- Bitcoin’s price settles around $80,000 on Tuesday after hitting a year-to-date low of $74,508 the day prior.

- MicroStrategy’s SEC Form 8-K filing indicates a loss of $5.91 billion, suggesting potential BTC sales to fulfill financial commitments.

- False reports about a tariff pause contribute to increased volatility in high-risk assets like Bitcoin.

- Technical analysis points to a ‘dead cat bounce’ with a possible rise to $85,000 before a drop to $76,606.

At the time of writing on Tuesday, Bitcoin (BTC) is trading around $79,000 after touching a year-to-date low of $74,508 the previous day. MicroStrategy’s SEC Form 8-K filing released on Monday reveals an unrealized loss of $5.91 billion on its BTC holdings for the first quarter, hinting at potential asset sales to address financial needs. Furthermore, the misleading news concerning a pause in U.S. tariff regulations has introduced volatility in high-risk assets, including Bitcoin. From a technical perspective, the current outlook suggests a ‘dead cat bounce’ with a possible recovery target of $85,000 followed by a dip to $76,606.

MicroStrategy may trigger BTC downturn

Michael Saylor’s MicroStrategy (MSTR) submitted a Form 8-K to the SEC on Monday, outlining significant financial updates for the first quarter of 2025.

According to the document, MSTR disclosed an unrealized loss of approximately $5.91 billion on its Bitcoin holdings for Q1. The company currently owns 528,185 Bitcoins. Additionally, no new Bitcoin or stock purchases were reported between March 31 and April 6, indicating that the filing concentrated on pre-existing assets and their valuation. It also noted total debts of $8.22 billion.

“Given that Bitcoin makes up the majority of our assets, if we cannot secure equity or debt financing promptly and on favorable terms, we may have to sell Bitcoin to meet our financial commitments, potentially at prices below our cost or under less favorable conditions,” stated MSTR in the filing.

If MSTR chooses to liquidate some of its Bitcoin to fulfill its financial obligations, the market’s reaction will depend on how it is executed. A well-planned over-the-counter sale might have minimal impacts, whereas a large-scale exchange sale in a downturn could significantly devalue Bitcoin and erode confidence, leading to a steep price drop.

This potential sell-off could prompt other corporate entities holding Bitcoin (like Marathon Digital with 46,376 BTC and Metaplanet with 4,206 BTC) to follow suit, further increasing supply pressure. On the flip side, it may dampen the rising trend in corporate Bitcoin investments.

False news about Trump’s tariff pause brings market volatility

A report indicated that at 10:15 AM ET, U.S. stocks experienced a $7 trillion swing within 30 minutes due to a “fake” headline about President Trump contemplating a 90-day pause on tariffs. The cryptocurrency market mirrored this activity, with Bitcoin bouncing back from its yearly low of $74,508 to a high of $81,243 on Monday.

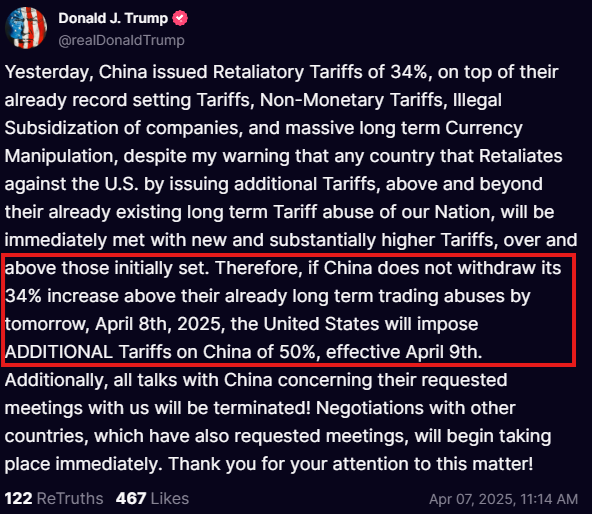

Shortly after, President Trump revealed major news via Truth Social, announcing a new 50% tariff on China that would take effect Wednesday if the nation did not withdraw its 34% retaliatory tariff by Tuesday. This increases the previously imposed 54% tariffs on China.

According to CNBC, China vowed to resist “to the end” regarding the tariffs, suggesting the market should brace for more volatility.

The announcement led to further negativity within the market, resulting in no tariff delay alongside the imposition of higher tariffs on China. Consequently, the crypto markets faced slight declines from their daily highs, with Bitcoin closing at approximately $79,000 on Monday.

Data from Lookonchain revealed that a wallet moved all 365 BTC, valued at $29 million, on Tuesday after being dormant for 10 years. This wallet received its BTC a decade ago when the price was just $284. This trend indicates early holders are offloading their BTC. If this pattern continues and escalates, Bitcoin prices could decline further.

Bitcoin Price Outlook: BTC shows dead cat bounce pattern

After hitting a year-to-date low of $74,508 during the early Asian session, Bitcoin’s price rebounded and closed around $79,000 on Monday. As of Tuesday, it remains near the $79,000 mark.

The present price trajectory of Bitcoin suggests a ‘dead cat bounce’ scenario, where a short-lived recovery towards the $85,000 resistance level may occur before resuming the downward trend.

If Bitcoin continues to decline, it may revisit its next daily support level at $73,072.

The Relative Strength Index (RSI) on the daily chart is registering at 38, indicating strong bearish momentum and reinforcing the pessimistic outlook.

BTC/USDT daily chart

However, if Bitcoin manages to recover and close above its daily resistance at $85,000, it could facilitate a recovery rally extending to the significant psychological level of $90,000.

FAQs about Bitcoin, altcoins, and stablecoins

Bitcoin is the leading cryptocurrency by market cap, designed to function as a form of money. It operates without being controlled by a single entity or group, eliminating the need for intermediaries in financial transactions.

Altcoins refer to any cryptocurrency excluding Bitcoin, though some consider Ethereum as a non-altcoin due to the fork dynamics between these two coins. Following this logic, Litecoin became the first altcoin, forked from Bitcoin and is viewed as an enhanced version of it.

Stablecoins are cryptocurrencies that aim to maintain a stable value, backed by a reserve of corresponding assets. They are typically pegged to commodities or financial instruments, like the U.S. Dollar (USD), with supply governed by algorithms or market demand. The primary function of stablecoins is to provide an entry and exit point for investors looking to trade and invest in cryptocurrencies, also offering a means to store value since many cryptocurrencies are volatile.

Bitcoin dominance is the ratio of Bitcoin’s market capitalization compared to the total market cap of all cryptocurrencies. This metric provides insight into Bitcoin’s popularity among investors. A high BTC dominance often precedes or coincides with a bull market, as investors tend to favor relatively stable and high-cap assets such as Bitcoin. Conversely, a decline in BTC dominance often indicates a shift of capital towards altcoins as investors seek potentially higher yields, which usually triggers significant rallies in those altcoins.