In a moment of apparent panic, one Bitcoin user forked over nearly 0.75 BTC (approximately $70,500) as a transaction fee using the replace-by-fee (RBF) method.

The transaction in question occurred around 12:30 AM UTC on April 8. It represented the second attempt at performing an RBF, which altered the transaction’s destination address, directing 0.48 Bitcoin ($37,770) and returning 0.2 BTC in change ($16,357).

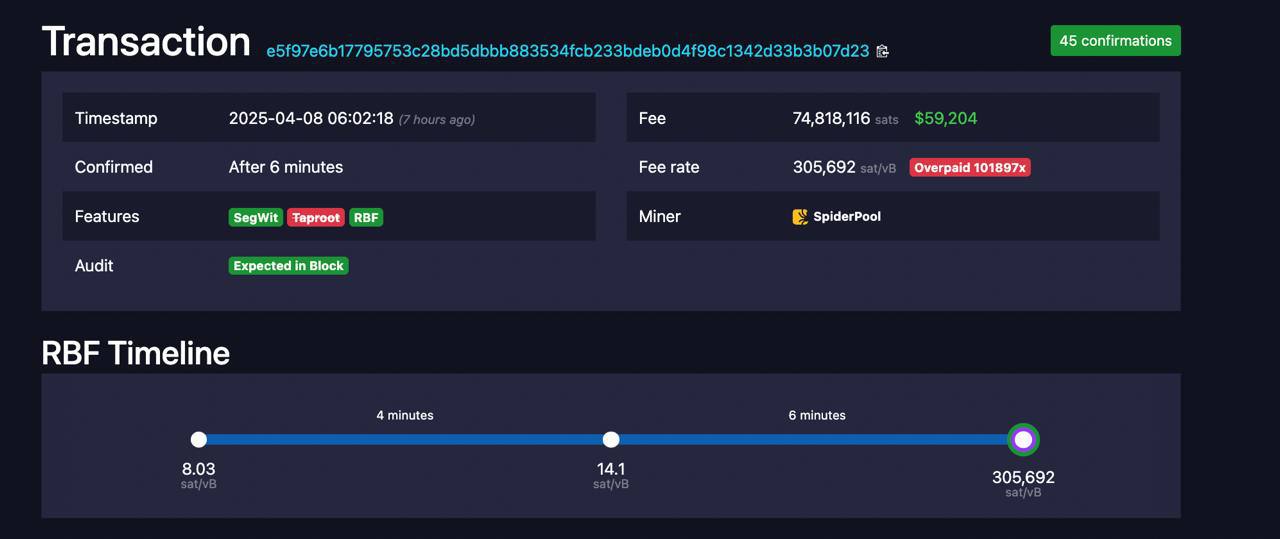

Second Bitcoin RBF transaction. Reference: Mempool.Space

Anmol Jain, a vice president at a crypto forensics company, indicated that the initial transaction had a “default or conservative” fee. The first RBF transaction almost doubled the fee and modified the output address.

Both transactions are stuck waiting for a confirmation that will not come. This is due to the significantly higher fee RBF transaction overshadowing the original, likely aimed at ensuring that the second transaction gets processed instead.

Related: A guide on resolving a stalled Bitcoin transaction in 2025

A presumed error triggered by panic

The transaction reflects signs of a hasty mistake, with the user swiftly making a follow-up transaction to prevent the initial one from being finalized in a block. Jain offered a few possible reasons for this:

“Perhaps he intended to set a fee of 30.5692 sat but, in his rush or due to a slip-up, ended up using 305,692 sat.”

The second RBF transaction included an additional unspent transaction output (UTXO), which held nearly 0.75 BTC. The change was likely misallocated as part of the fee, possibly because the user didn’t update the change address or misjudged the structure of the transaction.

Another theory posited by Jain is that the user might have confused a fee expressed in total amount with one set in satoshi per virtual byte (based on transaction size), or that there was a bug in the automated script handling the transaction. If the wallet allowed setting a fee in satoshis, this could create a situation where the fee is set far too low, prompting warnings and leading to an overcorrection:

“The system interprets it as a total fee of 30 sat, which is extremely low, so the user enters 305000 thinking it means 30.5 sat/vB, but the wallet inadvertently applies 305,000 sats/vB, which is outrageous.”

Related: A Bitcoin user incurs a $3.1M transaction fee for a 139 BTC transfer

Replace-by-fee: A debated feature

The RBF option is often misunderstood and contentious within the Bitcoin community. Transactions are considered non-final until they have been added to a block, with further security conferred by additional blocks on the chain.

Transactions held in the mempool are subject to the whims of miners, who make decisions primarily based on profit. Bitcoin’s developers expected that, with competing transactions, the incentive would be to process the one offering the higher fee.

Preventing miners from including just the first transaction submitted is a challenge, and determining which transaction arrived first is not straightforward due to the decentralized nature of the network. Therefore, this incentive structure was incorporated into the RBF feature, empowering users to modify unconfirmed transactions by submitting an alternative with a higher fee.

This feature has sparked debates in the past, with advocates of Bitcoin Cash claiming that RBFs facilitated double-spending on Bitcoin back in 2019. In contrast, Bitcoin Cash removed this feature, asserting that unconfirmed transactions on their network are definitive and safe to accept.

However, RBF-like transactions have still been confirmed on Bitcoin Cash, as RBF is an inherent characteristic of a blockchain consensus mechanism, even if formalized as a distinct feature.

Magazine: I took on the role of an Ordinals RBF sniper to achieve riches… but I lost a significant portion of my Bitcoin