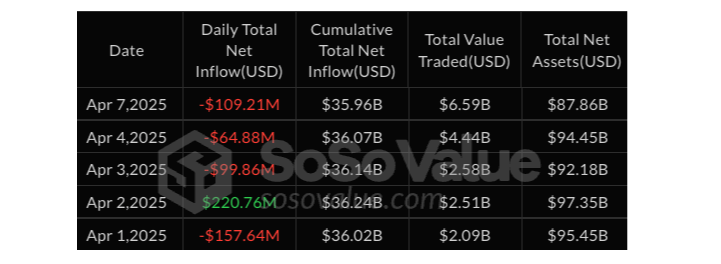

Following $207 million in outflows from global Bitcoin exchange-traded products (ETPs) last week, Bitcoin ETFs continued to experience losses, starting the week with an additional $109 million in outflows on April 7, per data.

Related: Michael Saylor halts Bitcoin purchases despite prices falling below $87K.

In the past three trading days, Bitcoin ETFs have collectively lost $273 million, according to the latest figures.

Spot Bitcoin ETF data from April 1 to April 7.

Despite the recent downward pressure, the firm remains one of the few spot Bitcoin ETF issuers to record net positive flows year to date. As of April 4, it had noted $146 million in inflows for 2025.

Other investment firms with positive inflows this year include BlackRock’s iShares, with $3.2 billion and ProShares, with $398 million.

Magazine: Is Bitcoin headed for $70K soon? Crypto investor funds SpaceX flight: Hodler’s Digest, March 30 – April 5.