- On Tuesday, Dogecoin’s price regained the $0.15 mark, achieving a swift 10% recovery over the past 24 hours.

- Tesla’s stock price has stabilized, continuing to reflect a 17.5% decline since the Liberation Day announcement.

- Important market signals indicate that DOGE’s price may be moving away from the influence of Elon Musk.

Dogecoin’s (DOGE) price surged by 10% in just 24 hours, reestablishing itself at the $0.15 threshold on Tuesday as global financial markets showed signs of a gentle recovery after a week marked by significant selling pressure.

In contrast, Tesla (TSLA) has seen a loss exceeding $160 billion in market capitalization following last week’s tariff announcements from the Trump administration.

The emerging divergence between the prices of Dogecoin and Tesla raises a compelling question for investors: Could Dogecoin be starting to break away from Elon Musk’s longstanding impact?

Is Dogecoin beginning to distance itself from Elon Musk’s influence in 2025?

Historically, Elon Musk has played a significant role in driving Dogecoin’s price fluctuations. His tweets, public support, and integration efforts—such as enabling Dogecoin payments for Tesla merchandise and mentioning it during SpaceX events—have led to notable price changes for DOGE over the years.

Nevertheless, recent developments and price trends seen in both the DOGE and TSLA markets suggest that Musk’s influence on the memecoin could be waning. Here are two key reasons:

- Washington’s crypto strategy overlooks DOGE

A factor contributing to this potential decoupling stems from the latest crypto policies emerging from Washington.

In March, the Trump administration introduced the “Crypto Strategic Reserve,” a government-initiated program to acquire various cryptocurrencies.

This plan notably excluded Dogecoin, contrary to many expectations that Musk’s prominent position in the administration might lead to a different decision.

Instead, the Trump administration launched its own memecoins—TRUMP and MELANIA—during the inauguration, effectively diminishing the likelihood of promoting a competing memecoin.

Dogecoin (DOGE) Price Action, April 8, 2025

Last week, Musk indicated that there were “no current plans” to incorporate Dogecoin into any government digital infrastructure. Despite this, DOGE’s price has swiftly surged, moving past the $0.15 resistance level on Tuesday.

This rapid recovery showcases a more mature investor base that is becoming increasingly aware of macroeconomic influences as hopes for government adoption through Musk’s involvement dim.

Dogecoin remains unaffected by Tesla’s tariff-related struggles

Since President Trump announced a sweeping series of import tariffs last week, U.S. equities have faced substantial pressure, with Tesla being significantly impacted.

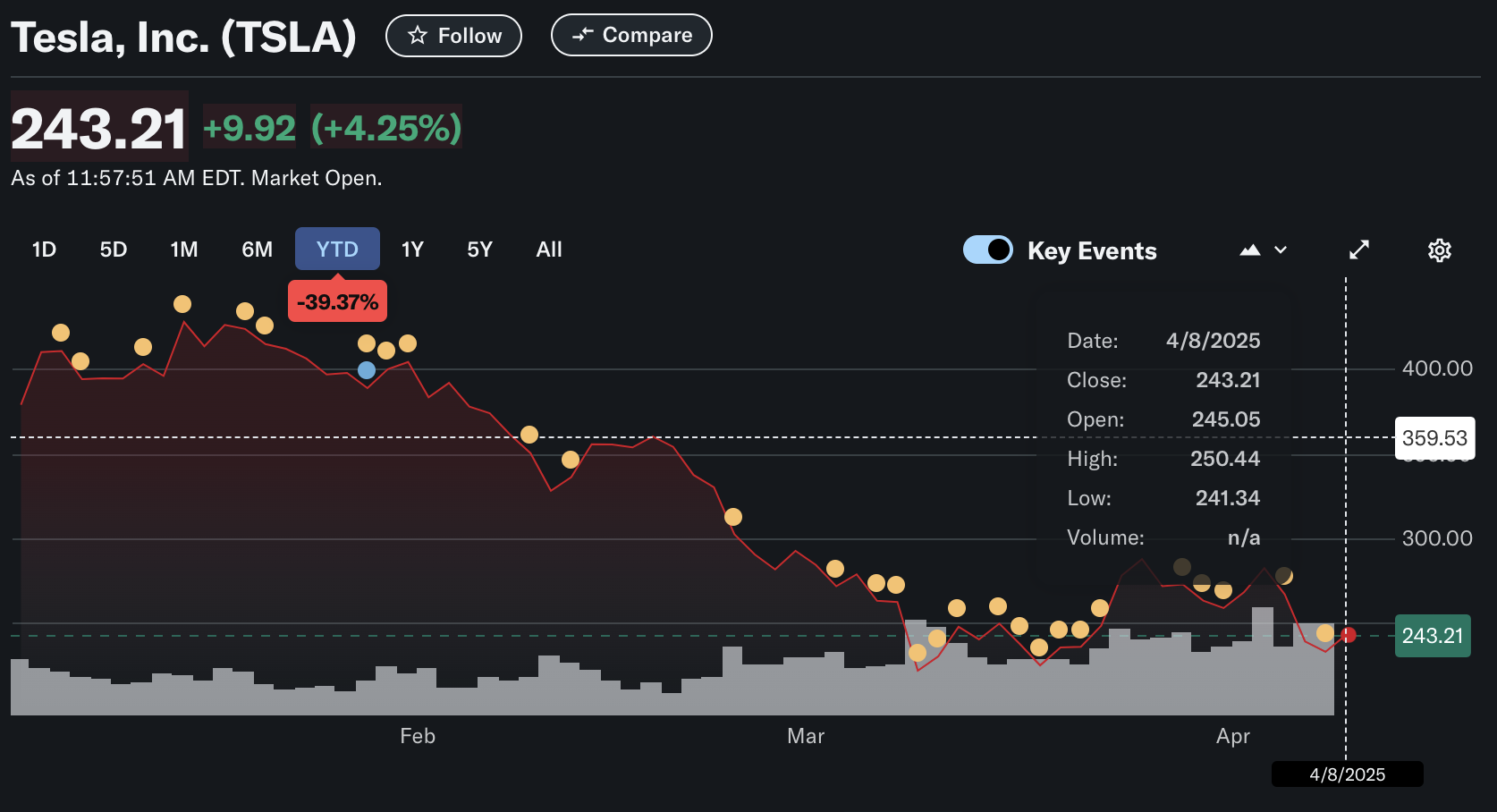

Tesla (TSLA) Price Performance, April 8, 2025

Tesla stocks opened at $245 on Tuesday, reflecting a 17.5% drop and a loss of nearly $160 billion in market value following Trump’s tariff announcement on April 2 through Monday.

Interestingly, after the initial $160 billion decline in Tesla’s stock, Musk shared a video of Milton Friedman criticizing trade tariffs, leading to speculation that Trump’s close aides might be advocating for a compromise.

The TSLA price showed some recovery in the 24 hours after Musk’s post on X. However, as of this writing, the White House remains firm in its position. With the overall market sentiment largely negative, a continued downtrend could be anticipated in the upcoming sessions.

Given the company’s global supply chains—especially with China and Canada—it faces risks from retaliatory tariffs, which could jeopardize its quarterly earnings targets as previously stated by Musk in March.

In contrast, Dogecoin is a decentralized asset without physical operations or supply chain liabilities. Its price is primarily driven by crypto market dynamics, community engagement, and investor sentiment, rather than by commodity pricing or geopolitical issues. This separation from conventional economic factors provides DOGE with a level of stability that Tesla, as a multinational enterprise, simply does not have.

Investors are closely monitoring Dogecoin as it stabilizes around $0.16 while Tesla grapples with its $160 billion loss. It remains uncertain if this trend will persist in the long term. However, clear signs of Dogecoin’s potential decoupling from Musk’s influence have surfaced since the beginning of the year.

Dogecoin forecast: Rally stalls below $0.16 as market evaluates momentum shift

Dogecoin’s price has reestablished itself at the $0.15 level, currently trading at $0.1511 after bouncing back from a recent low of $0.14. Although this represents a 10% recovery over 24 hours, caution is advised in expecting a sustained breakout above $0.16.

The Relative Strength Index (RSI) remains low at 36.95, significantly below the neutral zone at 50, indicating ongoing bearish momentum despite the recent uptick.

The RSI’s failure to cross over its moving average (currently at 42.16) suggests diminishing buying pressure, which diminishes confidence in the sustainability of the rally. This divergence highlights a possible fatigue in bullish activity unless trading volume supports further gains.

Dogecoin Price Forecast (DOGEUSD)

Trading volume spiked to 877.38 million DOGE, indicating renewed market interest, but prices remain below the 50-day moving average around $0.17, limiting bullish potential in the short term. Furthermore, the tightening Bollinger Bands indicate resistance at $0.19 and support at $0.15, suggesting a period of reduced volatility.

This implies that the recent bounce may be a correction of previously oversold conditions rather than the beginning of a new upward trend.

A daily close above $0.16 could alter the short-term outlook to bullish, aiming for $0.17. Conversely, a close below $0.15 would reinforce the downtrend, risking a decline to $0.13. As it stands, Dogecoin’s price forecast now depends on volume continuation and RSI crossover confirmation.