- The price of Shiba Inu plummeted to a new 13-month low on Monday, falling below $0.00001 for the first time since February 2024.

- Whale investors have purchased 874 billion SHIB tokens following the latest trade tariff announcement from Trump.

- Bulls seem ready for an intraday rebound as SHIB trades above the volume-weighted average price at $0.000014.

Shiba Inu (SHIB), one of the most discussed meme coins in the crypto market, experienced a sharp drop on Monday, dipping below the $0.00001 mark for the first time since February 2024.

Despite this decline, large investors have taken advantage of the situation, acquiring an impressive 874 billion SHIB tokens, which indicates a level of strategic confidence amidst broader market challenges.

Shiba Inu reaches 13-month low after breaching critical support level

The price of Shiba Inu sank to $0.0000098 on Monday, marking its lowest point in over a year and reflecting increased anxiety across the larger crypto space.

This downturn is significant for SHIB, which had been relatively stable through early 2025 but ultimately broke through key psychological support following a weekend characterized by low trading volumes and negative sentiment.

Shiba Inu price action from April 7

Market experts attribute this drop to various macroeconomic factors, including rising trade tensions following the announcement of new tariffs on Chinese imports by former U.S. President Donald Trump last Wednesday.

After Trump dismissed the possibility of a diplomatic resolution, SHIB’s price fell toward $0.000010 on Monday, hitting its lowest level since February 24.

However, SHIB’s price quickly bounced back by 4% to reclaim $0.000014, standing above the Volume Weighted Average Price for the day. This indicates that after an initial sell-off, SHIB attracted a cluster of buying activity as the trading day continued.

Whale investors buy 874 billion SHIB during the dip

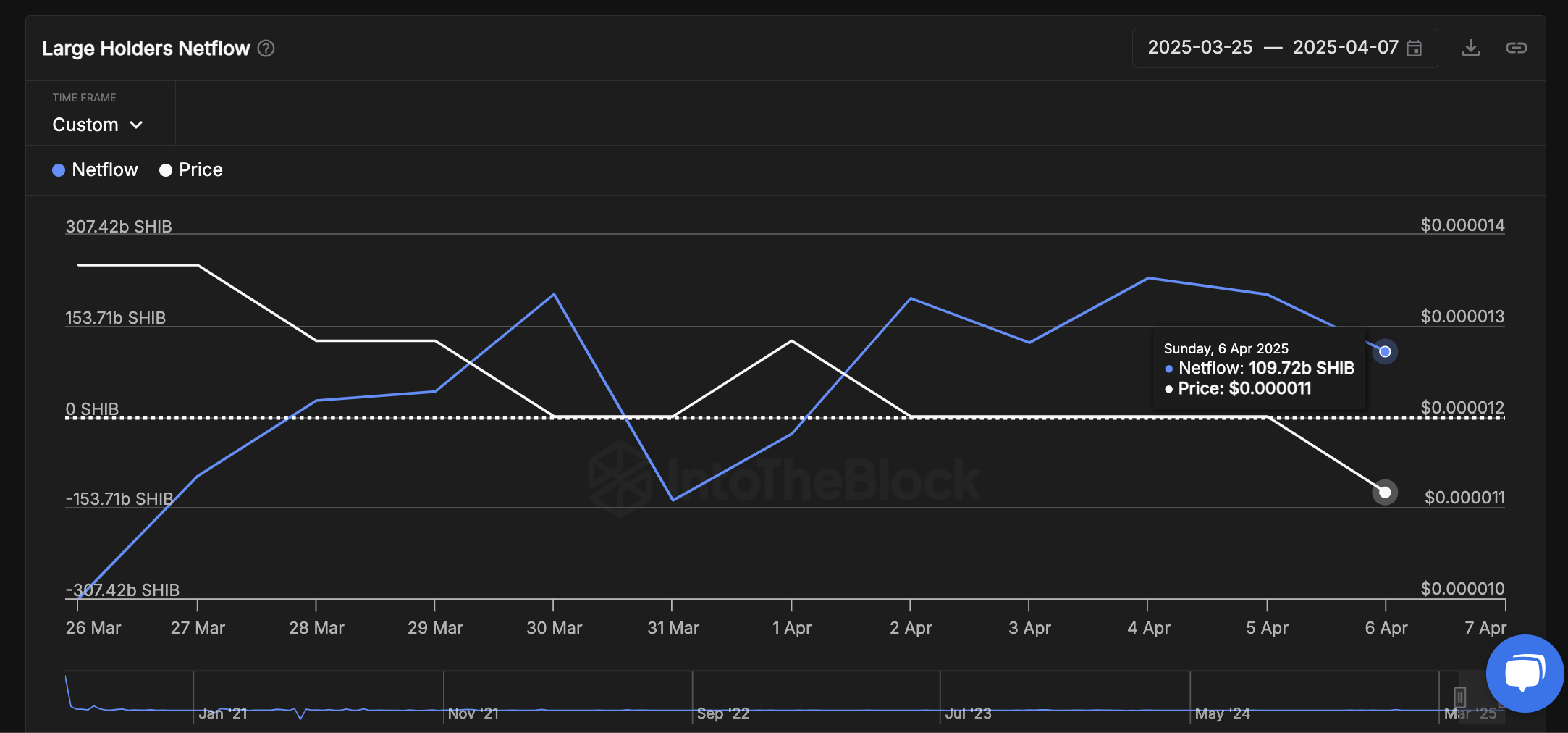

The Large Holder Netflow metric tracks the daily net balance changes of wallets that hold at least 0.1% of the total SHIB supply.

This offers real-time insights into the aggregated trading activity among the largest whale investors in the Shiba Inu market.

The chart detailing the SHIB Large Holder netflow shows that these wallets collectively bought over 874 billion tokens between April 2 and April 6.

Shiba Inu Large Holder Netflow

This accumulation began just hours after Trump announced significant tariffs during his Liberation Day speech on April 2, suggesting that whales might see geopolitical instability as an opportunity to buy.

Given that large investors often utilize sophisticated cold storage methods, an ongoing whale buying trend could imply a dwindling supply of SHIB on exchange-hosted wallets.

This may clarify why the SHIB price rebounded early on Monday to break above the VWAP after initially falling to a 13-day low.

At current price levels, the 874 billion SHIB accumulated by whales amounts to approximately $10.4 million. While the rationale behind this acquisition—whether speculative or based on developments like Shibarium—remains uncertain, it has ignited renewed interest in SHIB within crypto communities.

Shiba Inu price outlook: Is $0.000010 the local low or a weakened support level?

The price movement of Shiba Inu indicates a fragile recovery, but crucial indicators imply that this bounce may be more of a relief than a true reversal. SHIB recently touched the $0.000010 level, experiencing a slight rebound above it, closing at $0.0000115 on Monday. This zone aligns with a short-term support level tested twice in April, suggesting a potential local bottom, though not yet confirmed.

The Chande Kroll Stop, represented in blue, has dipped below the current price, indicating minimal short-term selling pressure. However, the resistance level at $0.000015 looms, and any failure to reclaim this level could signal a new downtrend.

SHIB Price Forecast

Moreover, the Relative Strength Index (RSI) indicates potential further downside risk. With the RSI trending at 37.63 on Monday, the weak divergence with price suggests that bulls may lack momentum for a stronger recovery.

Volume analysis further reveals dwindling conviction, even as prices attempt to recover, which undermines the bounce narrative.

Unless SHIB manages to reclaim $0.000042 with substantial volume and closes above the Kroll stop level, bulls could face a breakdown below the $0.000010 area.