A cryptocurrency and artificial intelligence investment firm has received approval from the U.S. Securities and Exchange Commission to list on the Nasdaq stock exchange.

The company, currently traded on the Toronto Stock Exchange (TSX), intends to shift its headquarters from the Cayman Islands to Delaware, as outlined in an April 7 announcement, pending approval from shareholders and the TSX.

“Our registration statement is now effective with the SEC. We’re looking to list on the Nasdaq shortly after our shareholder vote on May 9, provided we successfully complete our reorganization. Let’s go!” stated the CEO in an April 7 post.

Image via CEO post

The firm expects to trade on the Nasdaq under the ticker GLXY soon after the shareholder vote, with plans to finalize the transition by mid-May, contingent on meeting Nasdaq’s listing standards.

Delaware chosen for its corporate advantages

In a filing to the SEC on March 27, the firm indicated that it selected Delaware for its favorable corporate environment, which it believes will enable it to “compete more effectively with other publicly traded companies.”

Delaware was also favored due to its popularity among publicly traded corporations, the extensive case law available to interpret the Delaware General Corporation Law (DGCL), and lawmakers’ proactive updates to the DGCL in line with modern technology and legal developments.

Following the relocation, the CEO will maintain ownership and control of the firm, possessing nearly 60% of the voting rights, as detailed in the filing.

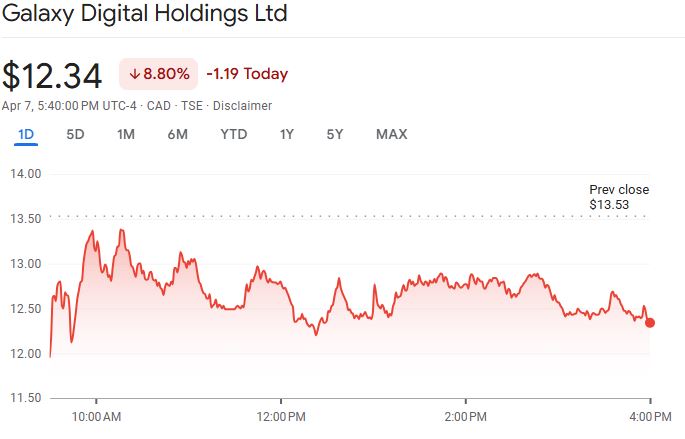

The company’s shares on the TSX fell by 8% after trading closed, settling at $12.30 Canadian dollars ($8.70), based on market data. The stock initially debuted in July 2015 and reached its highest point of just under $50 Canadian dollars ($35) on November 12, 2021.

The TSX share price decrease was noted after market closure. Source: Market data

Recently, the firm agreed to a $200 million settlement related to its alleged promotion of the defunct cryptocurrency Terra (LUNA).

Related: NYSE proposes rule change to permit ETH staking on Grayscale’s Ether ETFs

Other cryptocurrency firms are also listed on the Nasdaq. Coincheck Group, the parent company of the Japanese crypto exchange Coincheck, was among the most recent to list, debuting on December 11.

Additionally, Bitcoin-focused investment firm Metaplanet is reportedly considering a potential listing in the U.S., following meetings with officials from both the New York Stock Exchange and Nasdaq in March.

Magazine: New ‘MemeStrategy’ Bitcoin venture initiated by 9GAG; details on jailed CEO’s $3.5M bonus: Asia Express