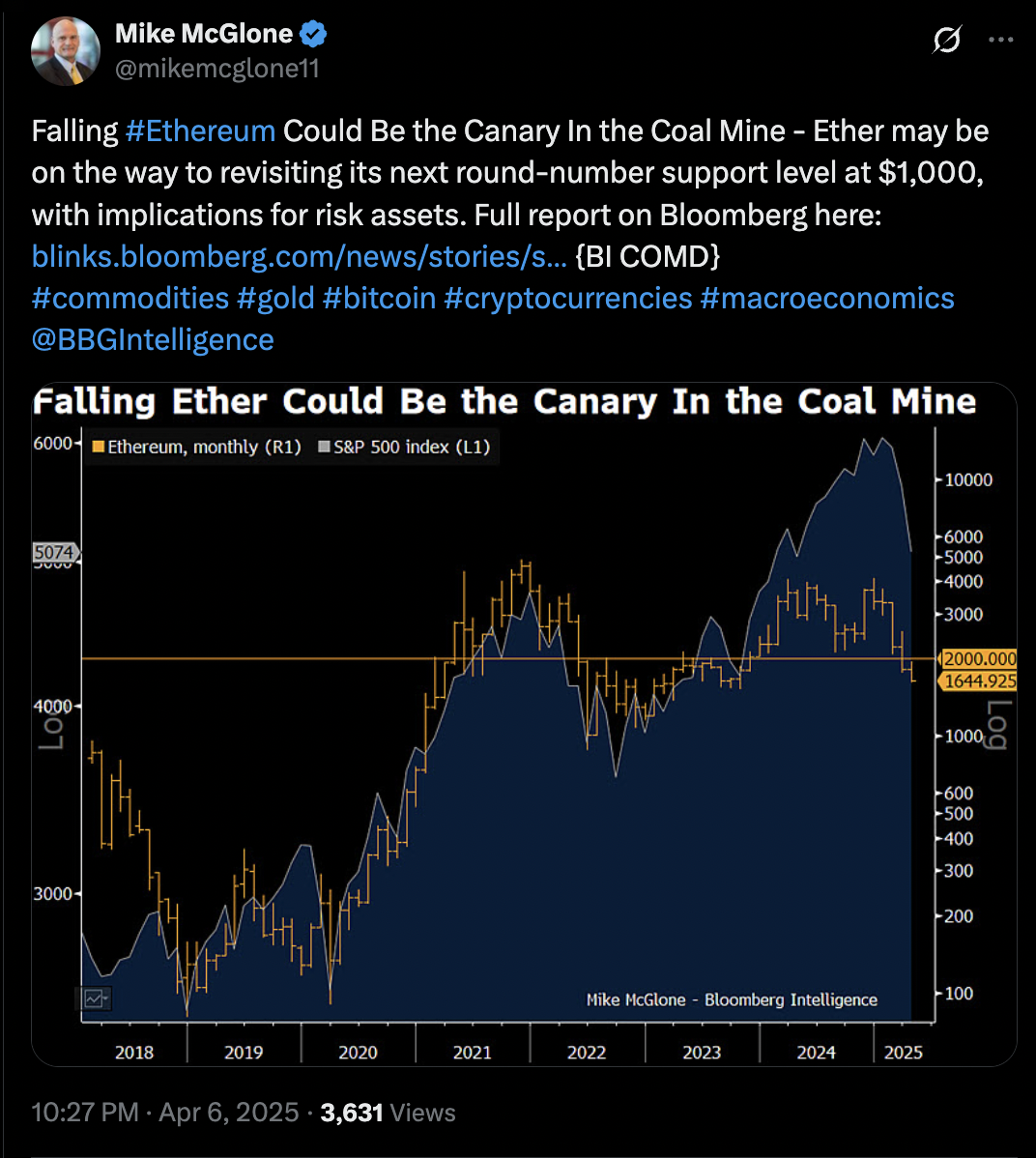

Ether (ETH), the native cryptocurrency of Ethereum, appears to be displaying signs of bullish exhaustion after experiencing a steep decline of 65% over the last three months. The rapid pace of this downward trend, combined with various oversold indicators, has left investors speculating whether a market bottom is on the horizon.

ETH fractals indicate a potential drop to $1,000

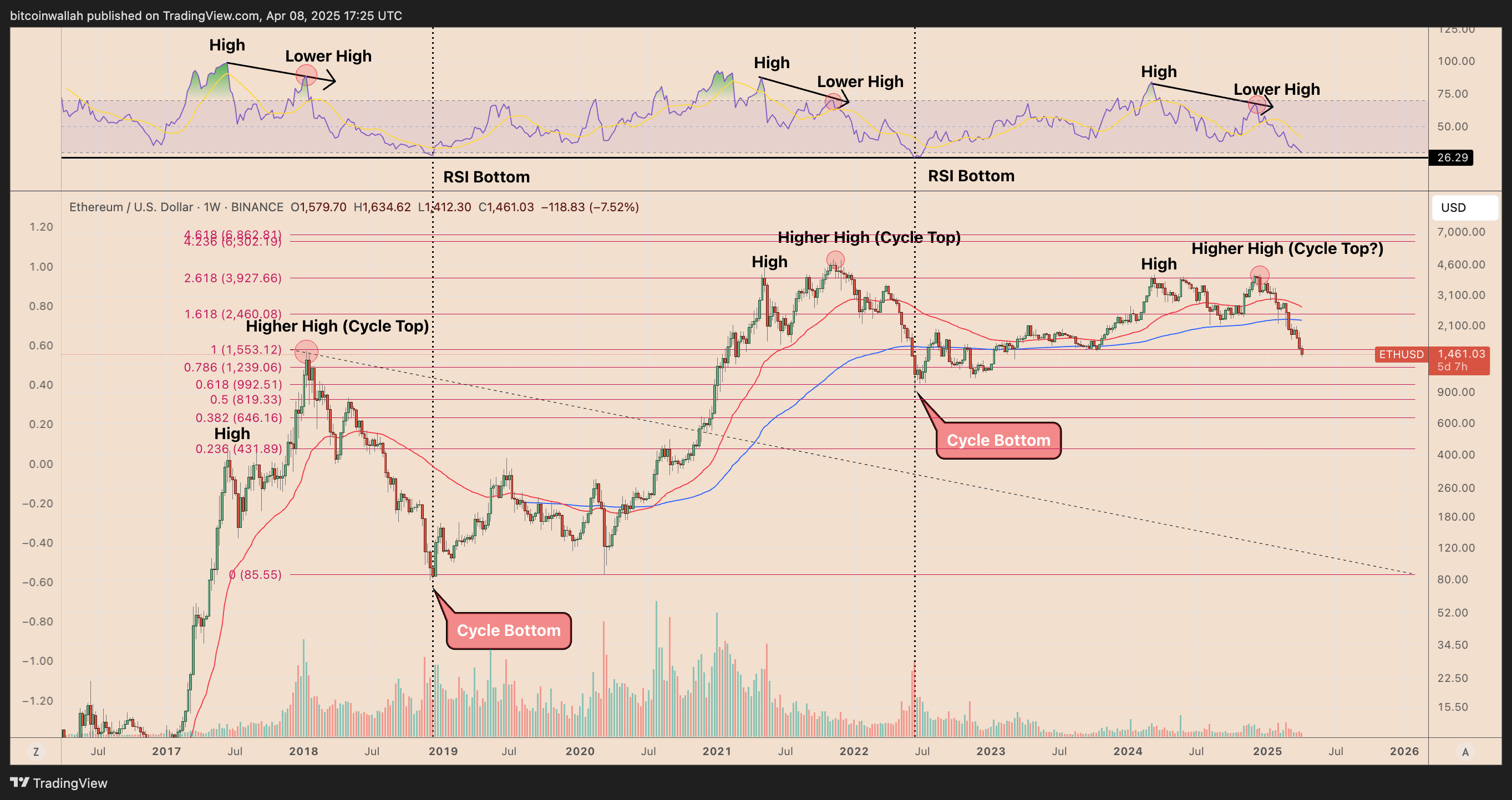

The current price movements of Ether reflect a known fractal pattern observed in both 2018 and 2022. During both of these periods, ETH’s price underwent euphoric surges followed by sharp downturns and extended bear markets.

Key characteristics common to these cycles include:

ETH/USD weekly price chart.

-

Following the price peaks (noted in the chart above), ETH experienced significant retracements, often breaching essential Fibonacci levels.

-

Typically, cycle bottoms formed when the RSI fell into oversold levels (below 30), stabilizing near historic Fibonacci zones.

The current situation resembles this established framework.

In December 2024, Ether reached a higher high around $4,095, while the RSI registered a lower high—reflecting the bearish divergence that was evident in prior tops. This divergence signaled the onset of a pronounced correction, akin to the trends witnessed in 2018 and 2022.

At present, ETH’s price has dipped below the 1.0 Fibonacci retracement level, approximately at $1,550. Additionally, its weekly RSI remains above the oversold threshold of 30, indicating the possibility of further declines until the reading falls beneath 30.

ETH/USD weekly RSI performance chart.

This fractal analysis suggests Ethereum could be experiencing the final stage of its downturn, with the next likely price targets hovering between $990 and $1,240, aligning with the 0.618-0.786 Fibonacci retracement area.

Source:

Related: Three reasons Ethereum may be poised for a turnaround: Kain Warwick, X Hall of Flame

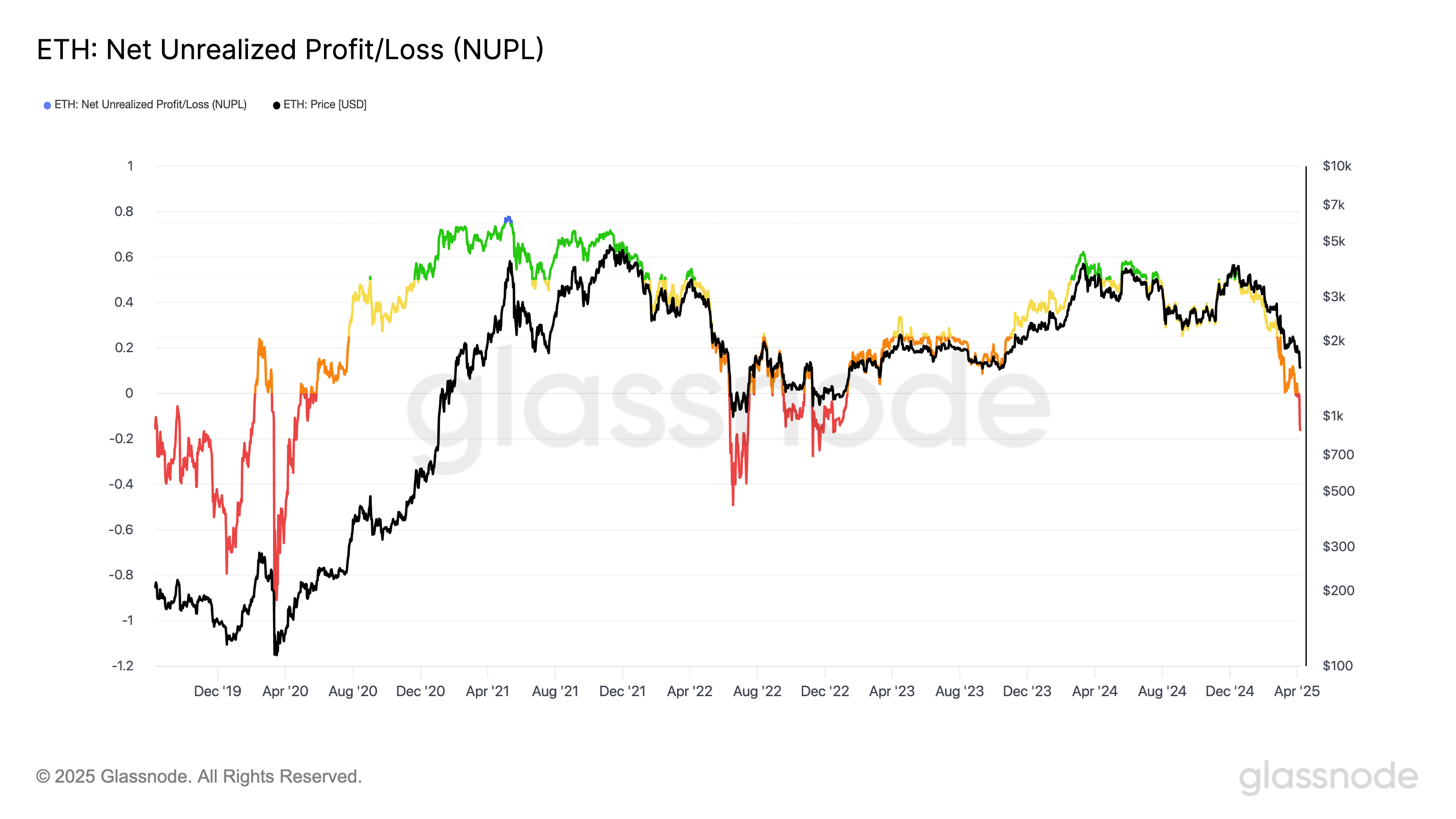

Ethereum NUPL indicates ‘capitulation’ — Another bottoming signal

Ethereum’s Net Unrealized Profit/Loss (NUPL) has entered the “capitulation” zone, a phase in which most investors are holding ETH at a loss. Historically, similar entries into this zone have occurred near significant market bottoms.

Ethereum NUPL vs. price chart.

In March 2020, NUPL turned negative just prior to a substantial ETH rebound following the COVID-19 market crash. A similar trend was noted in June 2022, when this metric dipped into capitulation territory shortly before Ethereum hit a bear market low around $880.

With ETH entering this zone once again, the present setup loosely parallels those earlier bottoming phases—coinciding with critical Fibonacci support levels near $1,000.

This article does not provide investment advice or recommendations. Every investment and trading decision carries risk, and readers are encouraged to conduct their own research before making any choices.