Amid the current turmoil in the markets caused by US trade tariffs, leaders from prominent cryptocurrency firms are optimistic about the prospects for institutional Bitcoin adoption in 2025.

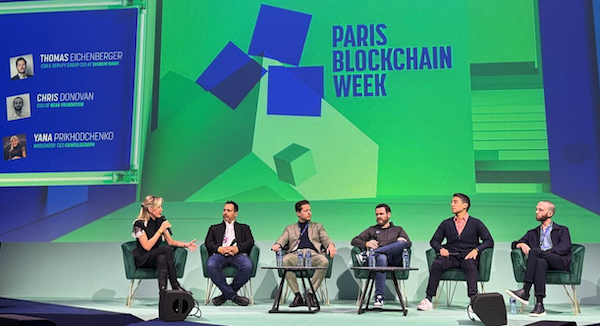

During a discussion panel at Paris Blockchain Week on April 8, the CEO of Messari and the co-founder of Sygnum Bank expressed their belief that there will be a notable change in how the banking sector engages with cryptocurrencies in the latter half of the year.

The executives highlighted that a worldwide shift towards Bitcoin (BTC) services by banks could gain momentum in 2025 as regulators begin to embrace cryptocurrencies, including stablecoins and banking-related crypto services.

“I anticipate we might see a quieter Q2, but I’m really looking forward to Q3 and Q4,” stated Messari’s CEO during the session led by the CEO of Cointelegraph, while hinting at “exciting” developments expected in the crypto market for 2025.

The broader picture of crypto adoption

While some investors might be preoccupied with the pro-crypto stance of former US President Trump, Turner pointed out that the key factor is the overall regulatory climate.

“When considering the potential for structured market regulations in the US, along with stablecoin regulations, it’s clear that the SEC and various regulatory bodies, not just Trump, are increasingly supportive of crypto,” he explained.

A panel discussion at Paris Blockchain Week, featuring industry leaders and moderated by the CEO of Cointelegraph.

The Sygnum co-founder noted that international banks with branches in the US are also preparing to engage with the market once the regulatory landscape becomes clearer:

“US banks are gearing up to offer crypto custody and at least spot trading services very soon.”

“I align with your sentiment, Eric,” he added, suggesting that uncertainty within the market will persist until the US lays out a defined regulatory framework.

Related: Ripple has acquired crypto-focused prime brokerage Hidden Road for $1.25B

Regulatory concerns are fading

With the introduction of concrete rules around cryptocurrencies for banks in the US, there is likely to be a surge of interest in crypto services from sizable international banks with a US presence, Eichenberger remarked.

“Some of these banks may have had plans to provide crypto-related services but have held back due to fears of regulatory scrutiny from US authorities,” he mentioned, adding:

“Now, there’s nothing to fear regarding regulatory bodies globally. As a result, many major international banks are expected to launch their services this year.”

Magazine: The era of financial despair in crypto is ending — It’s time to reimagine the future